Celsius May be Paying Down Maker DAO Loan

The latest behaviors of Celsius wallets suggest the organization is not just preparing to ensure its loan from Maker DAO against liquidations. Instead, Celsius may be trying to free up the Bitcoin (BTC) available and boost its portfolio.

In the past few days, Celsius paid more toward its collateral, based on blockchain data. But the repayments may be used to cover the whole of the loan’s balance.

In that case, Celsius may improve its solvency, though still without a guarantee for renewed withdrawals. Celsius will free as much as $439M in collateral in the form of BTC returned to its wallets.

If the loan is repaid, then the BTC price protections may not be meaningful in determining the future price direction for BTC. This adds to the potential trading attitude that the worst of the capitulation is over.

Celsius itself has held user funds for three weeks and has stopped most communications and reassurance. There are also doubts on how Celsius has found refinancing. The organization is not without assets, but some have been lent out. Celsius for now has not reported exposure to Three Arrows Capital, and managed to take its stake from Terra (LUNA) just days before the crash.

Celsius Restructures with Layoffs

At the end of June, Celsius also filed a series of terminations for a growing list of employees.

For now, Celsius has not hinted at seeking bankruptcy protection, but it is not impossible. Voyager Digital Holdings, Inc. is yet another centralized yield-generation hub where user funds were frozen. Days later, the company sought bankruptcy protection.

The losses from centralized crypto-based finance are now larger compared to exchange hacks, closures or frauds in the early days of crypto assets. This time, funds like Terra, Celsius, Voyager and Vauld presented themselves as having safety levels on par with centralized finance. However, most were non-transparent about the way they used the deposited coins and tokens.

The high yields promised were achieved by aggressive lending, which produced yield, especially during the 2021 bull market. The decision for mass withdrawals would have put pressure on operations, as in the case of Celsius. One of the reasons Celsius needed funds was precisely to protect its own loans from liquidations.

Did BTC Reach its Lows

One of the potential scenarios for BTC is that the capitulation and liquidity crunch is almost over and the market may be ready for another cycle.

As usual, in the background, there is spot buying and continued withdrawals from exchanges. At current levels, BTC is still just above the peak from the 2017 cycle, setting expectations any additional price drops may be done for now.

BTC balances on exchanges are at the lowest level in four years, in addition to the trend of miners once again holding onto their coins.

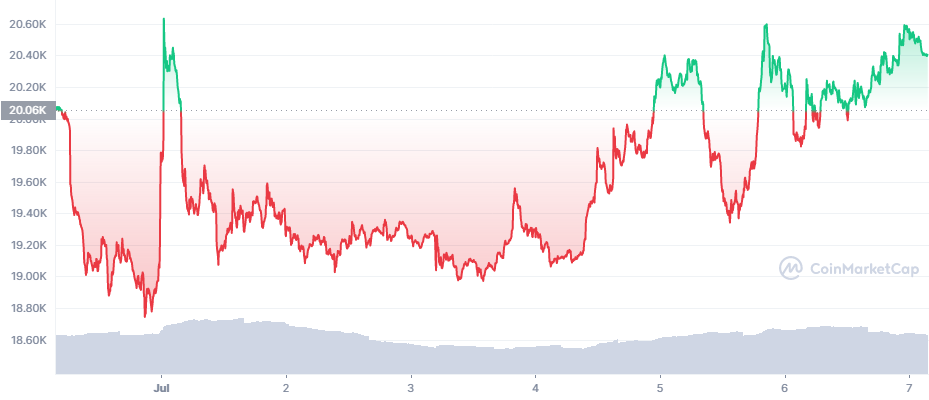

Short-term predictions for a drop to the $16,000 – $12,000 range are so far not arriving as expected, and trading is back on track after US traders returned.

BTC trading volumes remain subdued at $19B in 24 hours. Tether (USDT) is now just under 66B tokens, continuing the trend of retiring billions of tokens. USDT is now down more than 17B, removing a significant source of market liquidity.

The entire crypto market now has subdued trading activity around $60B in 24 hours, levels that were once achievable by BTC alone. While the price unraveling may be near its lows, there are still doubts if there will be enough enthusiasm for a rapid price recovery. It may take months for USDT to increase its supply if confidence returns.

BTC remains close to $20,000, but has not given signals of a short-term break. With volumes slowing down, there are still expectations the downward trend may be stronger. Even at a lower range, BTC may continue to be attractive for accumulation with a horizon of a few years.

Altcoins, ETH Regain Positions

After a stagnant week, altcoins are having some relatively active moves. Avalanche (AVAX) added 12% in a day to $19.65. AVAX tries to regain positions as a network hosting new NFT image collections and gaming projects.

Ethereum (ETH) recovered to $1,170.09, for now establishing relative stability. The loans among Celsius and other hubs have not affected DeFi, and for now Maker DAO has remained stable, with DAI keeping to the $1 range.

The collection of all small coins and tokens is under 17%, almost on par with the weight of ETH. The TRON USDD project is still ongoing, with around 718M stablecoins in circulation. TRX remains with little change around $0.067, and the growth of new USDD prints has stalled in the past week.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

From Airdrop to Wallet we look at all the crypto jargon and what it really means

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.