Bitcoin (BTC) Turns Red, Sentiment Shifts to Fear

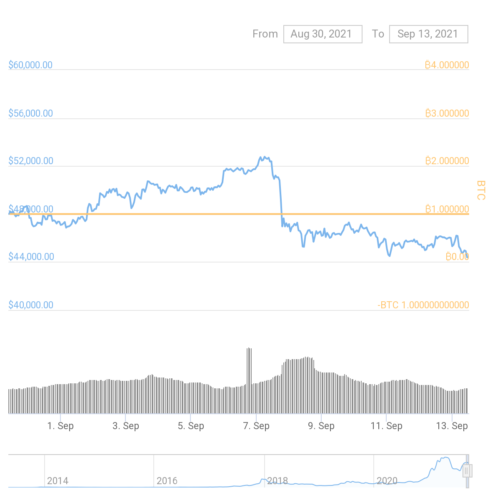

Bitcoin (BTC) broke below $45,000, putting a stop to its recent tentative recovery, which only regained the $52,000 range. The recent trading activity happened on volumes around $29B in the past 24 hours, within the usual trading activity for the past few weeks.

BTC also broke the trend of rising on weekends, and instead started erasing some of its gains. BTC traded at $44,885.99 on Monday, extending the slide from Asian trading. The current slide has been less dramatic than last week’s BTC flash crash, which pushed the asset down to $42,000 before it recovered.

The BTC market cap dominance is at 40.8%, a level not seen since late 2018. At the same time, the dominance of Ethereum (ETH) and its ecosystem of projects has expanded, to make up nearly 40% of the entire market capitalization for digital assets.

The market cap of BTC stands at above $825B. But the Ethereum and alternative blockchain ecosystems are chipping away at that value, already locking in a rough estimate of $130B in DeFi projects, lending schemes and decentralized trading.

Is the Yearly Trend Still Intact

One of the chief expectations for BTC is to regain its all-time high, and possibly achieve the $100,000 landmark within the coming months. The BTC price is volatile, and the possibility is not excluded.

The recent flash crash arrived with massive selling, but for some, this was a temporary event and the markets would recover.

One of the big problems for BTC are the liquidations happening within hours, which depress the price significantly.

Whales Keep Buying

Despite the recent trend reversal, there are signs that large addresses keep accumulating BTC. The latest on-chain data reveal significant spot BTC accumulation in the past four days.

The increased interest in spot buying is also adding to the scarcity of available coins. Exchange balances have thinned out, as more assets are moved to safer wallets. This also coincides with higher demand for altcoin trading, while BTC is once again turning into a deep reserve digital asset, with a prevalence of long-term holders.

With only 2.4M BTC on exchanges, retail buyers may have even more limited access to getting some of the coins.

Profit Takers Still Active

Despite signs of long-term holding, BTC is often sold to realize some of the gains. Trading conditions may change fast, as traders decide to switch to USDT or lock in some of their gains.

The exchange outflows so far have been a snapshot of general availability. In the short term, a smaller inflow of BTC with spot selling could continue to depress the price.

Most of August saw BTC outflows from exchanges and significant holdings in the wallets of miners. But it is still possible to see “whales” moving in to sell BTC and depress prices in the short term.

The past three months also saw more than 16% of all coins change hands during the latest period of price swings. BTC managed to move between $28,000 and $52,000 in about six weeks. Glassnode data for transaction output suggest profit-taking and ownership shifts remained significant during the recent price recovery period.

Market Continues to Deleverage

The rapid price movements of BTC have shaken down leveraged positions, for both short and long risk takers. The riskier trading climate also led to a rapid fall in the Crypto fear and greed index, from a recent high of 79 points down to 39 points, in the range of “fear”.

Currently, leverage levels for BTC coincide with slower trading in the past days.

The low volumes follow the significant deleverage of September 7, when more than $2.7B in positions were liquidated.

The significant liquidations over the past ten days also underlined the disparity between leveraged trades and long-term holders. Despite the price volatility, most coins remained unmoved.

Can BTC Expect Short-Term Boost

In the short term, a boost and a new breakout may happen for BTC, based on a recently approached golden cross of the 50-day MA and 200-day MA.

Short-term fluctuations delayed the golden cross, with renewed speculation on the direction of BTC. The new expectations for a breakout suggest BTC needs to regain the $48,000 level first, before continuing with new breakouts.

Mining Accelerates in the Past Month

Mining continued to accelerate and added about 25% to activity in the past four weeks. Mining activity is yet to return to the highs from the past months, but has made a significant recovery.

After closing a handful of mining facilities in China, the recovery suggests miners found new locations, or new farms took over.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

Crypto gets a lot of criticism sometimes but what sort of job are the current banks doing at looking after their customers. Who are the best and the worst banks to be with?

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.