Alternative Network Demand Boosts XDC, AUDIO, ICP

Leading coins like BTC and ETH are taking a breather, along with blue chips. The latest series of rallies now comes from a collection of coins and tokens belonging to alternative networks. Previously neglected coins are regaining attention as they branch out with new economic models.

In the past week, a series of assets made fast recoveries, with some marking new all-time highs. The rallies affected Cardano (ADA), Solana (SOL), Terra (LUNA), Avalanche (AVX) and NEAR Protocol. The trend lifted up some assets out of relative obscurity, pointing attention to their growth potential.

What is the Next Wave of Coins

The next wave of coins shows that Asian trading has returned, with significant volumes coming from Chinese and Korean exchanges. Binance International takes the lead, boosting assets that are still unknown and unavailable for US-based traders.

The latest rallies boosted the positions of Audius (AUDIO) and XFin Network (XDC), two coins that were relatively obscure within the top 100 of cryptocurrencies.

AUDIO is at $3.54, on track to repeat its all-time high from May 2021. The latest rally is happening on volumes of around $471M, an all-time high for this asset. For now, it is unknown if AUDIO will be able to keep up the pace and avoid returning to very slim trading volumes. The recent rally above $3.50 marks a five-fold growth since the asset dipped to $0.70 after the markets broke down in June.

AUDIO is an asset created with the goal of tokenizing music streaming and creating a decentralized platform for artists. The asset is built on top of the Ethereum network, and may be subject to limitations and relatively high fees. Based on the latest blockchain data, AUDIO is held by more than 18,000 wallets, though nearly 80% of all AUDIO are concentrated in two addresses.

XFin Network Makes Use of Korean Trading Spree

XFin Network is another dramatic breakout among the top 100 of digital assets. XDC rose to $0.15, an all-time high for the asset. However, XDC has limited availability and mostly relies on the KuCoin exchange activity.

Korean trading often sends assets to a premium price, but KuCoin is usually limiting access for international traders.

XDC broke its own record of $0.12 in May, and has now rallied from a low of $0.05 to the current price discovery stage above $0.15.

While XDC may return to lower valuations, its recent spike indicates a return for speculative and risky trading, which lifts up even relatively obscure altcoins. The KuCoin exchange recently noted its trading activity was consistent with another altcoin season where lesser coins may break out fast.

The XDC asset is the native token of the XiFin network, which aims to become an enterprise-grade smart contract network. The asset may be used as a blockchain settlement tool for both decentralized and legacy financial operations, such as insurance, or a replacement for SWIFT transactions.

XDC has existed since 2017, but has broken out in the past year as most assets got lifted by the success of BTC.

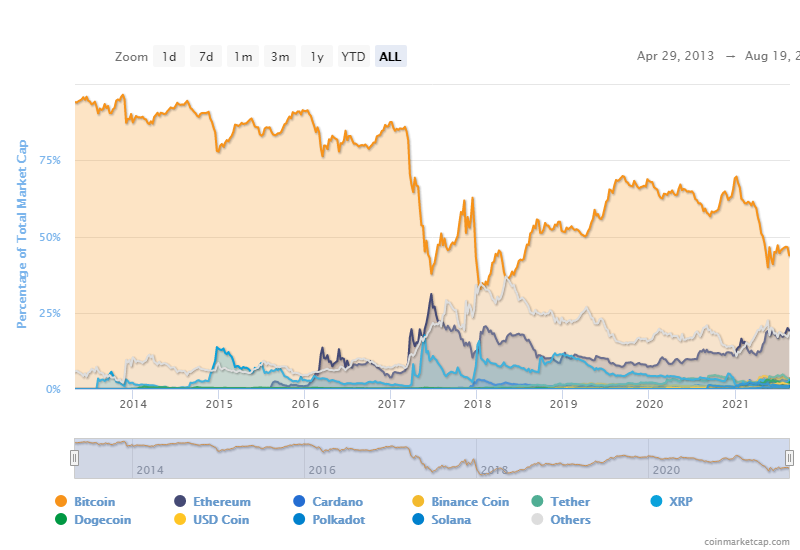

BTC Dominance Down Again

The market cap dominance of BTC is down to 43.9%, from levels above 47% in the past months. BTC dominance indicates interest in some types of assets, as well as overall market exuberance.

The rise in Ethereum dominance above 18%, coupled with the influence of multiple smaller altcoins, means about 35% of the market cap is concentrated in small-scale projects, some of which are getting almost immediate boosts from traders.

BTC market cap dominance turns up higher as traders lose interest in highly volatile altcoins and seek a safe haven in the leading coin. However, a relatively stable BTC price will trigger an altcoin season, where higher returns are possible.

The Cryptocurrency Fear and Greed index rose to 70 points, indicating greed territory. However, the latest trades for legacy coins are happening with a lower level of leverage, as the Binance Exchange leveraged trading and futures are now limited for new accounts, and will also be curbed for existing traders, to de-risk highly leveraged speculative trading.

ICP, XRP Expect a Boost

The rapid daily pumps for assets are re-sparking hopes for lagging assets to reach new highs.

Internet Computer (ICP) is back above $64, with volumes suggesting renewed accumulation and the potential for a rally to triple-digit prices.

Attention has also been diverted to XRP, which has lagged the altcoin rallies on caution about its security status. XRP traded at $1.12, getting closer to its April high above $1.40. XRP traders expect prices above $2 on renewed speculation.

XRP is still trying to position itself as an asset for bank settlement. But the recent hype for crypto collectibles has also affected Ripple, and now the network claims it has tokenization capabilities and may attract the next crop of NFT collections.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Will decentralised finance revolutionise the financial world or is a a lot of hype. Should you get invoved?

Part 2 covers intermediate trading strategies including Bollinger bands, the TRIX indicator and pattern trying

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.