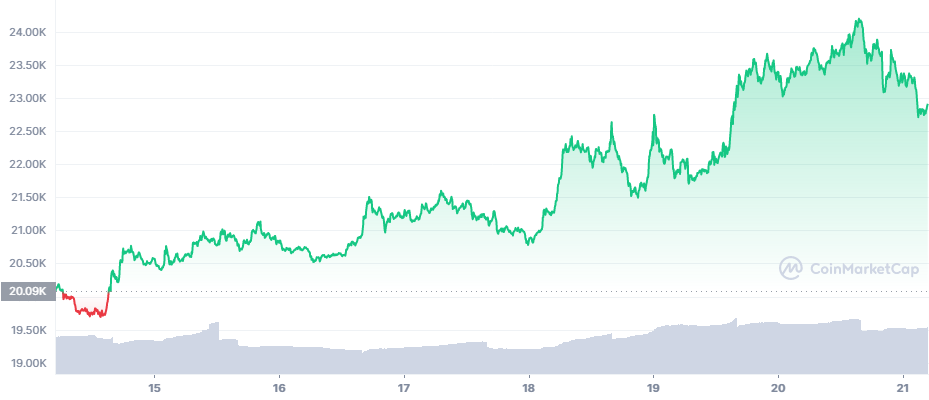

Bitcoin (BTC) Treks Above $24,000, Shorting Becomes Riskier

Bitcoin (BTC) continued to climb new tiers each day as it bounced from recent lows. Mid-week, the leading coin extended its recovery to above $24,100. In this price range, BTC is now outside the “fire sale” zone of the Rainbow Chart, though accumulation may continue. BTC remained highly volatile, also moving down to the $23,600 range within an hour of reaching the day’s peak.

Later, BTC retreated to $22,893.24, after news that Tesla, Inc. had divested 75% of its BTC holdings during Q2.

The Bitcoin volatility index also increased to 5.68% in the past 30 days, up from previous levels around 2.5%. At this price range, the percentage change of BTC is more significant. The recent rally happened with trading volumes above $40B in the past 24 hours. The Crypto Fear and Greed Index is at 31 points, still signaling fear though not extreme fear.

BTC extended its market cap dominance above 42.6%, with ETH stepping back in dominance to 17.8%. Smaller assets also showed their potential to hold onto gains remains very low, with most assets stepping back after Tuesday’s gains.

The upward move led to liquidations of around $53M in BTC positions, with FTX leading the way in derivative trading. Binance has fallen to the third spot, with around $9M in liquidations, of which more than 58.9% were short positions.

The current rally is seen as a relief from recent lows, though not necessarily the start of a bull run to all-time highs. Predictions for the current rally envision BTC trekking to $28,000, while ETH may revisit the $1,800 range.

The BTC climb continues along with the positive performance of Ethereum (ETH), which recovered above $1,600. Altcoins followed suit, with strong performance from Polygon (MATIC) reaching closer to the $1 tier.

BTC Trend Still Questioned

At this point, BTC may still turn down lower and retest the robustness of the current rally. A full reversal of the trend is not guaranteed and BTC is still far from returning to bullish territory.

BTC short positions remain highly risky, with warnings to avoid shorting until as high as $33,000. With expectations of downturns, BTC may move to liquidate various tiers of short positions.

The short-term trend remains bullish, with a timeframe to reach $28,000. However, predictions also include a potential return to the $17,000 level and a renewed bearish trend.

In the meantime, miners selling and retail accumulation are setting up the longer-term predictions for BTC. Miners offloaded around 14K BTC in weeks, one of the biggest selling pressures since 2021.

The unusual combination of increasing BTC prices and highly active altcoins is also looking like a summer relief rally, with the potential for short-term gains.

Bitcoin Holders: 50% at Loss

The holding behavior remains strong, with around 50% of short-term holders having unrealized losses. The readiness to buy at any price led to some of the more expensive BTC being bought as a long-term bet.

Glassnode noted the current trend shows some of the coins are off the market for now, despite a previous retail capitulation.

The past three months were also a peak holding period for BTC, especially with renewed accumulation near the lows. The mix of trends for realized and unrealized losses was also taken as a signal for a market bottom, or at least a smaller probability for BTC to slide under $10,000.

If BTC starts a bigger recovery now, it will be one of the shortest periods with more significant unrealized losses. The 2020 bear market continued longer, with the exception of the rapid recovery from a brief dip under $4,000.

DeFi Remains Stagnant

Despite the rally of ETH, the funds locked in DeFi remain stagnant. Currently, ETH-based protocols still hold around $40B in value. Demand for high returns remains subdued, especially after the risks of loans on DeFi protocols.

At the same time, DeFi remains safe from most loan liquidations and can continue at this baseline.

Recently, Aave (AAVE) recovered briefly above the $100 tier, though it has fallen back toward $93. AAVE remains one of the tokens representing a large part of the funds locked on Ethereum.

Stablecoins keep up their levels, with USDT and USDC remaining the most important assets for both centralized trading and DeFi. Even Neutrino USD is back to $0.99. USDD, the stablecoin issued by TRON (TRX), now covers close to 0.5% of the entire stablecoin supply.

UST, the Terra LFG stablecoin, has not recovered and hovers around $0.04. While LUNC, or Luna Classic trading continues, the market is extremely risky. LUNC is at $0.00017, while LUNA, the new asset, trades around $2.07, within its usual range due to loss of trust and lack of new investments.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

From Airdrop to Wallet we look at all the crypto jargon and what it really means

Who are the biggest influencers in the NFT space across the various social media platforms.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.