Bitcoin on Delicate Ice – Will it Hold?

##

The previous week has been special and exclusive for Bitcoin token. Cryptos, which always are in sync with respect to price action, went off correlation last week as Bitcoin rallied almost $10,000 – from $31,000 to $40,000 in five days and altcoins failed to keep up with the rise.

But considering the price movement of cryptos, including Bitcoin, the pattern seems to be transiting to a range followed by a mini downtrend. While analysts asserted that the recent bull run is here to stay and continue past $40,000, a counter-trend is in play at the moment.

In the last three days, Bitcoin crypto is gradually inching its way south after touching the recent high of $41,200. Though the drop is not coming in hard, the fundamental updates are in favour of the bulls.

Bitcoin Breaks below Support as Fed Raises Inflation Expectations

The US Federal Reserve on Wednesday announced its interest rates and inflation expectations. While it kept the near-zero interest rates unchanged, it sharply raised its inflation estimate to 3.4 percent for the fourth quarter of 2021. The increase is a whopping 1 percent from its previous forecast. The central bank, however, said that that inflation is transitory.

Furthermore, all officials expect the rates to be unchanged throughout 2021, and a few of the estimate it to rise in 2022.

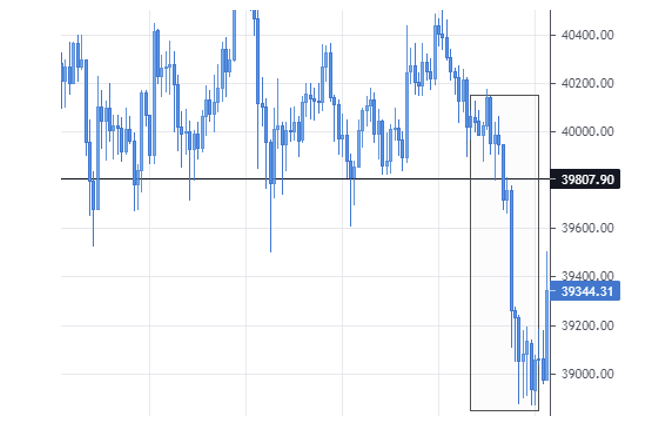

On the same day, when FED released its expectations, Bitcoin saw a sharp increase in volatility. BTC crypto, which was holding at the Support at $39,807 tanked below it as FED put up their estimates.

World Bank Refuses to Join Hands with El Salvador for BTC Application

It has not been easy-going for El Salvador since its adoption of Bitcoin (BTC) as a legal tender. After the International Monetary Funds (IMF) raised concerns over BTC implementation in the country, the World Bank too is following the same route as IMF – citing transparency and environmental issues.

Alejandro Zelaya, the Finance Minister of El Salvador, said that they are seeking technical assistance from the World Bank in making the world’s largest cryptocurrency a legal tender in their country.

The spokesperson of World Bank stated that,

“We are committed to helping El Salvador in numerous ways, including for currency transparency and regulatory processes. While the government did approach us for assistance on bitcoin, this is not something the World Bank can support given the environmental and transparency shortcomings.”

However, Zelaya claims the current negotiations of the IMF to be successful, despite it raising legal and macroeconomic concerns of Bitcoin adoption.

In addition, the Central American Bank for Economic Integration (CABEI) is lending a helping hand to assist El Salvador to make Bitcoin cryptocurrency a legal lender in the country.

Bitcoin Bulls Skeptical as Bitcoin Futures Enter Backwardation

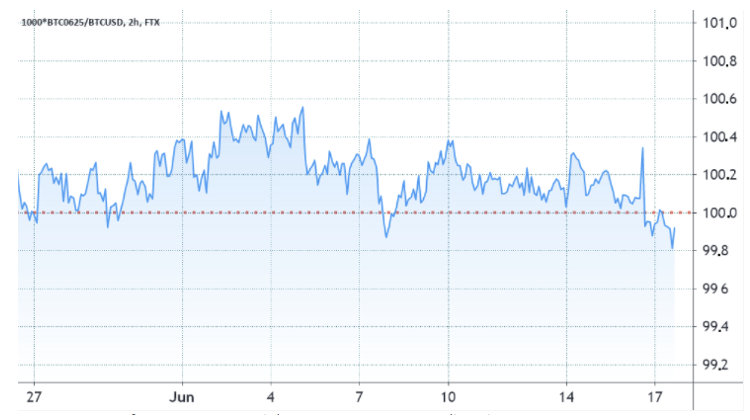

In the June contract of Bitcoin Futures, an unusual phenomenon of backwardation is taking place, which has left traders to anticipate short positions for the upcoming trading sessions.

Typically, the monthly contracts trade at a premium, indicating that the sellers are demanding more capital to withhold the settlement longer. Also, in a healthy market, the Futures market should trade at a 5% to 15% annualized premium, in accordance with the stablecoin lending rate.

But when the above numbers fade or turn negative, the signal reverses – indicating an unhealthy market. And such a market is known as backwardation, which is a clear bearish signal for that market.

FTX June Futures BTCUSD

In the above chart, the trade was healthy until 16 June, with a premium between 0.1% and 0.5%. But the recent drop equivalent to an annualized rate between 2% to 9% leaves the market in a bearish to neutral indication.

Having that said, there are no signs of highly leveraged short positions, though many traders are interpreting the backwardation as a bearish signal. Moreover, the lack of buyers in a single-month contract does not represent the overall sentiment of that market. Thus, looking at the bigger picture, the current bearishness stands insignificant.

Both Eyes on Bitcoin

It has been over a month since BTC crypto is trading between $34,000 and $40,000. The price is not clearly in a range despite the Support maintaining grounds, as it has been leaving lower highs every step of the way.

The previous dip indeed gave the buyers an excellent discount, where they breached through the lower high sequence. But there are a couple of concerns worth noting:

1. the price failed to reach up to the S&R level

2. the price also failed to hold at the nearest Support levels

The above two factors leave Bitcoin on bearish sentiment.

However, with the current price being at the lower high sequence trendline, it would be interesting to keep a close watch at this level. If the buyers shoot right back up to the S&R, the game turns in favor of the buyers. But the opposite scenario plays out, it would be difficult for the bulls to hold at the Support.

Now you can get your favourite cryptos from our list of reputed cryptocurrency exchanges in just a few clicks without any hassle. Happy investing!

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Learn how to keep your crypto secure and the different types of wallets you can use.

How do cryptocurrencies stack up against popular stocks and shares?

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.