Bitcoin Mining Loses Chinese Farms in Rapid Shutdown

##

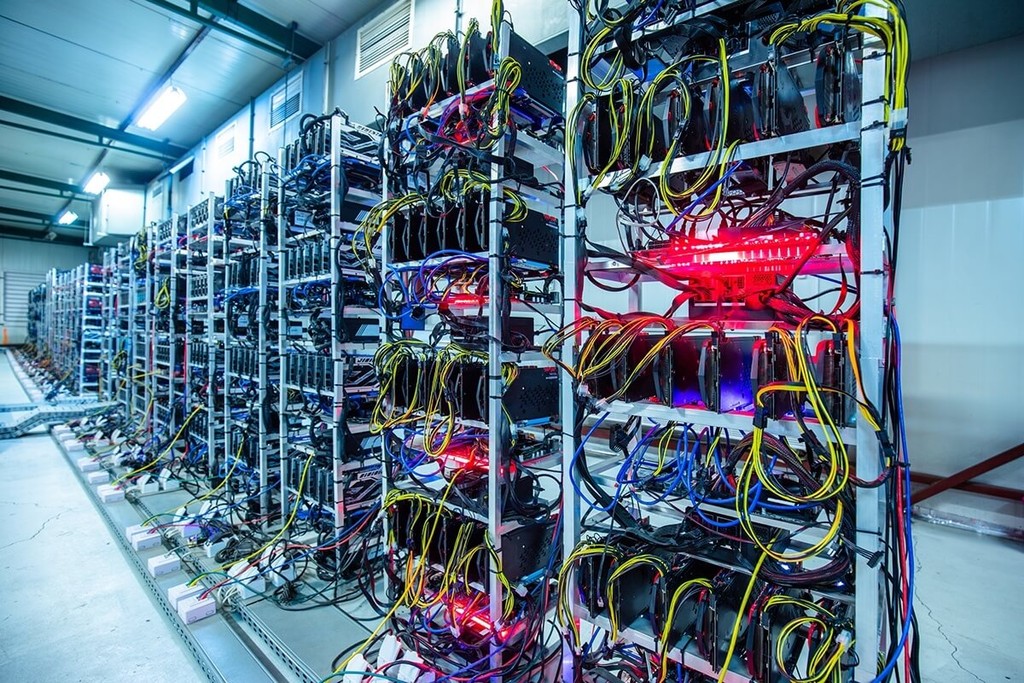

Bitcoin mining may be going through a watershed moment, as news of big “farms” shutting down in Chinese provinces hit social media. The loss of miners follows a drive to wean the network off coal-powered electric power. The shutdowns were reportedly ordered by local governments and led to immediate shutdown of the facilities.

The concerted shutdown affected 26 mining factories in the Sichuan province. Sichuan remains one of the most influential regions in mining, and the shutdown of most mining activities will bring a trend to transfer the hashrate to other farms. For now, there are no confirmed data of bans in other provinces, or on mining that uses hydroelectric power.

In the short term, the loss of thousands of mining machines means the Bitcoin network is smaller and less competitive. The combined work of all miners, or the total hashrate, has fallen to 91 EH/s, a level not seen since the end of 2020. Rough estimates see the network losing about half its miners.

Some mining will continue in China, as the ban will target larger farms first. In the past, the hashrate has gone through similar crashes due to various reasons, including shutting down some farms with no explanation, or flood damage to mining equipment.

BTC Block Production Changes Short-Term

The rapidly diminishing hashrate led to a slowdown in the Bitcoin network, taking more than 10 minutes to produce a block. Despite the recent reduction in difficulty, even at these levels big pools are struggling to keep up with block time.

Some of the biggest pools shrank their block production, leaving some of the hashrate concentrated in the hands of undetermined entities. Block discovery depends both on available computing power, and on luck in discovering blocks.

The next difficulty readjustment is expected on June 30, and will make it more than 12% easier to produce a block. But the actual difficulty may go even lower to reflect the loss of hashrate. In the short term, this may mean more delayed blocks and possibly network congestion. For now, there is less pressure to move coins and the mempool holds the normal number of waiting transactions.

What Lies Ahead for Bitcoin Mining

The news of hashrate loss from mining giants like Antpool and F2Pool is viewed in a rather positive light. The loss of mining power is a door to make Bitcoin production more eco-friendly by using renewable sources of electricity. While previously the news of a ban on mining was viewed negatively, in 2021 this is viewed as an opportunity for more diversified mining.

Mining in China has one of the lowest costs of production, with the drawback of using “dirty” coal-powered electricity. The cost of mining one BTC can easily reach $10,000, though at current market prices miners are capable of selling only a part of their block reward to finance their operations.

The other positive effect is that there is more clarity on China’s attitude to Bitcoin, thus saving the market from unexpected negative news on mining bans. In the past, mentions of potential mining bans has worked to crash BTC market prices.

Chinese mining farms have been one of the most significant drivers behind the extraordinary growth in hashrate. The favorable BTC price pushed miners to produce as much as 181 EH/s in mathematical calculations. Now, some of those farms will have to relocate their equipment and find new sources of electricity.

China still hosts 164 Bitcoin nodes, but the bulk of nodes is situated in the USA and Europe. Nodes do not reflect exactly the number of miners, though miners will often also run a Bitcoin node. Some of the nodes are cloud-hosted and give a somewhat distorted picture of the real decentralization of Bitcoin.

BTC Slides in Another Red Weekend

BTC market prices slid to the $34,000 level over the weekend, followed by sluggish activity. The question now is whether BTC can consolidate and recover previous valuations and new highs.

Negative scenarios envision a bear market capable of reaching lows close to $12,000 in the most extreme cases.

Despite the short-term selling, there are still signs of accumulation and some of the largest players have not sold their holdings. The recent short-term selling is reversing in a pattern suggesting a market recovery.

In the short term, the new working week may bring a reversal of prices with increased trading volumes. The entire cryptocurrency market is showing signs of reversal, with the potential to go through a bearish period.

The most recent data on exchange outflows and profitability show BTC is still searching for direction and signals uncertainty. The Bitcoin fear and greed index has slipped back to 23 points, within the “extreme fear” range.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Crypto investment remains unpredictable and risky, but good practices can save you from many of the potential pitfalls.

How do cryptocurrencies stack up against popular stocks and shares?

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.