Bitcoin On Thin Ice Yet Again

##

The markets have entered the August trading month. And the crypto market, which is known for its seasons and cycles, is in the consolidation cycle. In the last three years, Bitcoin crypto has remained sideways in the month of August. What stands interesting is that the buyers the subsequent typically observe a breakout – not necessarily to the upside. As a matter of fact, in the previous three years, the market had headed north only once, after the third quarter. Of course, the fundamentals and the price action were different, but surprisingly, the crypto does follow the seasons quite efficiently.

As far as this August 2021 is concerned, the chart visuals are different. The entire crypto market, which was consolidating from May, finally made a move north, breaching a few technical Support and Resistance levels. But in the last three days, the buyers seem to be slowing down as the trajectory is shifting from an uptrend to a range.

Bitcoin Price Struggles ahead of US Infrastructure Bill

Bitcoin’s recent bull run came with impressive strength and volume but is gradually losing out of momentum over rising concerns on the US Infrastructure Bill. It is expected that the bill could lead to a negative impact on crypto investors. As the crypto market got aware of the $550 billion infrastructure bill, the price saw some bearishness, with the buyers failing to hold at smaller timeframe S&R levels. The bills are yet to be passed, and it is said that the bills could lead to a gigantic tax burden for the crypto industry in America.

Bitcoin Active Addresses on the Rise

The network activity of the world’s largest cryptocurrency BTC saw a rise in the last week as the total active Bitcoin addresses shot up by almost 30%. According to the data published by Glassnode, a crypto analytics platform, the active Bitcoin addresses per day increased to 325,000, which was 250,000 in the past week. The primary reason for the spike can be accounted for by the latest mini bull run Bitcoin had a few days back.

Besides, the whales also showed active participation in the past week. A report from Finance Magnates indicates that a transfer of about $1 billion worth of Bitcoin crypto was made from Coinbase in a set of three transactions.

Additionally, BTC millionaires were also seen to accumulate in the recent push from buyers. According to a report from Santiment, a blockchain tracking company, approximately 170,000 coins we added from BTC addresses in the last month.

Fear Stays, No Greed Yet

The market gradually inching lower after hitting the local highs of $42,000 is causing the greed to drop, according to the Crypto Fear & Greed Index.

There are multiple factors that go apart from the price in the evaluation of the sentiment in the market. And a slight breach below the $40,000 mark has eradicated the greed.

Today, the Index stands at 48/100, indicating neutral sentiment. But, on Sunday, the index was seen to be sitting at 60, indicating some “greed” before the market actually dipped.

The Fundamentals and Technicals Do Not Line Up… Again

From the above fundamentals, it is evident that the bulls have finally made an entrance in the market and are in a position to ride it higher. But the technical picture does not completely go hand in hand with the fundamental update. No doubt that the buyers have made an impressive push to the upside, but the question of the sellers letting go of their positions, remains.

Trading essentially is based on demand and supply. The charts clearly indicate the presence of the buyers but do not indicate the absence of the sellers at the same time. With sufficient supply existing in the market, it is illogical for the price to head north unless the demand is extremely high.

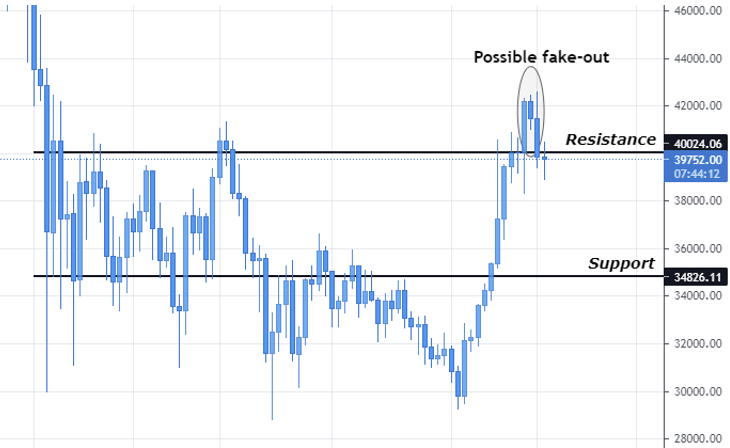

In the below higher timeframe chart of BTC/USDT, the market has made a massive push north from $30,000 all the way to $42,000, breaching above the intermediate Resistance at $40,000.

Despite the strong push from the buyers, they failed to hold above the Resistance and convert it to a Support level. The price dropped back into the Resistance, keeps the levels intact – signifying that the supply is still around.

Now in the below chart representing the BTC market on a smaller timeframe, it can be ascertained that the trajectory of the market has transited from an uptrend to a channel. However, the momentum being in favor of the buyers indicate that there could be a few more attempts that could be made by the buyer before the seller steps in.

Now get your favorite crypto instantly from our list of certified and reputed cryptocurrency exchanges.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

A review of the risks and rewards of trading with leverage and some of the best exchanges to consider

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.