Bitcoin (BTC) Rallies After Celsius Loan Coverage

The biggest pressure on Bitcoin (BTC) kept coming from the over-leveraged mix of centralized and decentralized loans. Celsius, which was threatened by liquidation, nevertheless managed to pay down one of its biggest loans to Maker DAO.

Now, the funds will be sent to the FTX derivative exchange, one of the leading markets emerging in 2021.

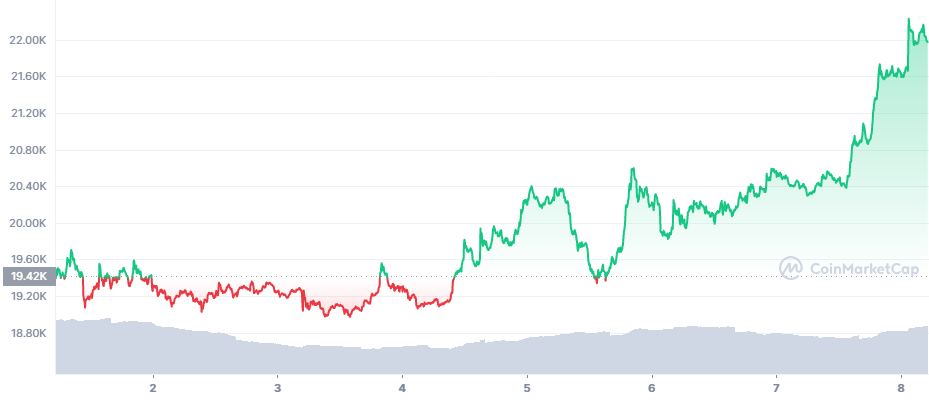

At this point, it is unknown if the BTC would be sold or used for trading. But the news of available funds affected the market, sending BTC above the $21,000 tier. The expectation of ending the slide, as BTC failed to crash to a lower tier in the past week, is also feeding the emerging rally.

BTC also managed to rally above the $20,500 range, which was considered a signal for an extended price move. Ahead of the weekend, BTC rallied to $21,982.48, extending trading volumes to around $28B in the past 24 hours.

Ethereum (ETH) followed the rally and moved closer to $1,300, while smaller tokens moved up in the green, compensating some of the losses.

However, the overall attitude remains bearish, with a dip to a lower range still a possibility. Spot buying may continue, but the logic of derivatives markets may send the price lower much faster, especially if specifically targeting leveraged positions.

Currently, BTC still lacks the trading volume and momentum, with shrinking stablecoin liquidity. The stagnation may lead to an extended sideways movement with potential dips along the way.

BTC volumes remain around 30% lower compared to levels before the June 19 capitulation event. Liquidations in the past day for BTC positions were just around $15M equivalent, a much smaller effect on the market.

Celsius Still Not Safe, Withdrawals Suspended

Celsius has managed to pay down some of its collateralized DeFi loans, as losing the deposit was a matter of automated smart contracts. At the least, Celsius could not afford the move made by Three Arrow Capital, which simply refused to pay non-collateralized loans to other centralized lenders.

But Celsius may not be entirely safe, and the organization may soon close in on a month of no withdrawals. Letting customers take their funds would in fact lead to the end of Celsius. The company now remains more solvent, but still risky for retailers.

CEL has been rising in the past week, moving rapidly from $0.62 to the current level of $0.89. The asset is still far from its one-month peak of $1.50. While the asset reflects the returning enthusiasm, it is also highly risky and volatile. CEL relies on FTX for its main trading pairs, which have a relatively low liquidity score.

Celsius Network itself has not communicated in any way after the withdrawal notification, currently waiting to see if the fund can continue to exist in some form and regain trust.

At the same time, DeFi is recovering fast, with Aave (AAVE) gaining more than 30% in the past week, to become one of the biggest gainers. AAVE returned to $71.44, while some altcoins gained above 10% overnight in small-scale pumps. Value locked in DeFi rose slightly to $41.3B in notional value, from a low of $39B a few days ago.

The renewed activity raised the Crypto Fear and Greed Index to 18 points, a significant recovery from the 6-point lows.

Binance, Nexo, Offer Zero Fees

Binance recently announced a program to encourage trading, with zero fees on its BTC pairs.

Binance exchange remains one of the least risky market operators, with transparent cold storage wallets. So far, Binance has only lost around 7,000 BTC in one heist due to human error. The exchange remains one of the most reliable in the market.

Unlike FTX, Binance has been more conservative in exposing itself to centralized lenders like Voyager, and has not been involved in supporting the fallout of unsecured loans.

Just a few days ago, Nexo also offered zero-fee crypto purchases. For now, Nexo reassures it will honor all withdrawal requests.

But the trend continues to buy and hold BTC on self-custodial wallets. Despite talk of laws to expose those wallets, this remains the best tool to control digital assets. Centralized crypto lenders, which hold coins in custody, turned out to be one of the biggest market risks during the latest downturn.

Unlike Celsius, Voyager Crypto has declared bankruptcy in the USA, after getting exposed to a $100M loan to Three Arrows Capital. Voyager has no recourse to reserves stored with DeFi protocols. Voyager also lent out funds to FTX and Alameda Capital, worsening its liquidity problems. The loss of centralized funds may hurt retail sentiment, while decentralized hubs may continue to offer riskier returns based on smart contracts.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

A roundup of the main exchanges in Australia allow you to quickly buy Bitcoin and other crypto on your card

How do cryptocurrencies stack up against popular stocks and shares?

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.