BTC, ETH Analysis: A Shift in Trend?

The September month has clearly not been in favor of the bulls thus far. In a period of the last three weeks, the sell-offs in the entire crypto market look to be gaining momentum.

Speculations were that the markets have been trending for quite a long time in the short term, and hence a retracement was due for action. But none expected the pullback to come in deep and last for almost a month and going.

The Bitcoin crypto market that was trading higher and higher in the past few months has finally taken a dip quite significantly. From the recent highs of $52,000 set in the first week of September, the prices plunged to as low as $45,000 during the flash crash. Later, as the recovery was mildly gaining velocity, it also got sold into and brought the prices to much lower levels at $40,000.

Ethereum token and other altcoins faced greater sufferings. ETH crypto that was heading to its all-time highs got rejected strongly at $4000, which crashed the prices down to $3000. But as people anticipated for the market to take support at these regions, the sellers went for another round of sell-off.

Crypto Plummets and its Effects on Crypto Exchanges

Of late, as there arose talks regarding the crypto market gradually getting stable, the recent drawdown proved them all incorrect. Market crashes are inevitable, but their frequency of occurrence has left cryptos as a cause of concern. Despite the healthy uptrend on both the higher and lower timeframes, the prices plunging considerably twice in a row is a certain fact the volatility is here to stay.

Whenever the crypto market goes through a sell-off, the exchanges face challenges and damages. Exchanges such as Coinbase, Kraken, OKEx, Gemini went down as the number of transactions stacked up significantly on the serves.

When the market goes through a sell-off, it is observed that most investors panic and rush to close their positions in order to protect themselves from further portfolio damage. As a result, the traffic on exchanges piles up, leading to the servers reach their bottleneck load and eventually crash.

Bitcoin Accumulation Continues Despite Crash

Scott Bauer, the CEO of Prosper Training Academy, a professional trading platform, commented on the recent crypto drop that the whales are using the correction as an opportunity to accumulate as many coins as possible.

The percentage drawdown in price does not determine the direction of the predominant trend; it is the support and demand levels that speak. According to Baur, the recent plunge in prices is simply a discount for the buyers until the market drops lower than $36,000.

Furthermore, he thinks that the consolidation shall continue until the Fed’s announcement of the interest rates. Of course, Bitcoin does not evidently have any correlation with the interest rates. But it is often observed that investors choose to wait before making their decisions.

Ethereum Futures Goes Off-sync With the Spot Market

The ETH futures contract premium that was oscillating between 8% and 10% in August saw a sudden spike to 15% on the day the price hit the $4000 mark. Like the price, the premium dropped back to the same range of 8-10%. Interestingly, despite the price massively taking a dip, the futures contract premium still held at the same levels as seen in Aug – clearly indicating the big bulls are still holding on to their positions, and the flash crashes are a no cause of concern for them.

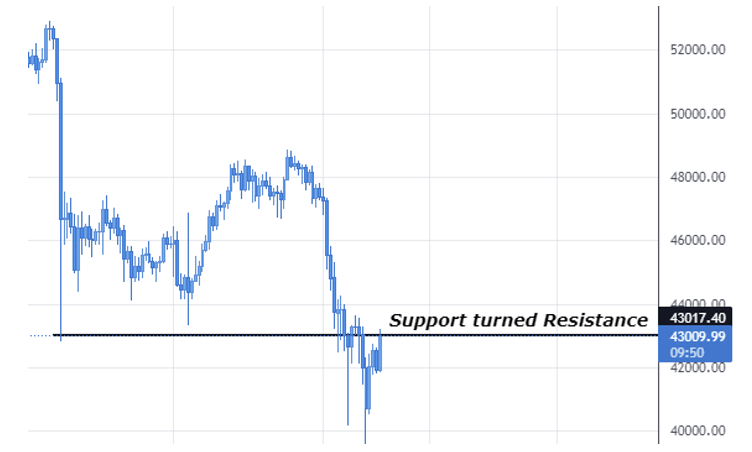

Bitcoin Slips in Trade but Sees Aggressive Recovery

Amid the major collapse from $52,000, the BTC token market observed an impressive recovery, with prices shooting back up to $48,000. During the first recovery phase, the market ranged between $44,000 and $47,000. And the buyers clearly won the range battle and took the prices to new recent highs of $48,000. At this point in time, the $47,000 had turned into potential support. Out of no surprise, the prices did react to this new support. But miserably failed to breach above the barrier, leading the price to crash all the way down to $40,000. With the massive intensity of the sellers, none of the support levels held on the move down.

That being said, the new support was formed at $40,000, in close proximity to the previous support (now turned resistance). Additionally, the market leaving wicks on the bottom at the current levels proves that the bulls are officially trying to make a move north.

Ethereum Heads Identical to Bitcoin

Paying close attention to the chart of Ethereum (ETH) and Bitcoin, it is observed both coins have been moving in the same trajectory ever since the drop at the beginning of September. For instance, when Bitcoin took its first support at $40,000, Ethereum took its support at $3000. During the recovery, too – buyers started off strong but later went into a sideways ranging market identical to BTC.

Currently, the ETH market has broken through the support and is slowly inching back to the same support level. It is about time to witness if the buyers will turn the current drop into a fake-out or the sellers will take this level as a resistance to drive the prices much lower.

Now you can get Bitcoin, Ethereum, and most of your other favorite cryptos from our list of popular and reliable cryptocurrency exchanges.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

In Part 3 we look at more advanced trading strategies including flags, false breakouts and the rejection strategy

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.