Bitcoin (BTC) Monthly Close Points to Consolidation

Bitcoin (BTC) closed at $57,005.43 in the last day of November, missing the expected breakout above $59,000. At the current price, BTC continues to consolidate, while lagging from the expectations of an immediate rally to six-digit prices.

BTC traded at $56,781.56 on Wednesday, on volumes around $36B in the past 24 hours. The supply of Tether (USDT) remains close to constant at 73.5B tokens, once again the chief source of BTC liquidity.

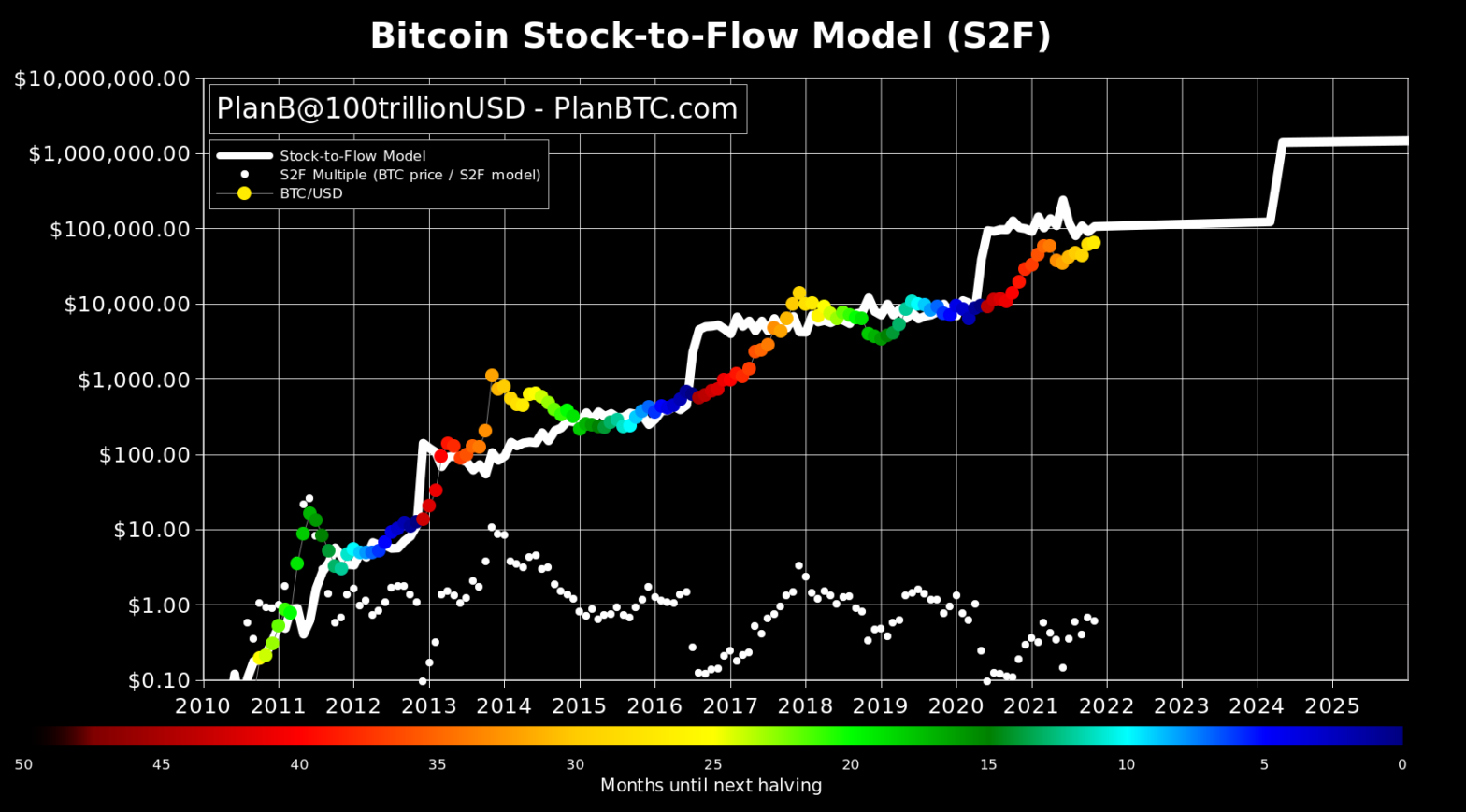

The monthly close was widely expected to point to the next direction of BTC, as well as the asset’s readiness to stick to the stock-to-flow model. However, the model holds a warning that short-term price fluctuations can diverge, and take more time to follow the trend.

