Money Flows to BTC Despite Bearish Fears

#

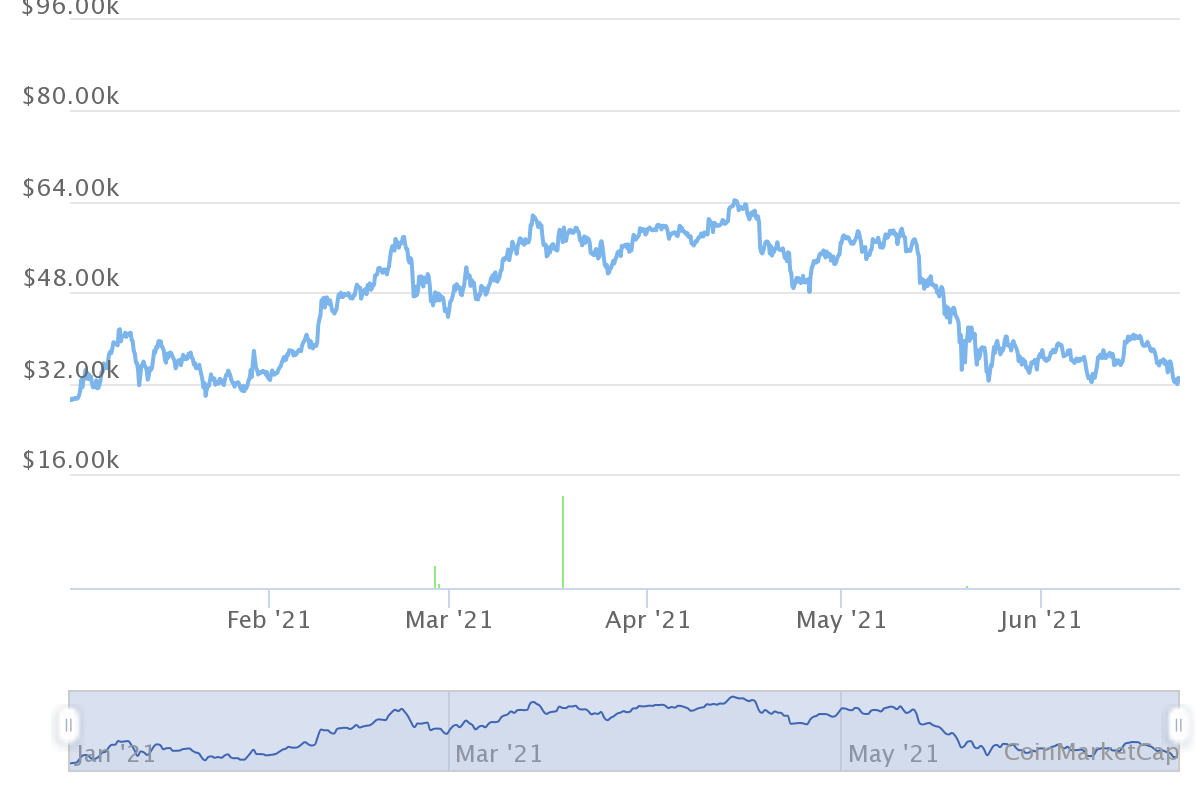

Cryptocurrency markets continue looking ominous, as Bitcoin (BTC) reveals the potential for a bear market of unknown length. In the short term, it looks like altcoin season is over, with all other assets marking deeper losses.

BTC traded at $32,598.25, losing nearly 20% in the course of a week. The losses of altcoins were deeper, as the ETH price went below $2,000 with ripple effects across its ecosystem of connected tokens.

Most large-cap altcoins are also rapidly unraveling, losing more than 10% in a day and sliding to lower valuations. This led to a technical increase in Bitcoin market cap dominance to above 46%, as funds flowed back into the leading coin.

BTC May Signal Bear Market

Trading Bitcoin now faces several options, of which one is a movement within a range with unpredictable consequences. The other option is that BTC enters another protracted bear market.

The most fear-inducing pattern suggests BTC may return to lows of $4,000, creating a fear spiral. Others believe BTC is moving back to new highs after some volatility.

BTC patterns remain notoriously unpredictable, and rapid price moves can work against both short and long positions. For now, BTC trades in a less leveraged market, while also showing signs of scarcity for actual coins.

Still, in the short term, BTC is expected to slide closer to $30,000 and even below that range.

Will Miners Sell their Coins

The recent news of mining farm shutdowns in the Chinese Sichuan province raised the question whether Chinese miners would end up selling their coins. Since China was responsible for a significant part of the hashrate, those miners could be sitting on significant BTC wallets.

However, the Miner selling index is currently in a period of accumulation and holding.

Miners have a much lower breakeven compared to even the current lower BTC prices, and may be incentivized to hold their coins for the longer term.

The Bitcoin mining rate has dipped to levels not seen since the end of 2020, with just 88 EH/s, suggesting continued shutdowns of mining capacity. The long-term bullish case for BTC is to expect the mining power to move to other regions, as there would be less competition from Chinese miners.

Overall Bitcoin Activity Falls

Overall Bitcoin activity based on active addresses has fallen significantly. On-chain activity is now comparable to levels not seen since 2019. Glassnode data show recent buyers keep moving and trading coins, while there are still indicators of long-term holding.

Bitcoin transaction fees, however, remain relatively high around $6 on average, a significant expansion since 2019 where fees ran as low as $0.40. During peak network usage, there is no ceiling to fees, especially for unique large-scale transactions.

Trading Sentiment Indicates Extreme Fear

BTC trading sentiment is now revealing extreme fear. The Bitcoin fear and greed index is at levels even lower compared to the March 2020 capitulation.

At 10 points, the index suggests significant fears of a deeper capitulation and loss of interest in BTC. However, the index does not reveal if the slide would be long-term or short-term.

MicroStrategy Keeps Boosting BTC Holding

MicroStrategy, one of the first and biggest corporate Bitcoin adopters, has now expanded its wallets to hold more than 100,000 BTC. The latest purchase took 13,005 BTC off the market, at the price of around $489M.

MicroStrategy now owns BTC on par with some of the largest exchange wallets. The holdings are not public, but reportedly the move has helped the company own 0.5% of the entire BTC supply.

Currently, more than 18M BTC have been produced, but rough estimates see about 3M coins as lost or forgotten. There is also a subset of large wallets that are keen on holding long-term. Above 191,000 BTC are held as “Wrapped Bitcoin” and used for decentralized finance purposes, supposedly not touching the original coins for trading.

Ethereum at Higher Risk of Crash

The Ethereum ecosystem is rather sensitive to the current market correction. ETH is now sliding both in dollar terms and against BTC, going down to the $1,940 levels from a peak above $2,700.

The ETH value is closely related to thousands of tokens, as well as decentralized lending schemes and liquidity pools for algorithmic trading. Rapid shifts in ETH value can erase even more value within the DeFi ecosystem.

In 2021, a large percentage of newcomers were involved with DeFi, as well as NFT collectibles. Most of those assets helped boost the value of ETH. Now that ETH trading has lowered prices, the collection of tokens will also suffer.

In the past weeks, there is a significant slowdown in DeFi, algorithmic trading, as well as NFT auctions. The lowered enthusiasm may bring valuations across the board, making new buyers more hesitant.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

A review of the many options for crypto exchanges and what the main differences are

In Part 1 of the guide we look at the stochastic oscillator, relative strength index and moving averages

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.