Bitcoin Slumps To $47k & Ethereum Enters the $500 Billion Club

#

Bitcoin (BTC) has shown immense growth since the beginning of 2021 and ended the first quarter with a record bull run. However, just 15 days into the 2nd quarter, things have been not going so well for the world’s biggest cryptocurrency. Bitcoin has printed a series of 10+ bearish daily candles which pushed its price down to $47k. Bulls started to give a strong fight and took the price back to $60k by May 8th but couldn’t manage to overtake sellers at any point to make a brand-new higher high.

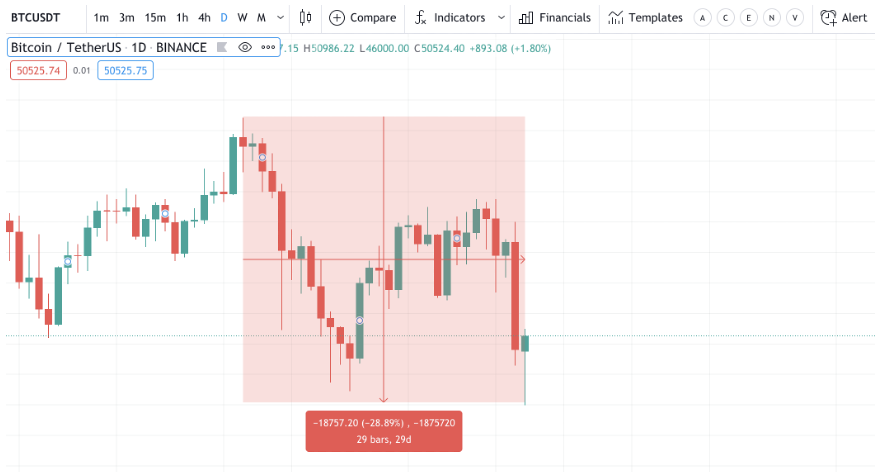

During the late hours on Wednesday, the price of Bitcoin fell back to $47k. Bitcoin has recorded a 29% fall in its value with this bearish move for the past 30 days.

At the time of writing, the price of Bitcoin got corrected and was hovering around the $50,900 level. The total market capitalization of Bitcoin got under one trillion dollars after a long time. Also, the dominance of BTC in the crypto industry is currently at 41.6%, which is the least in the past several months.

Ironically, this wasn’t the market sentiment of BTC during the early hours of Wednesday. Experts were anticipating a positive market movement, and this comes after Mark Zuckerberg, Founder and CEO of Facebook, posted a photo of his pet goats named Max and Bitcoin.

Mark’s involvement and interest in the crypto space, especially in Bitcoin, is a big deal because he owns the most popular social media and communication platforms, such as Facebook, Instagram, and WhatsApp. Any minor integration of cryptos in any of these platforms would instantly increase their credibility. However, things didn’t go accordingly as Bitcoin slumped.

Bitcoin (BTC) Technical Analysis

The price of the BTC/USDT pair is currently at $50,666. The support and resistance areas on the daily chart are at $47,903 and $59,481, respectively. The price action did take support from the daily support area to correct itself above $50k. The other crucial support levels to look out for are at $44,235, $42k and $36,325. BTC’s price action can reach any of these levels in case of strong selling pressure. If at all bulls come back stronger from the $50k level, the price might reach the $59,481 or even go beyond to touch the $62k mark.

Adding fuel to the fire, Elon Musk’s recent tweet has further contributed to the selling pressure of Bitcoin. The tweet was an official announcement of Tesla stopping the acceptance of Bitcoin as a mode of payment. The tweet goes as follows.

