Recovery 2.0 – Bitcoin Never Fails to Disappoint

##

It has now been a month since the bloodbath of the crypto markets. Bitcoin crypto, mostly altcoins that were surging 2x,3x took a massive dive south in mid-May after Tesla stopped accepting Bitcoin payments and China warned miners for the third time.

Previously, there have been volatile drops over 40% or more but have bounced back in a V-shape or W-shape within a month.

The recent drawdown is quite similar to the rest. But, of course, the fundamentals have changed over time. For instance, with the participation in cryptos increasing exponentially, the market was expected to become much more stable than before. But the increased liquidity brought no effect on the volatility. The markets are as volatile as they were before.

Shedding light on the current recovery post the crash, Bitcoin (BTC) and altcoins put investors on a sceptical spot as the big boy buyers and sellers seem to dominate the markets.

That being said, Bitcoin crypto brought in some hope, with it rising over 7% in the past week and 27% considering the recent lows. The news on Tesla dropping hints on it resuming to accept Bitcoin again has also helped the price gain throttle.

On the other hand, altcoins have not really following the same trajectory as that of Bitcoin in the last 7-10 days. In essence, many big-shot altcoins have breached through the technical Support level and are trading below it. The price action is clearly reducing the correlation coefficient between Bitcoin and altcoins.

BTC Dominance Back on Track

Altcoins, which have been outperforming the world’s largest cryptocurrency since 2021, has taken a halt.

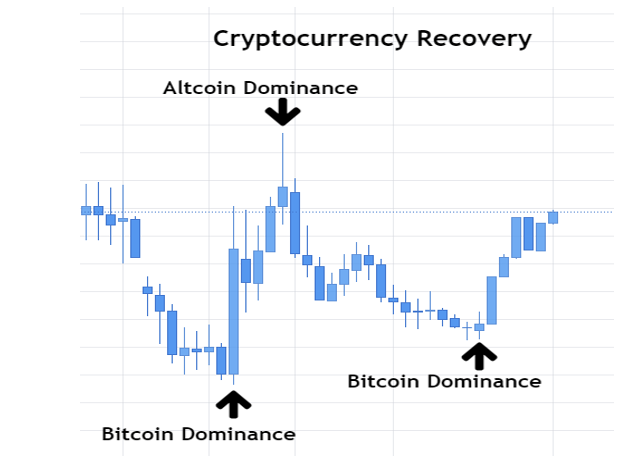

The relative recovery in Bitcoin (BTC) and other cryptos are rather interesting to analyze. Following is the stages of recovery of cryptos since the drawdown in May.

Stage 1: Cryptos show initial sharp recoveries with Bitcoin on the lead.

Stage 2: They go for another round of selling from the nearest Resistance.

Stage 3: Most coins recover with altcoins clearly Bitcoin

Stage 4: Consolidation gets narrower, and some begin to drop beneath the Support.

Stage 5: Cryptos drop yet again, but Bitcoin recovers strong.

Both Bitcoin and altcoins seem to look on the same page, but the charts beg to differ as BTC is back on buyer’s grounds, and most altcoins still struggling.

In the below chart of Market Cap BTC Dominance (%), it is ascertained that BTC cryptocurrency had led the dominance twice through this recovery.

Having that said, we cannot come to conclusions yet, as altcoins may come in stronger later in time.

Where do Cryptos Stand on the Charts?

The markets have been quiet for a while. There was intense action after the drop, but the markets are now losing out of momentum – with ATR values at the lows. However, in terms of price action, several cryptos have broken through important technical levels.

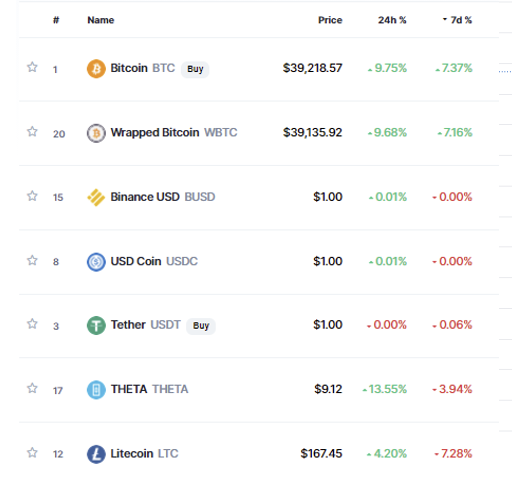

In the past seven days, considering the 20 largest cryptos, Bitcoin has taken the lead with a gain of over 7%, followed by WBTC with a similar gain. Hence, leaving WBTC, all altcoins were in the negative in the period.

Let’s have a look at the price action of these top-performing cryptos and understand if there is anything in store for investors to get it.

Bitcoin (BTC) at Impressive Levels

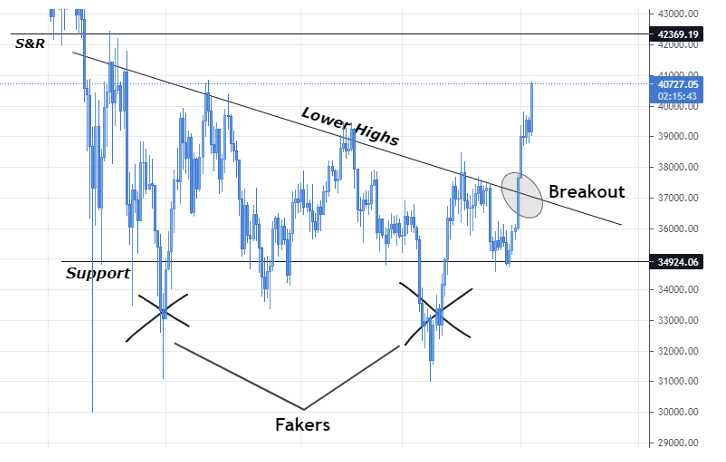

The entire consolidation was about the price hovering between the Support equals Resistance (S&R) and the Support.

The market did hold at the Support for over three times, but the lower highs that kept coming indicated strength from the sellers. Consequently, the market dropped through the Support. However, the price jumped right back up and firmly help above the Support. And finally, the lower highs sequence came to an end as the buyers breached through it with intense power.

The current price action puts us biased on the bulls, but not with complete certainty. Given the volatility of the market, one must not be surprised if the market drops right back inside the lower highs trendline. That said, if the market holds above the same trendline, the story will be in favor of the buyers.

BTC/USDT

Theta leads Bitcoin while Litecoin lags both

The price action al cryptos throughout the recovery phase have been pretty much the same. However, are there some minute yet significant differences to note.

Looking at the Theta cryptocurrency, it has already breached through the S&R is maintaining grounds well above it. Thus, it makes it obvious that the buyers are much powerful here relative to Bitcoin.

THETA/USDT

Coming to Litecoin (LTC), the price action is redundant to that of Bitcoin. Though the price is holding at the Support like BTC, Litecoin crypto has failed to break through the lower high sequences – clearly illustrating that the bulls are not as strong as that BTC.

LTC/USDT

Since the breakout for Bitcoin has come today, we will have to watch if altcoins follow the big boy – Bitcoin.

You surely do not want to miss the bullishness incoming in Bitcoin and altcoins. Visit our popular crypto exchange list to buy your favourite coins at the best possible rates.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

Will decentralised finance revolutionise the financial world or is a a lot of hype. Should you get invoved?

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.