Bitcoin (BTC) Recovers, Noting Strategic “Whale” Buying

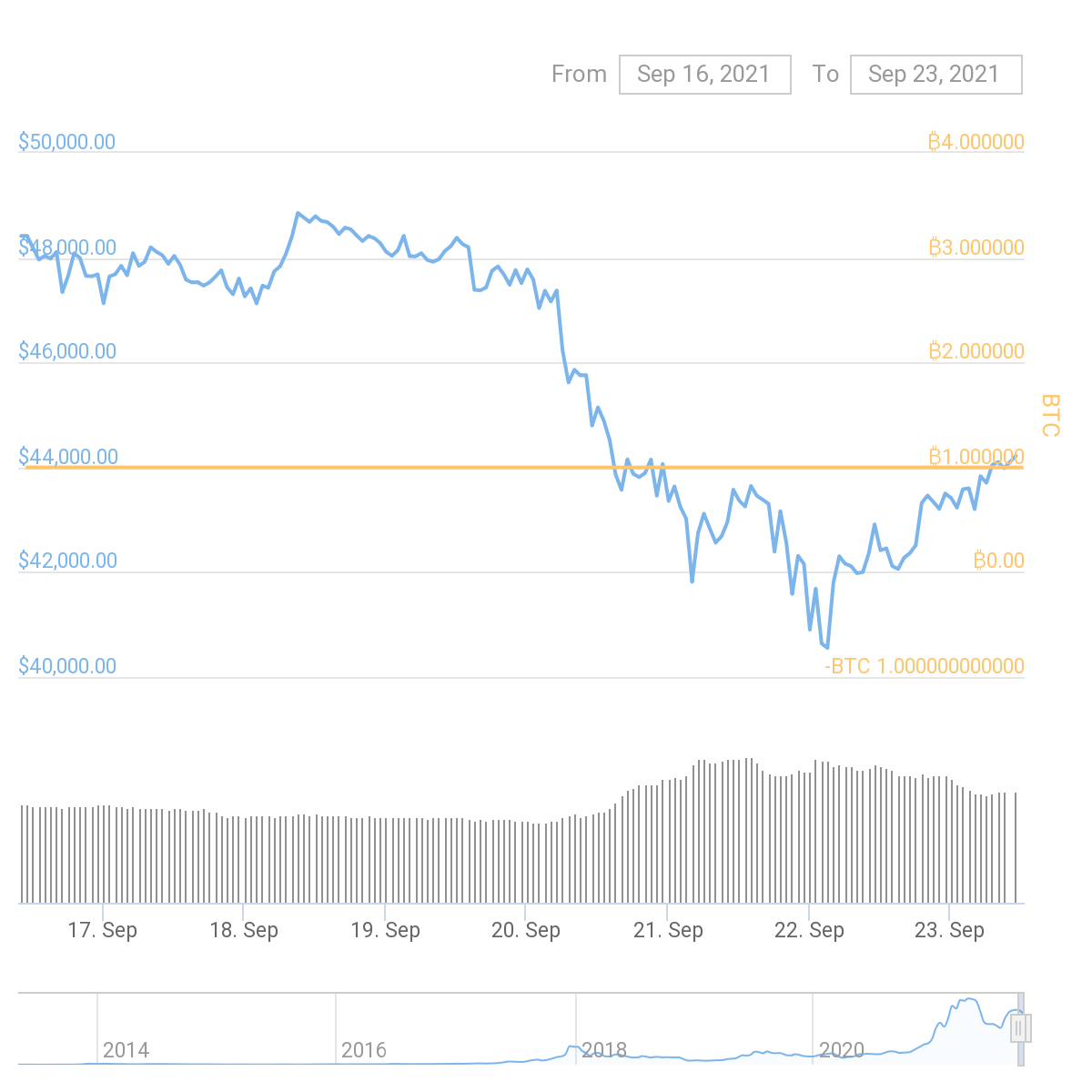

Bitcoin (BTC) recovered in the $44,000 range after briefly dipping under $40,000. The latest crash caused worries on breaking the potential of BTC for another yearly high. On Thursday, BTC reached $44,129 on the Binance exchange, with a slight Coinbase premium.

BTC trading volumes with renewed buying extended to $37B in the past 24 hours. After the recent recovery, no significant increase of the Tether (USDT) supply has been noted. The BTC market cap dominance receded to 41.9% as altcoins are a stronger factor in the past few months and manage to have rapid price recoveries.

