Bitcoin (BTC), Ethereum (ETH) Dips Still Happen

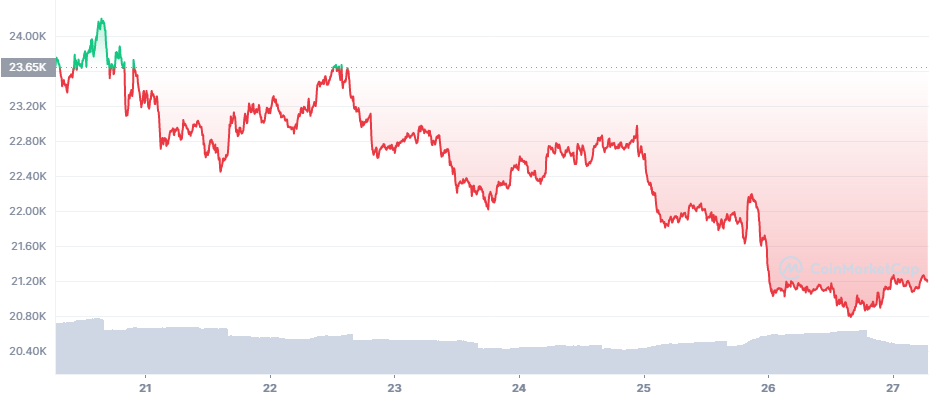

After an encouraging day for both Bitcoin (BTC) and Ethereum (ETH), the leading assets showed a fast rally is still not easily achieved. After a day of sideways trading, BTC and ETH started to slide to a lower range.

ETH sank under the $1,400 level, erasing the gains and dropping its advantage to BTC. The narrative of moving to proof-of-stake is already established and the ETH market price was not capable to defend a return above $1,600. Mid-week, ETH recovered once again to $1,449.88.

BTC sank to the $20,700 range, after losing the $22,000 tier just a day ago. Later, BTC regained to $21,214.50.

With this, BTC broke the recent rally above $24,000 and may be entering another week of testing the downside. BTC still trades with a warning for being in a bear market, making the downturn less surprising. However, the breakdown may delay another run closer to $30,000 as previously predicted or at least hoped for by traders.

Liquidations turned almost double overnight, to $11.32M for BTC, but grew much larger at $23.24M for ETH positions. The downturn liquidated long positions, with Binance at the lead having more than 93% longs liquidated in the past day.

Trading for BTC remains more volatile than usual, not only on average but within the bounds of even one trading day. Moves like this may additionally hurt sentiment.

The Crypto Fear and Greed index did not react this far, sliding to 26 points from 30 points the previous week. The index is now still away from the extreme fear range, though still not signaling a return to neutral or greedy sentiment for months now.

Current price moves have also broken the bullish potential for an immediate breakout, with the potential to revisit levels under $20,000.

This time, the slide happened on larger volumes around $39B in the past 24 hours, in contrast to the low-volume upward moves during weekends or less active trading periods.

Can BTC Still Break Out Above $25,000

BTC is keenly watched for indicators of bouncing off the current levels for a more significant rally. For now, BTC is still close to the overall downward trend seen during the first half of 2021.

Yet BTC is not far from short-term dips which may be expanded and accelerated in case of returning panic. BTC moves are also still happening to attack positions, as in the current liquidation of longs.

BTC also keeps growing its capacity, with upward of 4,100 BTC locked in the Lightning Network. Miners are also adding activity, keeping the hashrate close to 200 EH/s. BTC is still not so readily seen as a hedge to inflation, especially after the losses from its peak in late 2021. However, even short-term buyers keep holding the coin as a longer-term bid, with a time horizon into 2024.

BTC still has the advantage of being a more liquid and reliable asset, replacing riskier crypto investments.

Can ETH Fall to $500

One of the big fears for ETH is that a bull market is not guaranteed, even leading up to September 19 and a switch to proof-of-stake. ETH may display more price weakness, and any move under $1,000 will be watched for the potential to lead down to the $500 price range.

ETH slid from a recent peak at 0.07 BTC down to 0.068 BTC, still holding ground against the leading coin.

ETH is one of the assets with more significant losses year-on-year, reflecting the competition from altcoins that succeeded in keeping their levels or making bigger gains.

One of the reasons for previous rallies were expectations of ETH rising as high as $10,000. ETH rose the most during peak periods of DeFi growth, which caused a circular effect of bloating the book value of DeFi assets. Currently, ETH is back to its role as a utility token, used for staking, gas fees and partially for derivative trading.

Tether Keeps Supply Steady

In the past few weeks, the supply of Tether (USDT) remains steady just under 66B tokens. Tether, Inc. is yet to show a full audit of its assets, but so far the token remains the major source of liquidity, especially for ETH and BTC. USDT takes up more than 68% of all BTC volumes, and around 55% of all ETH trading.

USDT also gained exposure after the launch of a new chat app by Bitfinex with integrated crypto payments.

In addition to ETH-based USDT, a large part of the supply runs on the TRON network and can be used via the Atomic wallet, with card purchase. Despite insecurities, USDT returned to the $1 peg and remains one of the most useful tokens for more intuitive payments.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

A roundup of the main exchanges in Australia allow you to quickly buy Bitcoin and other crypto on your card

What do members of the public think about Crypto in 2021/22? We survey some UK people and look at search data with some surprising results.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.