BTC, ETH Slip After Musk, Buterin Frighten Markets

#

Bitcoin (BTC) crashed close to $50,000 and Ethereum (ETH) returned to the $3,900 range on a shifting social media mood. The BTC market price slid after Elon Musk, tech king of Tesla, Inc., announced that selling electric cars for BTC is suspended for the foreseeable future.

Musk cited the most common criticism against BTC, that its production requires too much fossil fuel usage. The company intends to keep its BTC, acquired at levels below $40,000, and use it for transactions, but once BTC mining improves its fuel mix profile.

BTC crashed to $46,980 after the news, before recovering toward $51,000. Now, it remains to be seen if Musk’s statement was a short-term shock. BTC has remained consistent above the $50,000 level, and dips below that have been rare. Still, the recent panic caused a significant crash within minutes on the Kraken exchange, showing the price is still easily swayed by fears at least in the short term.

Is BTC Near the Top?

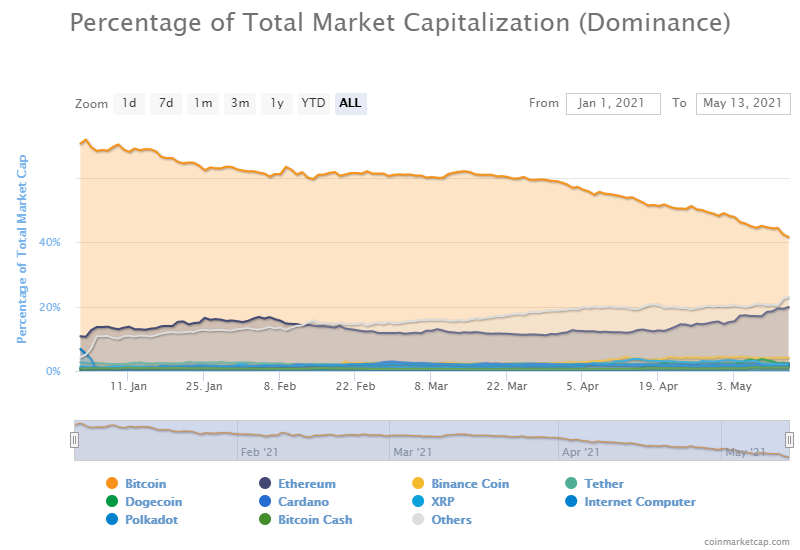

BTC is in uncharted territory, and has held relatively stable in the past months. The recent slide diminished BTC’s market cap dominance to 41.2%, down from above 60% at the end of 2020.

Trading volumes, however, are near $100B per day. BTC is not only scarce on exchanges, but OTC trades as well show a trend of diminishing available coins.

Trading interest in altcoins is also high, as activity flows into ETH and other large-cap assets. At the same time, miners are holding onto their coins and not selling. BTC mining is at break even somewhere between $3,500 and $9,000 depending on the price of electricity.

The current price range incentivizes miners to hold after covering their costs with relative ease. Both block rewards for BTC and transaction fees for ETH are currently favorable for miners, incentivizing pools to a highly competitive drive for rewards.

Is BTC Really an Environmental Burden?

BTC mining has been a topic of division. Roughly, each transaction is estimated to use as much electricity as one household uses per day. Multiple mining pools possibly source their electricity from coal-powered production in China. Other mining farms use downstream recaptured hydroelectric power.

Changpeng “CZ” Zhao noted that to function, the financial system also requires energy-expensive computing systems.

But despite the final calculation, Musk’s statement was enough to bring BTC down close to $10,000 between the day’s high and the recent dip.

What Caused the Ethereum Panic?

Ethereum (ETH) remains close to its peak prices above $4,300. However, the project’s co-founder Vitalik Buterin seemed to dislike the recent dog-meme token hype. Buterin has been known to prefer the technological side to the potential for quick gains, and dog-meme tokens were the final spark that lit his temper.

The teams of tokens like ShibaInu (SHIB) and similar ones like ELON and AkitaInu, decided on a marketing ploy to increase their visibility. About 50% of their token supply was “burned” to Buterin’s original ETH address.

The address has been known for never selling ETH, so the project founders were confident Buterin would be another loyal “hodler”. Unfortunately, the tokens were not locked or inactivated in any way, and it was up to Buterin to choose what to do with them.

On May 12, he chose to send the tokens to their respective Uniswap pairs, pay exorbitant gas fees and perform what amounts to a fire-sale rug pull.

One possible reason for the move was that the tokens, which emerged over the course of a few days, were eating up the gas on the Ethereum network, running up prices for all participants.

So far, the idea that Buterin would hold the tokens and thus give an unspoken endorsement has failed to materialize. Buterin donated the ETH from the swaps to the India Covid-Crypto Relief Fund.

It’s Over for Dog Tokens?

SHIB is now down 30% from its peak, while AKITA was already on a sliding trend before the sale. Dogecoin Mars (ELON) was down more than 60% in a day, though it had already crashed 60% from its peak.

Despite Buterin’s fire sale, SHIB continues its promotion, once again encouraging the community to hold and possibly increase the SHIB price and growing its liquidity.

Dog tokens may have caused a short-term spike, similar to food tokens a few months ago. A hot DeFi pair can lift up prices, but quickly unravel in the event of a rug pull.

At the same time, tokens like WOOFY seem unaffected and continue their usual level of Uniswap activity. The original DOGE market price hovers around $0.44.

It is impossible to tell if the tokens are now defunct. Meme tokens can spark enthusiasm and irrational buying even after a high-profile rug pull. But the event shows that a quickly developed project may still hold outsized risk.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

Learn how to keep your crypto secure and the different types of wallets you can use.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.