Bitcoin (BTC) Set to Revisit $40K?

##

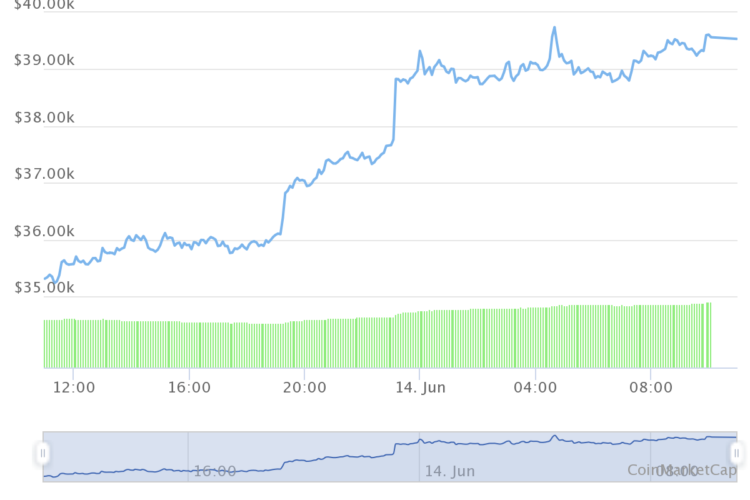

The biggest question for Bitcoin (BTC) is whether the recent drop to the $30K range was a regular event, or a concerted effort to depress prices. BTC trading picked up in the new week, sending prices above $39,000, with a growth of more than 12% in a single day. BTC markets showed they are still capable of a fast recovery, once again setting BTC to seek a new price direction.

BTC prices expanded to above $39,500 within minutes on Monday, as trading volumes also picked up to above $43B in the past 24 hours. BTC moves within the range of hundreds of dollars, touching $39,535, with the potential to expand to $40,000 within a short timespan.

Altcoins only grew passively, with most adding about 10% to their price on the back of the BTC rally. ETH market prices remained close to $2,500 despite slower activity in decentralized finance.

In the past days, BTC trading also got a boost from several bullish factors suggesting at expanded adoption.

Taproot Upgrade Accepted on Weekend

On June 12, the Taproot upgrade finally gathered more than 90% of miners’ signalling votes, thus locking in the decision. The actual upgrade, which will be in the form of a soft fork, is expected some time in November, with the potential for insignificant delays.

Taproot will add new privacy features to BTC transactions, and add the opportunity to build smart contracts in a more accessible way. For the Bitcoin network, this will be the most significant upgrade since adding the SegWit feature. The issue is not contentious, meaning no chance of miners slipping away to form a new hard fork.

BTC Sentiment, Accumulation Recover

The BTC trader sentiment improved, as shown by the Bitcoin fear and greed index rising to 28 points. Recently, the index dropped to a yearly low close to 11 points, as the market de-leveraged.

As BTC approached the $40K range, expectations are recovering for another summer rally.

One of the encouraging parameters is that despite short-term fluctuations, older BTC holders seem confident and have slowed down their selling. In the past week, there is a trend for older addresses to keep their coins from the market, based on Glassnode statistics.

This, along with miners still hoarding their coins, adds to the long-term prospects for BTC. In the short term, there are indications for BTC futures trading to return to previous levels of activity. A more leveraged BTC market stood behind the rally above $60,000.

Now, both short and long term interest remain tentative, as BTC went through weeks of downward price pressure that liquidated a record level of long positions. Increased leveraged trading, however, works to increase BTC volatility in the short term.

In the past day, long-term accumulation also looked stronger, as recent buyers sold off some of their coins. The sales were offset by more large-scale buying.

Tesla, Microstrategy Still Hungry for BTC

The recent price turbulence arrived after Tesla, Inc. removed BTC as a payment tool for its electric cars. But in a more recent tweet, Elon Musk explained the removal is temporary and hinges on having a better energy mix for mining BTC.

Currently, BTC mining uses some renewable energy in the form of hydroelectric power. But Chinese mining pools also have access to coal-derived electricity, making for a rather polluting energy profile.

The other bullish factor for BTC are rumors of renewed buying from MicroStrategy, one of the first corporate buyers that went public with their interest in BTC. MicroStrategy announced a new bond round meant for buying more BTC at current price levels. The potential sum for new purchases will be $400M, and the corporation wants to expand its BTC portfolio to above 100,000 coins.

This will turn MicroStrategy into one of the biggest known “whales” on the market, further adding to actual physical coin scarcity.

