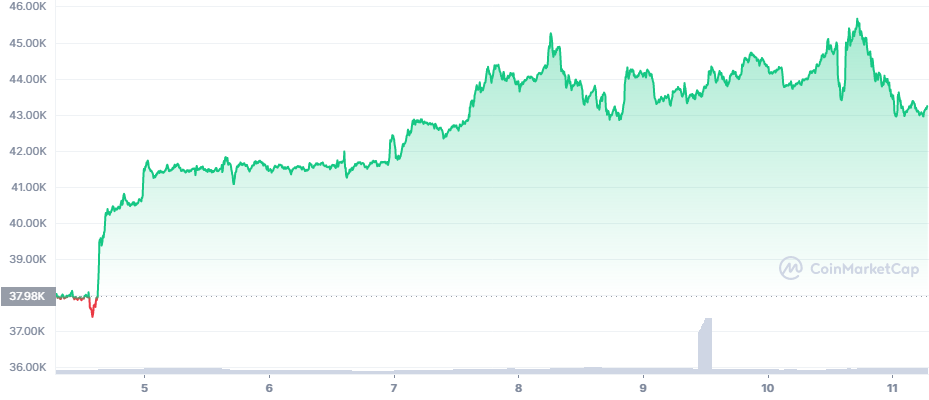

Bitcoin (BTC) Touches $45,000 Range Before Retreat

Bitcoin (BTC) recovered from the recent shock of discovering the Bitfinex stash of over 94,000 BTC and arresting Ilya Lichtenstein and Heather Morgan for attempting to launder the coins. BTC easily regained the $44,000 tier and was on track to go over $45,000 as trading volumes picked up.

Within an hour late on Thursday, BTC managed to rally to $45,557.95, and soon after sinking back to $45,000 again. In the short term, BTC makes surprising price movements, increasing risk with a volatility index of around 3.5%. This led to another slide just under $42,000 ahead of the weekend, leaving BTC with uncertain direction in the short term.

BTC Mainstream Expansion Continues

BTC markets received news with the potential to be regarded as bullish. Russia will present a bill that will treat BTC transactions as a form of currency transfers, requiring the declaration of transfers larger than $8,000. This may be a problem for users from the Russian Federation, who until now enjoyed unrestricted BTC transfers.

Interest in cryptocurrency also grows in Turkey, where the government has encouraged the liquidation of gold reserves to support the freefall of the Turkish lira. In this case, some crypto assets may be in demand as a safer haven that keeps its value.

Despite expectations for a price drop, BTC was driven by a series of potentially positive news underlining the wider adoption of crypto assets. The most recent rally arrived after news of the Binance exchange buying a $200M stake in Forbes, as announced by the co-founder and CEO of Binance, Changpeng “CZ” Zhao.

Binance will replace $200M of a total of $400M pledged by investors in Forbes.

What Comes Next for BTC

In the short term, day-trading for BTC remains highly risky as even short-term price swings can attack leveraged positions. At the current pace of appreciation, predictions see the rally accelerating if BTC breaks a series of resistance prices above $46,000.

In the more extreme predictions, BTC may be able to go for a new all-time high by the end of February. For BTC, the shift to optimism and greed, followed by rapid appreciation, often takes a few days, while stagnation or bear markets continue much longer.

Is BTC Continuing the Upward Trend

BTC looked like resuming its upward trend since setting the bottom of the latest dip at the $32,000 range. The market mood shifted from fearful to neutral with a Crypto Fear and Greed Index at 50 points.

Over the past months, addresses with 10,000 BTC and above diminished, though it is uncertain if this is due to selling or moving coins.

Overall, BTC holders still keep most of the coins, with less movements noted in the past year.

What the Potential BTC Recovery Means for Bitfinex

The Bitfinex exchange back in 2016 performed a haircut and awarded specific tokens to all the traders that were active at the time of the hack.

The potential return of nearly $4B in BTC helped raise the price of Unus Sed Leo (LEO), the new token of Bitfinex issued in 2019. LEO rallied to an all-time high of $7 before sinking again to $6.33. LEO was issued with a nominal price of $1 and only appreciated slowly over time.

Because the US law enforcement agencies have full control of the private keys, they can choose to keep or sell the coins. The wallet is comparable to the holdings of some of the more prominent corporate buyers.

In the past, the US government has auctioned off BTC taken in custody. Bitfinex still has an open reward offer of 30% of the recovered BTC, which has now bloated to a reward of around $1B. In the years following the hack, Bitfinex managed to regain the lost value, which at the time of the theft was just around $700M.

Market Recovery Remains Uneven

While BTC recovered its market cap dominance to its recent range of 42%, some altcoins were slower to regain previous positions.

Ethereum (ETH) stalled under $3,300 and now shrank its market cap dominance from around 20% to 17.2%.

XRP stopped its climb but kept most of the gains around $0.87. Avalanche (AVAX) turned into one of the big movers, extending the rally above $94.26. Other assets remained mostly flat waiting out for direction from BTC.

Crypto.com was an anomaly, with the CRO token rising to a one-month high. CRO sank to lows of $0.33 during last week’s overall market crash, then quickly regained its position to $0.53 with almost no rest in last week’s gains.

This time, the supply of Tether (USDT) rose ahead of the BTC rally, gaining from 77.9B to 78.1B tokens. The supply of USDC also continues to grow gradually, to above 52B tokens.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Who are the biggest influencers in the NFT space across the various social media platforms.

Crypto gets a lot of criticism sometimes but what sort of job are the current banks doing at looking after their customers. Who are the best and the worst banks to be with?

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.