On-chain data suggest the price fluctuations of BTC are still affected by spot buying on the part of large-scale wallet owners.

A look at the Bitcoin rich list suggests there is still interest in large-scale BTC ownership, as a long-term store of value, as well as a short-term trading opportunity during peak prices.

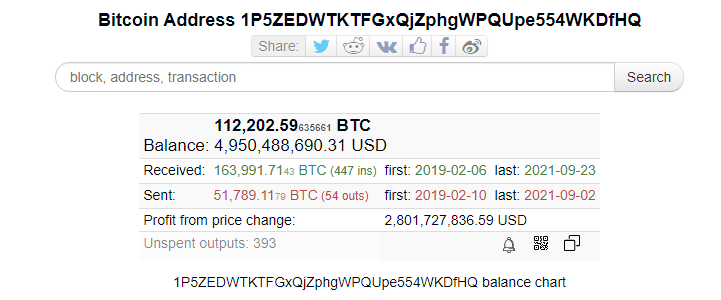

Third Largest Whale Wallet Expands Holdings

During the latest dip of BTC down to $40,000, a notable wallet became active. Over the course of two days, the address added more than 729 new coins.

The latest big purchase was dated September 23, bringing in 408 BTC at temporarily depressed prices. This lifted the wallet’s balance to 112,202 BTC, lining it up as the third-largest single holding of BTC. The wallet’s owner is unknown for now, but the stash does not belong to any known exchange.

The large-scale ownership was built in only the past two years. The wallet was created on February 6, 2019, and only a few days later started buying BTC by the thousands. Some of the latest purchases for this wallet happened at prices above $48,000.

The wallet’s size is similar to the known purchases of MicroStrategy, the company dedicated to publicly expanding its BTC holdings. However, the large wallet remains anonymous, and there is a history of trading and buying back more than 50,000 BTC over the past years.

Interest in Spot BTC Shows Bullish Sign

Despite the volatility of BTC futures trading, and the overall panic attitude during liquidations, demand for spot coins has repeated a bullish pattern from the past. As the BTC price distanced from the $50,000 range, new large-scale buying has been noted.

Not only the prominent wallet increased its holding, but other buyers mopped up more than 31,000 BTC in the past days. Data show most deals are spot exchange buying, and the coins are taken off exchanges.

Exchange balances have been dropping in September, with additional scarcity increasing every day. The behavior of whales, however, does not exclude short-term selling after significant gains.

This measure coincides with a high address activity, with around 749,000 active wallets in each 24-hour period.

Exchanges still keep relatively high balances. However, the Binance exchange cold wallet saw a significant withdrawal of 11,000 BTC in July. Binance now holds around 288,000 BTC on behalf of traders.

Small Holders Join the Buying

The latest price shakedown also saw small-scale buyers with under 10 BTC extend their purchases. Glassnode data show those small-scale wallets now hold 13.9% of the supply. To compare, the prominent whale wallet in the third spot holds around 0.59% of the BTC supply.

Exchanges hold about 2.4M BTC in total, with even smaller holdings on the most widely used markets. The spot market thus remains increasingly important and influential, as both whales and retail buyers could quickly deplete the supply.

Liquidations Slow Down

The latest bout of liquidations saw a peak on Wednesday, with around $1.4B liquidated in BTC positions. On Thursday, BTC liquidations reached around $245M, slowing down across all markets.

The Binance exchange futures market has put a damper on leveraged positions starting in July. Newly created accounts or those with less than 60 days of trading history will be limited to 20X leverage.

At the same time, most EU-based accounts will soon have to close their leveraged positions. The Binance exchange is rolling back the availability of derivative products for EU-based traders.

Can BTC Continue Higher

BTC has shown some signs of finding support above its 21-week moving average. The derivative market still causes trading to show a “fear” profile. However, the Bitcoin Fear and Greed Index often shifts directions, and BTC is still capable of significant price swings.

The latest unraveling means the market is yet to rebuild leveraged positions. In the meantime, bullish attitudes envision another rally for BTC, with the potential to break the $100,000 mark.

As BTC prepares to enter the last quarter of 2021, expectations of a rapid recovery are once again on the table. The next expected level for BTC is to recover the $45,000 range.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

How do cryptocurrencies stack up against popular stocks and shares?

Who are the biggest influencers in the NFT space across the various social media platforms.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.