The model, which takes into account the halvings of the block reward, has worked for the trend up to now. The most recent rally, however, did not fit the exact expectations, despite both mining scarcity and a low supply of BTC on exchanges.

What Stops BTC from Peak Valuations

The S2F model tends to look overly-optimistic, while the BTC price is instead driven by a mix of spot and leveraged trading.

The presence of leveraged positions can cause some of the more dramatic price moves. Despite this, in the past months a trend of holding onto coins has emerged, for both large-scale and retail BTC buyers.

The BTC rainbow chart model suggests the best strategy is to hold onto the coins in expectation of clearer price moves. The current trend of cold storage holding and lowered leveraged trading is viewed as a strategy to wait out the current stagnation.

However, the investors may be ready to hold onto the assets until the next significant rally. On the other hand, BTC futures trading driven by USDT inflows does not need physical coins. The actual BTC, especially new coins from miners, shows a trend to be held long-term in expectation of growing cryptocurrency influence.

Is Attention Shifting from BTC

While BTC trading leads the cryptocurrency market, attention has also shifted to a collection of coins and tokens. Ethereum (ETH) is charting its own path, expecting to move to a higher valuation as its related projects grow a gamified crypto economy.

ETH recently had its best monthly close in history, and promises a bigger upside compared to BTC.

The ETH economy also has more potentially positive news to drive prices, with value flowing between ETH and token projects. Additional optimism derives from the ETH/BTC monthly close, where the previously predicted weakness for ETH has turned to a potential for a bullish price move.

The ETH market cap dominance now exceeds 20%, with added value from the performance of altcoins. ETH also kept seeing exchange outflows in the past month, as more tokens are locked in DeFi projects and in the ETH 2.0 staking contract.

On Wednesday, ETH proved some of the predictions true, as the price jumped suddenly, adding another 8% to trade at $4,754.15, just days after dipping close to $4,000. ETH has become more volatile, with smaller platforms mimicking the recovery.

Is the BTC Peak in the Past

The 2021 rally for BTC, which brought prices momentarily above $69,000, was considered a mid-stop to a more significant rally. But the sliding BTC dominance point to funds flowing into new platforms.

One of the possible scenarios is that the October peak for BTC was also the peak of this bullish cycle. Other scenarios allow for a new all-time high around $75,000, though not a hike to the predicted valuations from the S2F model.

The more optimistic predictions also see ETH at a higher valuation, between $7,000 and even $10,000 in the near future.

Gamification Turns Platform Coins More Bullish

The addition of crypto-based gaming and the upcoming new wave of game headlines is one of the factors lifting platform coins in the last quarter of 2021. Even Cardano (ADA) finally expects to build a DeFi and gamified economy, by hypothetically allowing smart contracts and predicting new project building in the coming months.

The trend boosted Binance Coin (BNB) back to $632, with expectations of higher valuations in the future. Solana (SOL) has recovered to nearly $220, and Terra (LUNA) defied the market panic to add 39% in the past few days, to $57.58.

While not all platform coins perform in unison, there are always outliers. The previous crop of winners, The Sandbox (SAND), Decentraland (MANA) and Gala Games (GALA) are consolidating, while Avalanche (AVAX) is rising again, at above $126.

Most platform coins have strong representation on the Binance exchange, and rely on significant liquidity in their pairings with USDT.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

Crypto gets a lot of criticism sometimes but what sort of job are the current banks doing at looking after their customers. Who are the best and the worst banks to be with?

Part 2 covers intermediate trading strategies including Bollinger bands, the TRIX indicator and pattern trying

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.