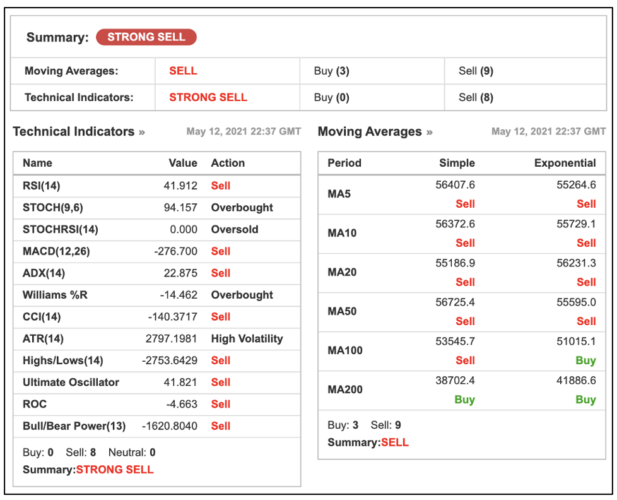

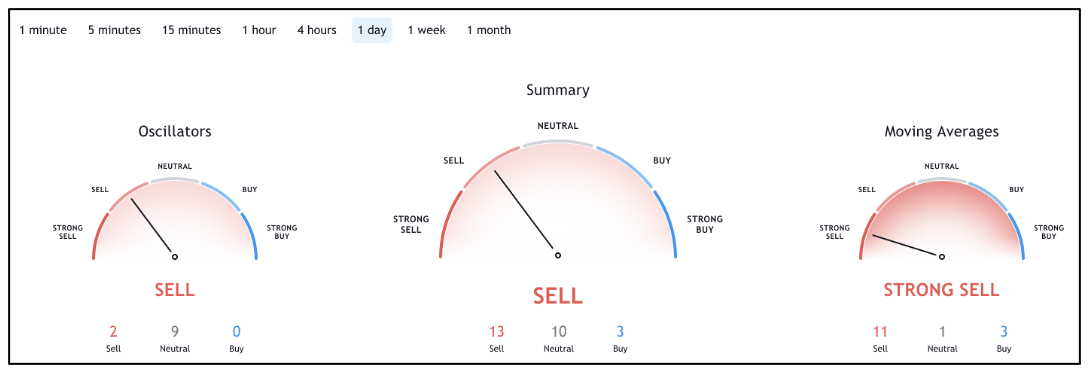

Bitcoin (BTC) Sentiment on The Daily Timeframe

Source: Investing.com

Source: TradingView

As you can see in the above images, the current BTC sentiment on the daily timeframe is bearish. Almost all of the indicators are forecasting a bearish signal in this crypto at this point. If you are an intraday trader, please refrain from taking any long positions. However, if you are an investor, you can’t find a better price than this to buy and hold Bitcoin (BTC). According to expert predictions, the asset’s value could rocket to beyond $64k once this pullback gets over. You can buy Bitcoin here for the best price at some of the most popular exchanges in the world.

Ethereum (ETH) Technical Analysis

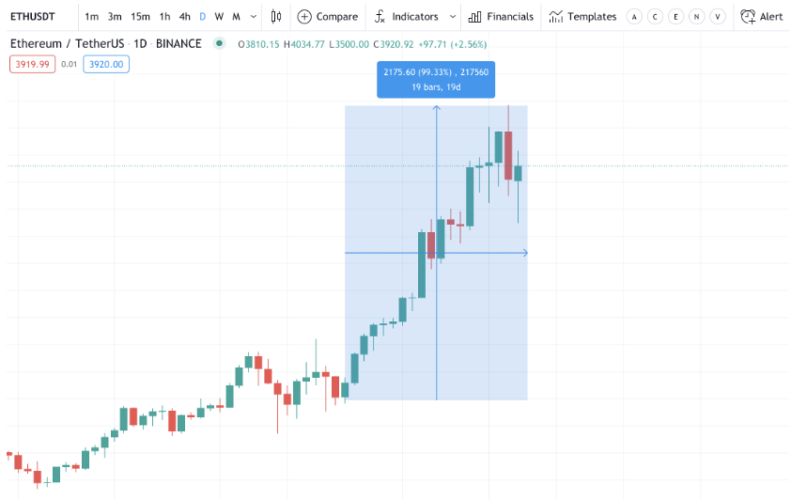

Ethereum broke its previous all-time high value and also briefly touched the $4,400-mark yesterday. With this, Ethereum has entered the $500 billion Club for the first time since its inception. With this upsurge, Ethereum has now recorded an impressive 100% growth in a matter of 20 days.

At the time of writing, the price of ETH/USDT was at around $3,910. The price did take support from the 4-hour support zone at $3,570 and could make a higher-high to create a brand new all-time high value. Other significant support areas are at $2,933 and $2,147 on the daily and weekly timeframes, respectively.

The only resistance level is at its current all-time high value – $4,411. The 10-period moving average is still under the price action indicating the continuation of a strong bull run. However, just as we saw in BTC’s price action, the current ETH trend on the shorter timeframes is bearish. So, it is recommended to refrain from going long or take a double confirmation before going long in this pair.

We hope you find this article informative and useful. In case of any questions or queries, please let us know in the comments below. Cheers!

#

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

Crypto gets a lot of criticism sometimes but what sort of job are the current banks doing at looking after their customers. Who are the best and the worst banks to be with?

From Airdrop to Wallet we look at all the crypto jargon and what it really means

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.