Can Waves (WAVES) Recover from the Crash

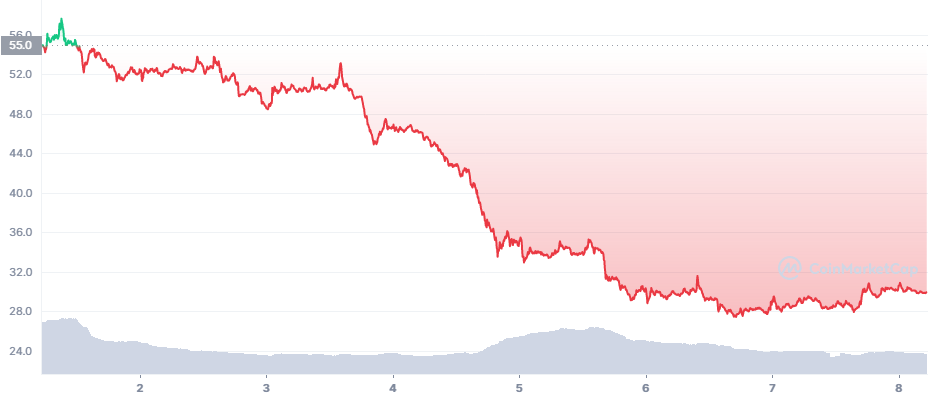

Waves (WAVES) started a recovery from its deep crash in the past week, regaining the $30 level. The asset rallied in March, after years of waiting to break that price range, and marked a new all-time high above $60.

But the climb stopped just as abruptly, erasing nearly 50% of the newly gained value. One of the explanations was a deliberate pump with the intention of selling actual WAVES at the highest possible price.

WAVES has a liquidity score of 684 on the leading Binance trading pair, and could absorb $1.18M of selling with 2% slippage. But panic selling also accelerated and brought a faster crash. WAVES also followed the general market weakness, where BTC still stays under $44,000.

The WAVES recovery may also have to wait as BTC still faces a scenario with a dip under $40,000 and several potential support levels before a new breakout.

How Neutrino DAO Repaired the Crash

The WAVES crash was the first stress test for Neutrino Protocol, the issuer of the USDN stablecoin. USDN briefly lost its peg and fell to a low of $0.69 and after an intervention only recovered to $0.95 $0.98. For a second day, USDN struggles to completely regain its dollar peg, making it one of the riskier algorithmic stablecoins.

This recovery was an example of a real-time DAO decision and intervention to stabilize a DeFi protocol. This may be a first for the Waves-derived DeFi space. Previously, protocols like Maker on Ethereum faced multiple challenges during periods of market volatility.

One of the actions taken for USDN was to burn the tokens and diminish the supply relative to the WAVES collateral.

Neutrino Protocol also held an emergency vote on rebalancing the token as much as possible, gaining a decision within hours.

The total value locked based on nominal WAVES prices fell from $4.75B down to $2.6B, of which Neutrino holds more than 66%. The efforts to rebalance USDN may help repair WAVES prices.

Will WAVES Revisit Previous Peak Levels

WAVES raises the question whether the temporary shock could be erased and the coin recover and try to regain an even higher valuation.

The short-term price action does not negate the future plans for the project to grow in the USA. Waves is also planning to launch its 2.0 network some time in Q3, potentially adding hype to the asset.

The recent rally also brought attention back to Waves, which had been one of the neglected projects in the past years. Waves waited until 2022 to make a comeback after the long bear market. But only in about a month, Waves became the seventh largest DeFi ecosystem, closing in on Solana, Terra and even Binance Chain.

Is WAVES a Scam

The rapid rally of WAVES, followed by almost complete backtracking, raised questions whether the rise was organic or a pump. Sasha Ivanov, the project’s founder, defended the growth as a result of DeFi.

It is still impossible to tell whether WAVES is swayed intentionally. However, the project is attacked on social media and the token price may respond to the messages of fear. A few days ago, tweets spread calling Waves a Ponzi scheme, adding to the uncertainty.

Waves has received similar comments to Terra (LUNA), another platform coin that was more successful in launching and supporting the UST stablecoin. However, Terra is a more liquid project with a longer history of prominence and success during the latest bull market, while Waves is a niche network.

For some, the opposite suggestion is true for Waves – the project is met with skepticism and a concerted effort to undermine its reputation and even affect DeFi funding. In any case, WAVES may remain volatile and be affected by attacks.

Waves, however, has existed for a long time and has built up a grass-roots community, similar to other platform tokens. Perhaps the biggest flaw was that this project created its own ecosystem, which stood aside from the boom of Ethereum projects.

Because Waves also uses a different type of wallet, it lagged behind Ethereum’s startup ecosystem. Now, Waves is catching up quickly with DEX protocols, and even a play-to-earn game, Waves Ducks.

The Waves project has also been transparent about its creator and team, and has been around for years in crypto space. While the WAVES market price has rallied in the past, it has remained behind other tokens with much lower peak levels.

The Waves network is also the 12-th busiest blockchain, based on Blocktivity data. In 24 hours, the network carries 452,468 transactions, compared to 597,621 for the Bitcoin network. There are also faster blockchains, but Waves is capable of carrying significant traffic if the need arises.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.