Should You Be Excited About The Recent Crypto Bull Run?

##

Finally, the cryptocurrency market had a green weekend after about a couple of months. Bitcoin crypto, which was slowly inching higher from $29,500, rallied over 10% in the last two days. The altcoin leader, Ethereum, and its followers, too, headed north with appreciable momentum.

That being said, cryptos did have smaller bull runs within the consolidation that is in play at the moment. But none of the moves sustained as anticipated. Now the question lies if the current buyer’s move will maintain grounds or get sold into like the previous times.

The consolidation in Bitcoin is certainly overextended. While many altcoins are in a downtrend, making lower lows and lower highs, Bitcoin and even Ethereum, for that matter, are ranging sideways. However, from the perspective of a buyer, it can be interpreted that they are holding technical Support stronger than others cryptos.

Bitcoin Spot Market Aims for $40,000

The last 24 hours have been rather surprising to cryptos investors as the price rallied to a double-digit percentage, breaching a long-held Resistance. Though it is early to confirm if the breach is real and here to stay, it is indeed bullish for BTC token on the bigger picture.

As the market was approaching the higher Resistance at $40,000, the profit-taking came in at a lower level ($39,750). However, the retracement is minuscule relative to the bull’s move.

Bitcoin Mining Difficulty Reverses to Positive Territory

As the price is showing signs of the buyer waking up, the fundamentals have begun to fall in the same basket.

Besides the increased decentralization of hash rate overall, Bitcoin’s has rate is yet again approaching the 100 exahashes/second after two months – a positive indication for the current price action to hold grounds.

As we speak of mining, bitcoin being eco-friendly is still a significant topic of discussion among the big players and influencers. However, with large miners moving to renewable and sustainable energy are trying to reassure the dilemma regarding the environmental issues.

Bitcoin back to Consolidation Again?

The expectation on Bitcoin token has lowered since May 2021. When the buyers used to push the market rallying over 10% in a short timeframe, they typically held onto the gains. But since the China crackdown and concerns over mining power, the bulls are struggling to hold over any important price levels. As a result, few technical analysts still have not turned optimistic about Bitcoin despite the powerful push.

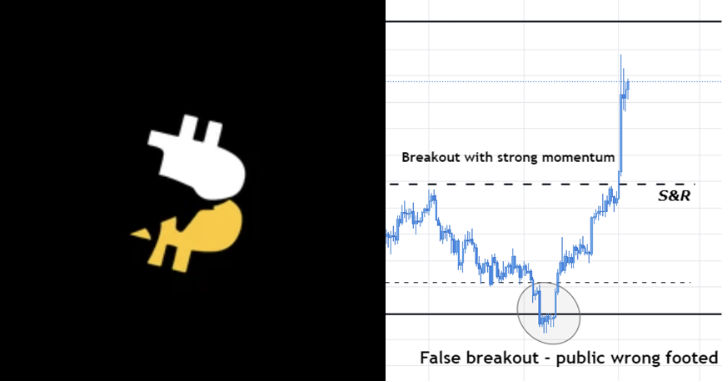

Touching base on the price action, the overextended range seems to be coming to an end very soon. After 30 days of heartbeat signal movement in May, June the markets dropped below the Support at $35,000 and began to hold under – converting the level to a Support equals Resistance (S&R).

As many expected the market to hold the S&R as the Resistance and bears take over the market all the way down to $24,000, the reality played out to be different. The market took support at the dotted line as shown in the chart a couple of times and shot up breaching above the S&R after leaving a faker below the Support at $30,000.

As the buyers picked up the pace every step of the way, it is highly likely that the current price action is ought to continue further north in the short term.

Altcoins Follow Along

Correlation among cryptocurrencies is a factor that has always lasted positively despite the high volatility. And the same is being witnessed in the current mini bull run. As Bitcoin headed as high as 15% in the last 24 hours, altcoins experienced a better average, like always. Let’s have a look at a few cryptos and understand where they stand after the buyer’s push north.

Cardano Rallies but Remains Insignificant

The price action of Cardano (ADA) is one of the most bullish cryptos relative to other altcoins and, to an extent, represents the price action of the entire altcoin market.

When the market failed to hold above the S&R, the price slumped below it and found Support at the demand zone. The first attempt from the buyers at the demand drove the price up to the S&R, where the sellers went short on the market yet again. However, the demand zone held, and the buyer shot up the second time with firmer momentum.

Given the momentum, a question one needs to ask themselves is – “What did the current buyer achieve, technically?” And since the buyer is still unable to breach through the S&R, we could conclude that the buyer stands insignificant at the moment.

It is indeed good news for the crypto investors, as the markets have finally made a move to the upside. But one must also be careful at the same time, considering the recent fundamental aspects that are not fully in favor of the bulls.

Did you get in on the bull run yet? If not, you can instantly get your favorite crypto from our list of certified and reputable list of exchanges.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

We explain the safest and easiest way to buy Bitcoin and other crypto using your credit or debit card.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.