Bitcoin (BTC) Under $48,000, What Caused the Dip?

#

Bitcoin (BTC) further distanced itself from peak market prices nead $64,000. The leading coin wiped out a few thousand dollars, dipping to the $47,000 range. With the latest move, BTC broke short-term predictions of a dip to the $51,000 support level.

BTC continued to slide ahead of the weekend, extending the slide to $47,838.06, sparking fears of further panic and a red monthly candle for April 2021. The slide breaks a six-week streak of BTC prices above $50,000.

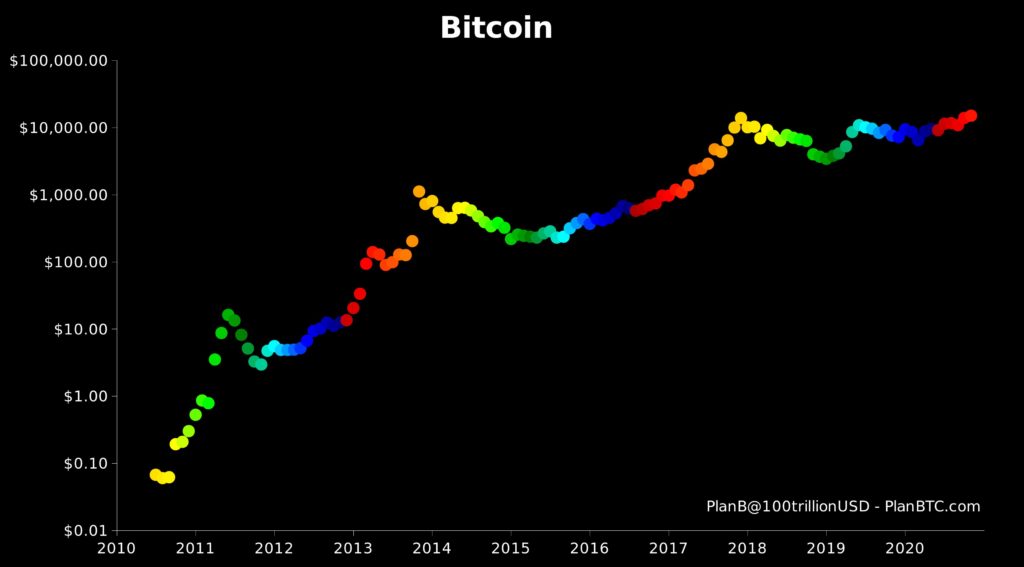

During the current round of volatility, the next move for BTC remains uncertain. For now, BTC has held close to predictive models, and the latest price dip has not broken down most long-term indicators of price growth.

Yet BTC is still vulnerable to short-term selling and price anomalies. The past few days saw a series of factors that could sway markets and cause panic.

Turkish Exchange Thodex Suddenly Closes

In the past week, one of the biggest shocks to retail investors was the sudden closing of the Thodex exchange in Turkey. The country is one of the most active markets for crypto trading, and even has its own branch of the Binance Exchange, Binance Turkey.

However, crypto regulations in Turkey are tightening and exchanges may be facing higher taxation starting at the end of April.

The Thodex exchange froze deposits and withdrawals, locking out thousands of traders out of their accounts. The estimated assets frozen include $2B in BTC and up to $10B in total including altcoins.

Traders also reported the exchange sold Dogecoin (DOGE) at vastly discounted prices, as low as $0.11 while the coin traded at $0.42. This drew in multiple new registrations and deposits. Unfortunately, days after the sale of DOGE, the exchange’s CEO disappeared from social media and from the country.

While $2B in BTC lost is small compared to the entire market, it still shook the Turkish community and added to the overall fear of crypto risks. The exchange halted the trading of more than $500M in assets per day, and has been inactive for more than 60 hours at the time of publication. The exchange posted a message that only an estimated 30,000 users have been affected, and the company is working toward compensation.

BTC Futures Expiring

BTC market prices have dipped historically on the last Friday of every month, when options are set to expire. The options levels may be puting price pressure on the market. Friday is the expiration of weekly options, and next week will see the expiration of BTC monthly options.

Options to buy or sell the asset at a predetermined price may trigger attempts to bring down BTC temporarily. Currently, BTC is still affected by large-scale selling from “whales”, and this may benefit option sellers by cutting their losses. The options on the Deribit exchange are the most active, and have shown a regular pattern of correlating with BTC price moves.

Shift in Trader Behavior?

The Bitcoin fear and greed index crashed by 20 points, and veers toward neutral. At 55 points, the index is the lowest in a month, drifting toward the levels at the end of March. The index is down from 78 points or “extreme greed” only a week ago.

The drop of the index is mostly caused by lower trading volumes and growing volatility. The index also reflects social media trends and the general attitude toward BTC. BTC prices are thus easily swayed by fears, and sometimes respond with a fast crash.

Ethereum Taking Over

The price of BTC is mostly correlated with that of Ethereum (ETH). But the asset has been attempting to uncouple and reach new highs independently. In the past week. ETH managed to hold above $2,500 on growing trader enthusiasm.

On-chain usage for Ethereum reveals the impact of decentralized finance and token-based projects. Despite high gas fees, activity remains significant, as DeFi also promises high returns.

ETH moved toward 0.045 BTC, the highest level since 2018, suggesting the asset may gain dominance and decouple from BTC price moves.

The slower expansion of BTC is also triggering a wider altcoin season, where all other assets are gaining faster, leaving BTC behind. Unlike BTC, ETH is also trading at near-record volumes above $58B.

The recent DOGE trading hype is also subsiding, and may redistribute attention to other assets. Most of the DOGE gains were made in relation to the 4/20 meme date, and since then the coin lost about 50% of its value.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

How do cryptocurrencies stack up against popular stocks and shares?

In Part 3 we look at more advanced trading strategies including flags, false breakouts and the rejection strategy

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.