DeFi Faces the Hardest Downfall, But No Cause for Concern!

The cryptocurrency market has yet again shown its colors of volatility. The market that was trending to the upside since the very beginning of August found barely any major resistance along the way. But finally, yesterday, the gains were washed away by half in most cryptos as the prices stumbled instantly during the New York session.

Crypto Flash Crash

The budding crypto market is always known for its high volatility. Despite the markets with a market cap in hundreds of billions, the volatility does not stabilize. Coins including Bitcoin (BTC) and Ethereum (ETH) still witness over 10% drops and rises within a signal trading session despite their high market capitalization.

Flash crashes are no surprise in crypto. It occurs once in a while and does happen with logic. There have been several flash crashes in the market to date. Most of them have recovered impressively, with the buyers getting it back up. The current tumble looks no different. The BTC market, for instance, had been in a massive run to the upside from July 21, 2021. And at no point in time had it been that the price dropped significantly. The maximum drawdowns were no greater than 5% in a day despite the existence of strong supply levels along the way. Hence, it was logical for the prices to take a hit to the downside, breaking the overextended trendline.

Who is Facing Bigger Damage?

The crypto space has plummeted from the recent freefall. If we were looking at the percentage drawdowns in different sectors, there exists variance among them. For instance, the scaling solutions have tried to bounce back strong after the crash, but the thriving defi space took a massive hit as the instant recovery came in weaker.

The defi space consisting of projects including Aave, Uniswap, Pancakeswap, Compound has faced a deeper fall relative to other big sectors. Of course, when compared to low market cap cryptos, the percentage drawdown is lesser, but the same does not hold true relative to the best-performing crypto space.

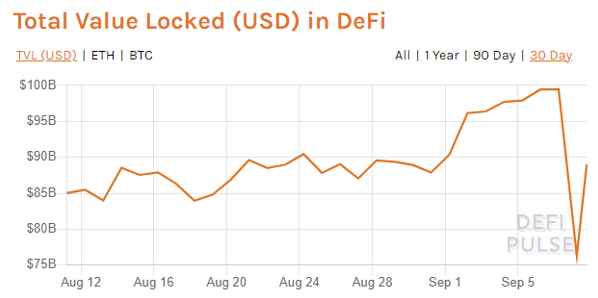

Total Value Locked in DeFi Fails to Touch $100B Mark

The Total Locked Value (TVL) in DeFi has always seen an upward trajectory irrespective of the market conditions. After being around $85B to $90 for about a month in August, the value was finally on the rise since the beginning of September. As every DeFi enthusiast expected it to breach the $100B milestones, the TVL dropped hard with high intensity from $99.47B in syn with the flash crash.

The value came to as low as $76.30B within a day. However, surprisingly, the TVL shot back up to $88.99B today, as of writing. This sudden jump clearly shows the existence of bullish nature in defi despite the crash.

Source: DeFi Pulse

Are the DeFi Tokens in any Danger?

The introduction of the decentralized finance sector in the crypto market has been a Gatorade to keep the entire market up and running successfully. The decentralized way to handle finances is revolutionizing the current traditional financial products.

Although the defi space has been through a few hardships along the way, never has it a decline in user base – signifying the trust in the decentralized industry. There will be downfalls in any financial item, but the key here is to focus on the bigger picture. The same goes with defi as well; users must pay attention to the sector as a product fundamentally rather than getting carried away from immediate trends.

Aave (AAVE) Holds yet Again

Aave (AAVE), a defi project, has grown to be the current leader in the decentralized finance industry. The price chart evidently depicts that too.

The AAVE token had one of the longest bull runs at the beginning of 2021. Of course, the trend got sold into in the month of May, but it did not change the fact of the price still being in an uptrend. The market attempted several times to make a lower low but always ended up a faker.

The resistance at $393 stood strong as the sellers never let the price evident trade above it after the crash. On the second attempt by the buyers to head higher, the bulls came in strong, leaving higher lows sequences. The market did reach a few dollars above the resistance, but the sellers pushed it back to the recently formed support levels.

The flash crash has brought the price lower than the support price, but visually the market is leaving wicks on the bottom – indicating the presence of buyers at the support.

The recent crash coming with intense velocity and still unable to breach below the support clearly shows that the buyers are not willing to let off of the discounts that are available in the AAVE crypto market.

Now you can get your favorite defi tokens from our list of popular and reliable cryptocurrency exchanges.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

We are now paying prizes in Iota. Learn a bit about it and where you can buy, sell and store it

We explain the safest and easiest way to buy Bitcoin and other crypto using your credit or debit card.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.