Celsius Network Resorts to Chapter 11 Bankruptcy

Celsius Network, the custodial service for passive crypto income, announced its Chapter 11 bankruptcy filing. With this, the organization finally admitted insolvency based on US regulations. The event was also one of the first communications from the firm since withdrawals were frozen in June.

In the weeks of freezing user funds, Celsius also gave signs of being relatively solvent. On-chain data showed Celsius repaying loans made to DeFi protocols. The Celsius announcement arrives just weeks after the insolvency of Voyager Digital.

Celsius narrowly avoided exposure to Terra LFG, withdrawing some of its funds at the last moment. But centralized crypto lenders and passive income hubs have been suspect. Non-transparent lending between companies, exchanges, DeFi protocols and other participants created a state of dependencies which started unraveling once the crypto market saw a downturn.

Will CEL Recover

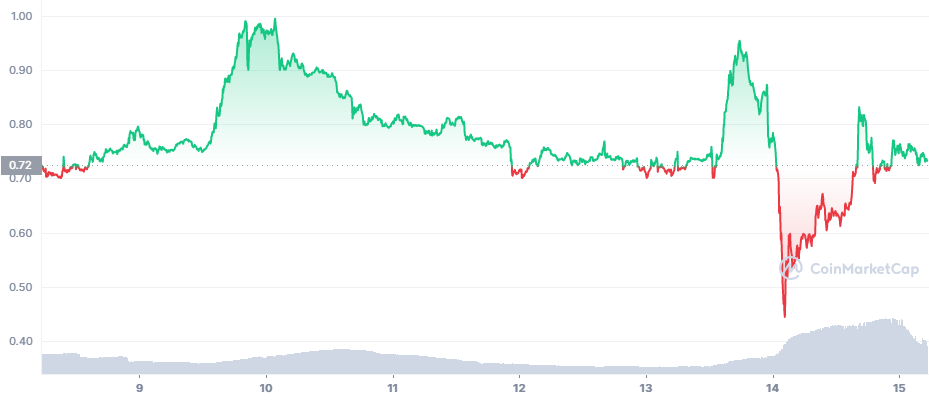

The market price of CEL sank immediately after the news, hovering around $0.75. CEL has already taken some hits and there were only the thinnest hopes for an eventual recovery. CEL still crashed from levels near $1 down to around $0.46 before regaining the $0.75 range as the market absorbed the news.

But in that price range, CEL remains highly volatile and may be risky for leveraged trading. The fears of CEL going to zero may also make the market unpredictable. The latest price move may be caused by a short squeeze due to the scarcity of tokens.

A concerted effort on the FTX exchange was made to cause short positions to be liquidated, essentially causing a short squeeze. The shortage of CEL tokens on FTX may further exacerbate the trading situation or lead to liquidations.

The bankruptcy filing means the rest of the CEL tokens held with the issuer may remain locked. There is no relief for short position holders, with some potentially ending up buying at a much higher price. There are also deliberate selling orders, hence a potential bigger CEL rally in the short term.

There may be some relief as CEL withdrawals from FTX have been blocked due to the current market conditions.

Celsius Delays Payouts Indefinitely

The Chapter 11 filing announcement made it clear that Celsius is not entirely insolvent. Currently, the company has $167M in cash on hand, and has paid down several of its biggest DeFi loans.

However, the company aims to restructure and wants the protection to avoid pressure and demands for immediate withdrawals. Celsius was also worried about a bank run that would leave it insolvent, while leaving others with no pay.

The initial aim of Celsius was to wait out highly volatile market conditions. But over time, Bitcoin (BTC) stabilized around $20,000, allowing Celsius to avoid the worst liquidations. Yet none of the available funds went back to depositors.

Former supporters remain shocked that their BTC or other crypto assets were held in custody but could not be returned due to risky investments.

BTC Prices Remain Weakly Affected

The BTC market already absorbed most of the Celsius shocks. The leading coin is feeling more pressure from the stock market and overall liquidity squeezes coming from the US Fed.

BTC fluctuated between $19,800 and rapid climbs to 20,574.81 ahead of the weekend. BTC is also viewed as more predictable and liquid compared to altcoins, which is another effect of the Celsius fallout. BTC now has market cap dominance of 42.7%, while altcoins have weakened more significantly.

BTC trading happens in a mood of “extreme fear”, or 18 points on the scale of the Crypto Fear and Greed Index. Ethereum (ETH) still holds above $1,000, though with predictions that a steeper dip may also send the token down to the $600 range.

For BTC and other leading assets, there is no consensus on the next step. Predictions range between a relief rally after reaching the market bottom and a dip to a lower range. The actual effect of Celsius remains limited, and the losses of centralized lenders may have been absorbed. But the overall market remains attractive as a source of unexpected upside.

Sudden rallies are still present, as in the case of Polygon (MATIC), up more than 20% in a single day. MATIC is one of the tokens with great utility, used for gas fees on multiple blockchain games and NFT collections. MATIC rallied to $0.66, and is seen as having more upside due to its currently depressed price. MATIC has made hikes above $1, and a return to a higher price range is seen as highly probable. The reason for the rally are talks of Polygon joining Disney Corp. in its Web3 plans to create metaverse projects, games and digital items.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

Part 2 covers intermediate trading strategies including Bollinger bands, the TRIX indicator and pattern trying

Learn how to keep your crypto secure and the different types of wallets you can use.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.