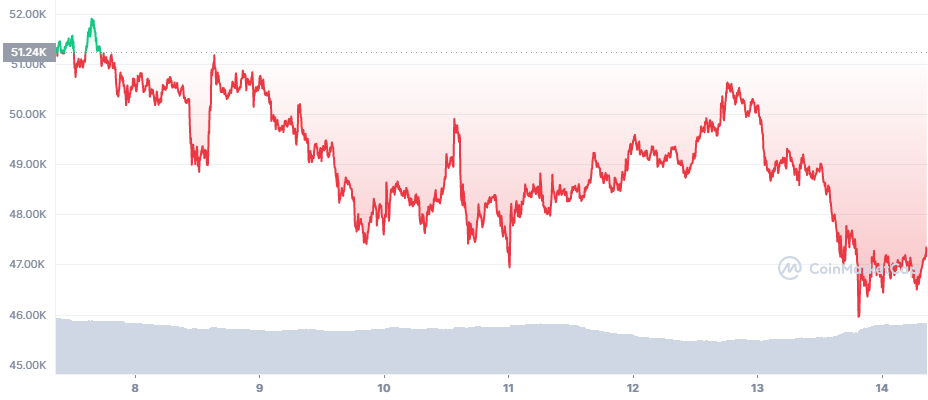

Altcoins Erase Gains, Bitcoin (BTC) Breaks Under $47K

The previous week’s price weakness expanded re-sparking predictions of a bear market and a further price slide. Some predictions see BTC breaking to the $41,000- $42,000 range before eventually taking off again. Yet the latest price moves also recall fears of another prolonged period threatening a bear market.

Once again, despite the evolution of the cryptocurrency market, there are fears the latest rally cannot be sustainable and most assets will backtrack. The effect of leveraged trading is making the price moves steeper, causing liquidation cascades several times in the past months.

The latest price slide caused relatively small liquidations, as most of the leveraged positions were wiped out in the past few days. Futures trading on the Binance exchange saw about $10.49M in liquidations, of which $6.66M longs and a smaller fraction of short liquidations.

Can BTC Recover

BTC prices moved below their 200-day moving average and closed on Tuesday at $46,737.48, just below the recent 50-day moving average. Despite the chart factors, there is still encouragement the retrace may be temporary.

So far, BTC dipped to a temporary low on the day at $45,894.85, on slightly more active trading volumes around $33B in the past 24 hours.

Funding rates for BTC are extremely low or negative, with trader sentiment still signaling extreme fear.

For the immediate short term, the spot market may hold up prices and cause significant outflows from exchanges. But without a return to leveraged trading, it may take weeks for the pace of trading to pick up again.

Based on the Rainbow chart, BTC is still not in the buy zone, though a further drop may signal a buying opportunity. The BTC market remains uncertain whether the cycle peak is in the past, or whether the leading coin still has the potential to reach six-digit prices.

The BTC market volatility is more significant in the past month, rising from recent lows around 2% to around 3.86%. Both bullish and bearish pressures, especially during periods of options expiry, drive the price action. Trading anomalies also produce rapid deep losses, such as last week’s erasure of $8,000 from consolidated prices.

Altcoin Projects Affected More Deeply

After weeks of record-setting prices, previously hot altcoins took a deeper hit. Most assets lost about 10% of their recent value, extending the slide from the past few days.

The Ethereum (ETH) market cap dominance is still 20.9%, despite the asset slipping to the $3,700 range. The Ethereum DeFi ecosystem proved resilient, still holding more than $96B in value. Despite short-term liquidations, DeFi has recovered once again as algorithmic operations prevent some of the losses.

Altcoins at some points provided relief for a stagnant BTC, but during liquidation events, their volatility is higher. The altcoin market still makes up 20% of the total market cap of all digital assets, though liquidity and price move potential is concentrated with the more prominent projects.

The most optimistic scenarios for both BTC and altcoins is that the market has not yet reached the top of this bull cycle, and is yet to mark new highs.

Despite this year’s setbacks, most crypto startups are showing significant growth and development, with more use cases appearing every day with the rise in play to earn games.

BTC Transparency in Demand

Despite short-term price fluctuations, the acceptance of BTC is widening. One of the biggest problems of BTC, the need for transparency, has been overcome through blockchain analysis.

The Robinhood app, one of the tools for retail BTC buying, also has a need for compliance with regular fintech reporting. Tracking BTC addresses and coin history may add to the transparency and availability even for services worried about reporting and regulations.

On the other hand, the tracking of the BTC network and even the Lightning Network will raise demand for newly mined coins with no transaction history.

As of December 2021, 90% of the entire BTC supply has been mined. The rest of the supply will take more than a century to mine based on a four-year halving schedule. Miners have held onto their recently mined coins, and exchange balances remain low.

The underlying bullish factors set the expectation that the recent short-term volatility may be part of a bigger picture, with more upside for BTC in the longer term.

In the short term, some BTC investors have recently sold coins closer to the market top. At the current levels, 70% of BTC holders are in the money. The most recent sell-off also coincided with a rapid inflow of BTC on exchanges.

The selling events are unpredictable, and there are signs of outflows resuming.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Part 2 covers intermediate trading strategies including Bollinger bands, the TRIX indicator and pattern trying

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.