El Salvador Raises BTC Visibility

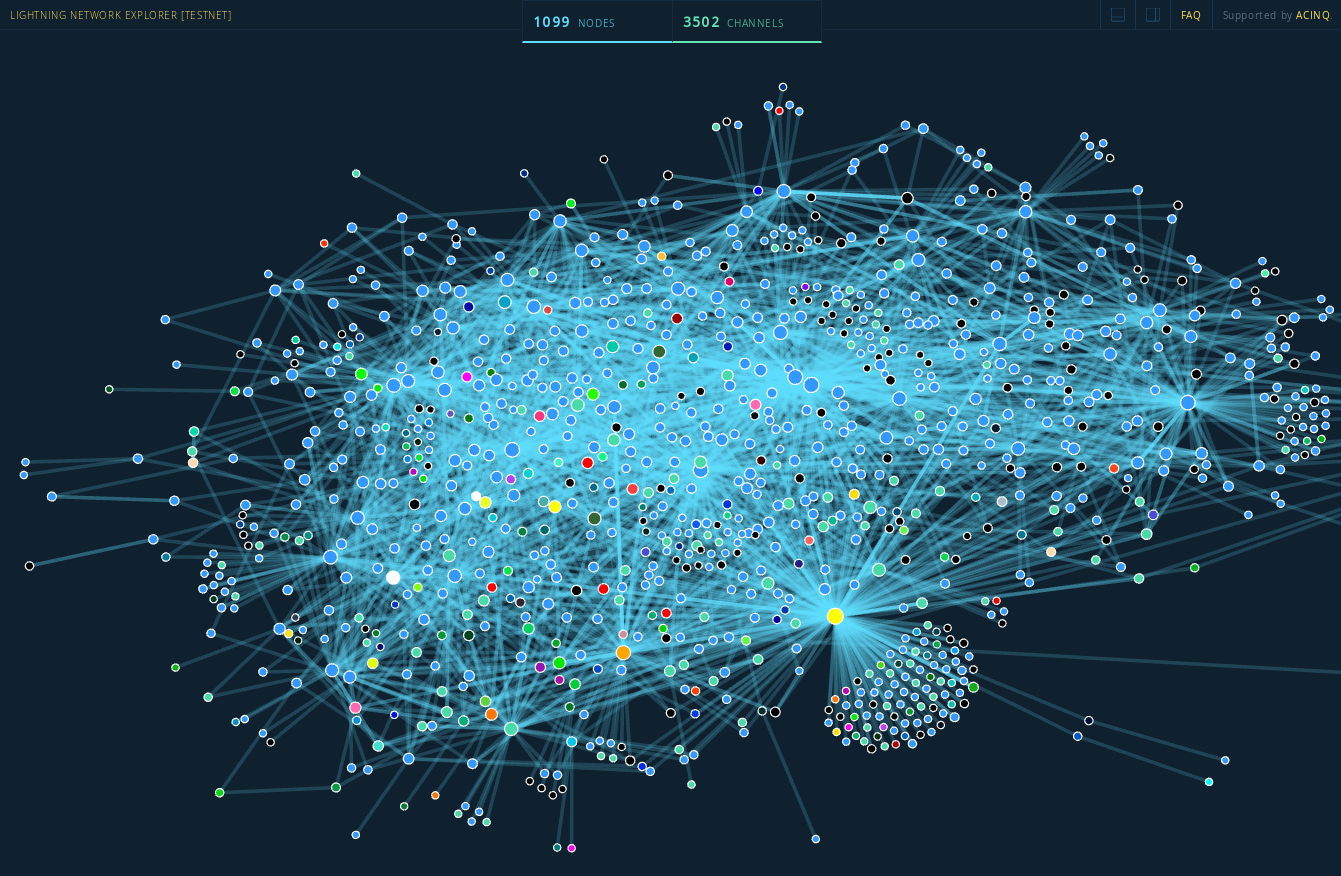

El Salvador raised the visibility of BTC after becoming the first sovereign nation to adopt the digital coin as legal tender. Because of potentially high fees to send the asset, the country’s users may start accessing the Lightning Network, a secondary collection of nodes. In the past days, LN usage has grown significantly:

The capacity of the LN has reached $100M in value across 10,000 nodes and all possible channels. The LN started as a small experimental effort, and has helped build a faster transaction tool for lower fees.

The reality of implementing BTC remains to be seen for El Salvador. The country has attracted BTC owners in the past, due to its liberal attitude to digital assets. Now, the country will also sell the right to mine BTC using geothermal power, trying to solve the problem of sustainable network security.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

A review of the risks and rewards of trading with leverage and some of the best exchanges to consider

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.