Correlation Analysis: BTC, ETH, and ADA!

The weekends have been interesting for the crypto market for the past few weeks. The entire crypto market has been making a move to the upside, even breaking through some strong technical levels. But the uptrend game has been different this time, relative to the previous ones. Usually, Bitcoin (BTC) and Ethereum (ETH) used to lead the market for the longest time of the uptrend, and altcoins would follow along. In the current bull run, BTC and ETH were indeed the first ones to transit to an uptrend after a massive consolidation but fell short of buyers post their initial push to the upside. In other words, altcoins initially started off as laggard currencies but took pace from its second impulsive push. In fact, few cryptos already set their ATH while Bitcoin and Ethereum are still approaching it gradually.

All that being said, the fact remains that the top two cryptocurrencies (in market cap) are in a strong uptrend. A laggard market does not make it a weak market. These cryptos do make it to their destination, but slower than the leader currencies.

The performance of a cryptocurrency is typically compared with cryptos in the same domain. In addition, they are also compared based on where they stand in terms of market capitalization. For instance, Bitcoin is usually compared with Ethereum and Cardano, and not a lower market cap crypto that does not stand in the top 5-10.

Crypto Price Round-Up

The last few days were dry for Bitcoin mainly – as the price was hovering between $49500 and $48500 for longer than expected. The minor consolidation, invisible on the higher timeframes, lasted for over two days. Of course, the market did make a move to the upside, as we speak, but has again started to consolidate at $50000.

Ethereum, on the other hand, has been struggling more than Bitcoin in the past two weeks. The market set a recent high at $3325 ten days ago, and the price has still been trading below or around it. However, other altcoins, including Cardano, Binance coin, Terra, Solana, Polkadot, etc., have made a significant push to the upside. As a matter of fact, Cardano token beached its ATH ($2.4) in its latest impulsive move to the north.

Bitcoin Touches Much Awaited $50,000 Mark

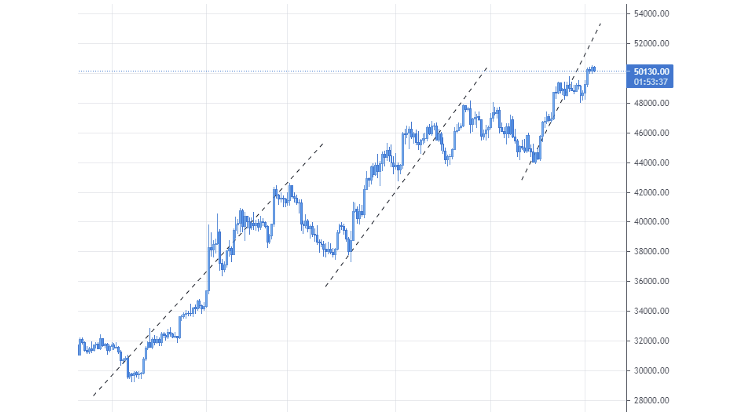

The Bitcoin crypto never fails to disappoint investors. Since the breakout in the first week of August, the market has been heading higher every step of the way. Starting from the recent lows of $30,000, the market began its uptrend making higher highs and higher lows and is now trading at $50,000. In the last one month or so, the Bitcoin market has returned 70% gains.

Technically speaking, the entire uptrend had three pushes and two retracements. And if we were to understand the health of the market, the length of the pushes to the upside is getting shorter as the market is making a new high. However, the retracement being quite shallow on both the attempts, it is clear that the buyers are going long on their positions at every discounted price.

Given that the buyers are still in control and the retracements are weak enough, it is certain that the prices shall head higher in the subsequent trading days, despite facing some resistance along the way.

Ethereum on the Verge of Breakout?

Ethereum has been coming with a price action similar to BTC crypto. But the recent price action has not been in sync with it. The uptrend in ETH kicked off on 20 July and has been in the same trend ever since.

On a bigger picture, the Ether market took Support at around $1700. In the entire consolidation period, never did the price drop below the Support – proving the existence of bulls at these levels. As a result, the market finally breached above the Resistance at $2700 and is currently trading about 17% higher at $3312.

Shedding light on the uptrend of ETH, a single push north and one retracement is observed, unlike Bitcoin with a couple. On a relative note, Ethereum started off stronger with no retracement (as shown) but slowed down later as Bitcoin made another higher high.

ADA Witnesses Hockey Stick Growth

After altcoins like Terra and Solana, crypto analysts excepted Cardano to make its ATH, and that is exactly how the market indeed played out. In fact, the price breached strongly from the ATH Resistance is trading over 20% higher from it.

Cardano, usually being either the third or fourth-largest cryptocurrency, has become the first top 5 cryptos in market cap to make an all-time high, leaving behind both Bitcoin and Ethereum.

Interestingly, the momentum of the buyers is not slowing down despite the price getting expensive every step of the way – indicating that the bulls are desperately buying into the ADA market and are certainly not done yet.

Now you can get these three cryptos and several others from our list of popular and reliable cryptocurrency exchanges.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

A review of the risks and rewards of trading with leverage and some of the best exchanges to consider

Learn how to keep your crypto secure and the different types of wallets you can use.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.