Polygon (MATIC) Indicates Renewed Breakout

#

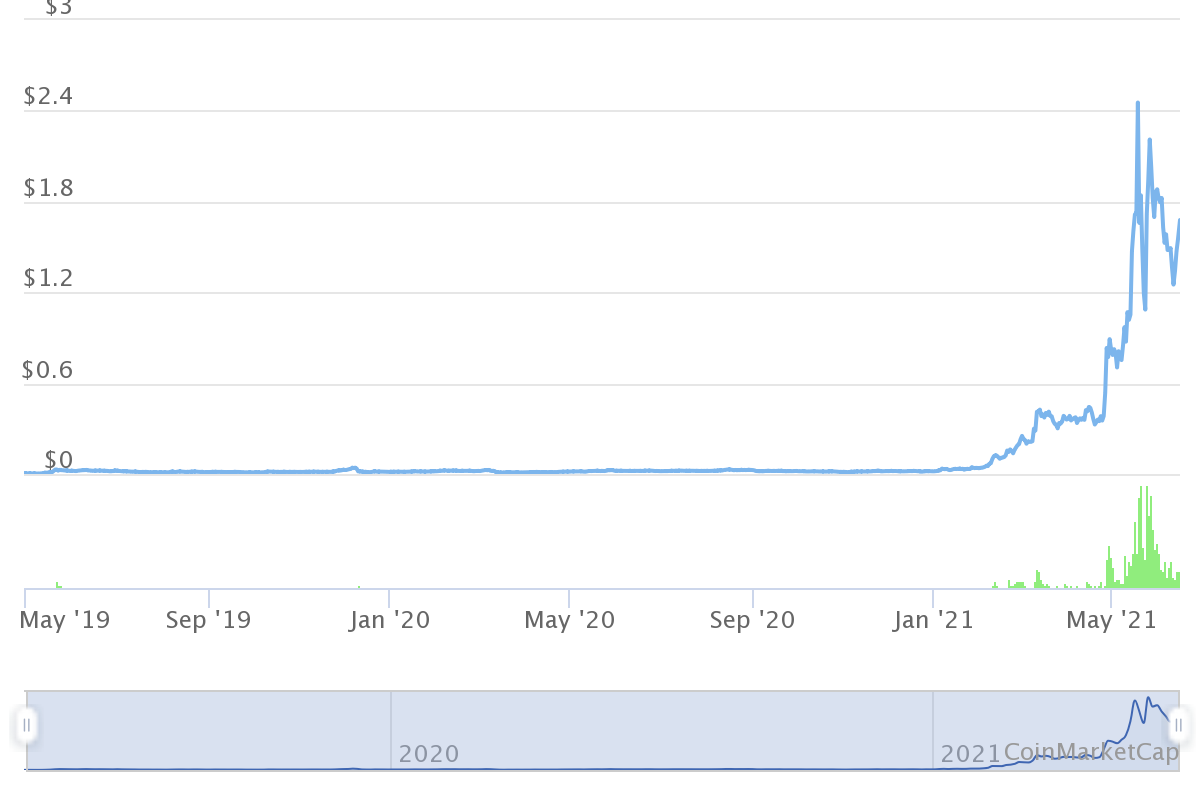

Polygon (MATIC) is one of the networks with growing importance for token trading. MATIC has recently given off signals for a renewed potential price rally, as the entire market recovers. After BTC prices recovered above $40,000 once again, altcoins also moved up based on their respective strength.

MATIC rose to $1.69, up from a recent low around $1.30, with the potential to regain previous records. MATIC reached a peak above $2.45 during peak Ethereum growth, as the project is tightly related to the popularity of decentralized finance (DeFi). MATIC is up nearly 14% in the past day, and has entered the top 15 of assets by market capitalization.

Why MATIC is Recovering Strongly

One of the reasons for the more active MATIC performance is a new derivative market for the asset. Until recently, MATIC was a token for spot speculation, but the Dy/Dx decentralized exchange has added a perpetual swap with up to 10 times leverage.

A leveraged market for a token is extremely risky, but may yield outsized gains, based on previous MATIC performance. MATIC is also only one of the tokens that is reawakening, as there is demand for more active price moves.

How MATIC Apps are Stacking Up

The chief function of MATIC is to scale transactions on the Ethereum ecosystem, granting access to faster, cheaper DeFi trades. MATIC works as a second-layer solution to Ethereum and can connect to all Ethereum-compatible networks, including Binance Smart Chain.

QuickSwap is currently the biggest exchange on MATIC, with more than $390M in assets traded. The exchange is still small compared to centralized cryptocurrency markets, but shows that decentralized protocols are still attracting value. For MATIC, one of the chief bullish signals comes from network growth and new users choosing it as a scaling solution to Ethereum DeFi.

MATIC is also very transparent, with most of the tokens held in strictly controlled smart contracts. The token is aiming for wider adoption as the basis of staking, trading and communication between protocols.

Can MATIC Secure Surprising Price Moves

MATIC has trading volumes of around $1.9B per day, slowing down to a fraction of the activity during peak trading times. However, MATIC remains highly active in 2021. With its relatively low per unit price, MATIC is also a speculative asset, expecting potential fast price moves and a breakout from current positions.

The recent rally also reflected the listing on Bithumb Official, the Korean exchange that offers fiat pairings against the Korean Won. While Bithumb trading is isolated from international crypto traders, the MATIC/KRW pairing will increase the asset’s visibility.

In addition to the new listings, MATIC is also viewed as one of the tokens and altcoins that are set to break out based on chart patterns. MATIC remains risky, and upward moves have been followed by significant corrections.

Despite its participation in DeFi, for the MATIC token, the key to liquidity is trading on Binance. More than 59% of all activity for MATIC is concentrated in the Binance International pairing. MATIC has been traded for a relatively long time, and has a wider exchange adoption.

Other options to buy MATIC include Coinbase and the Kraken Exchange, where US-based and European buyers have access to fiat-based trading. These pairs are less liquid and riskier but may serve as a tool to buy MATIC. The token is accessible through all Ethereum-compatible wallets, including MetaMask. Recently, MATIC was added to the multi-asset Exodus wallet, with the option for fast exchanges.

MATIC currently has a circulating supply of 6.29B tokens, only a fraction of the total of 10B. The tokens have an unlocking schedule over the course of a few years, with the next tranche expected in August 2021.

DeFi Market Still Aims for Recovery

The entire DeFi market is still trying to recover from the recent lows. Total value locked has inched up to 62B, but still significantly down from the peak near 100B. One of the reasons is the slide in the ETH market price, which nominally decreased the locked-in value.

MATIC is partnering with Maker DAO (MKR) for the usage of DAI stablecoins on its side chains. Currently, Maker is one of the most important hubs of activity for DeFi. MATIC also partners with well-used DeFi apps like Aave, Curve Finance, Augur, SushiSwap and others.

SushiSwap is especially important, as it is one of the best-used Ethereum decentralized algorithmic markets. MATIC has shifted users from the purely Ethereum-based SushiSwap, to its own version that offers faster computation and no unexpected gas fees. Algorithmic trading hinges on timely transactions, and having gas fees in the hundreds of dollars often discourages small-scale users from adopting DeFi trades and participating in liquidity pairs.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

In Part 3 we look at more advanced trading strategies including flags, false breakouts and the rejection strategy

A roundup of the main exchanges in Australia allow you to quickly buy Bitcoin and other crypto on your card

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.