The Bears are Officially Active – Will the Bulls Fight Back?

##

The month of May and June have not been favourable to cryptocurrencies. While analysts initially asserted that every bull market needs to go through some corrections for it to stay healthy and mature – the current dip is larger than anticipation.

Many crypto founders also were confident that the markets would not experience corrections over 50-60%, considering the increased numbers of players in the market. But the present move in all cryptos has breached their expectations.

The past three days have been rough for Bitcoin and altcoins. Last week, Bitcoin crypto had outperformed altcoins after an impressive rise from $31,000 to $40,000. Despite the strength of the buyers on that move, the sellers brought the price down with similar strength. As of writing, BTC crypto has broken below some major technical support levels.

On the other hand, altcoins are also on the same boat as Bitcoin. Unlike Bitcoin, they did have a temporary bull run in the previous week. And currently, the drop is coming in harder than BTC.

Cryptocurrency Market Cap Plunges Below $1.4 Trillion

The extended drop in the crypto market has left the market cap of digital assets breach below $1.4 trillion. And the market cap of the largest cryptocurrency Bitcoin is currently at $640 billion, with the price down 6% in the last 24 hours.

Some analysts are even speculating that the entire market cap could see levels lower than the recent low of $1.25 trillion.

The reasons for the drawdown are several, but none were in anticipation of such a massive drop. Taking into account statements from many analysts, the main driver for the plunge is the recent crypto ban announcement in China. Besides, Elon Musk, CEO of Tesla, announcing a pause on Bitcoin payments considering environmental impacts, drove the prices much further down.

Michael Saylor, CEO of MicroStrategy, stated in favour of Bitcoin,

“The dominant driver of Bitcoin right now is the crackdown on mining & trading in China that began in May. This created a forced & rushed exodus of Chinese capital & mining from the Bitcoin network – a tragedy for China and a benefit for the Rest of the World over the long term,”

Michael Saylor, CEO of MicroStrategy.

Biggies Hold, Rest on Freefall

The second round of the crypto dump seems to have begun. Bitcoin down over 6%, ETH token over 10%, and other altcoins more than 15% is clearly showing signs that the bears are going for another session of shorting.

Cryptocurrencies in the top five seem to be still maintaining grounds at/above major Support levels, while the lower market cap cryptos have broken through their recent Supports. Here is the technical analysis of few cryptos to represent the entire crypto market.

Technical Analysis – Bitcoin

Throughout the retracement, BTC crypto has been holding at Support 1 and 2 leaving lower highs every step of the way.

When the market failed to hold at Support 2, the price dropped down to Support 1. The buyers led the action and breached the lower high sequence but failed to hold above it, as shown in the circle. As a result, the sellers have taken over the market and is heading to Support 1 yet again.

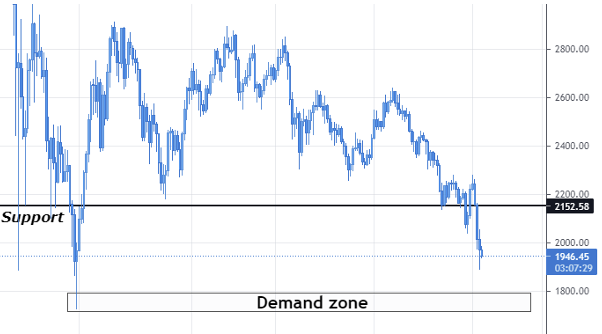

Technical Analysis – Ethereum (ETH)

The ETH market is similar to that of BTC. While Bitcoin is trading between two support levels, Ether is holding between the Support and demand zone.

The market ranging with equal power from buyers and sellers has currently broken below the Support after the buyers failed to show interest at $2,152.

Now, the demand zone is the last point of hope for the bulls to make a move. If the buyers fail to hold above the Support on the reaction from the demand, then we could expect levels of $1,500 in the short term.

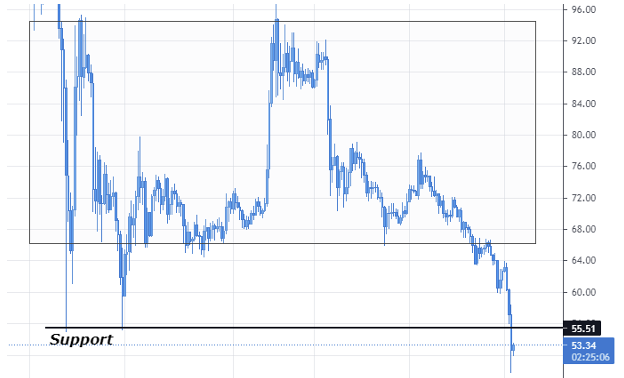

Technical Analysis – Filecoin (FIL)

To depict the price action of relatively lower market cap cryptos, we have chosen the Filecoin token.

FIL has been through a volatile range throughout the consolidation. But a point worth noting is that the sellers pushed the price beneath the bottom of the range – twice, which gave rise to a Support at $55.51.

And the strong reaction from the Support kept the market going in both directions. But on the third touch of the bottom of the range brought no buying into FIL. As a result, the market headed to the Support level.

Unlike BTC and ETH, the market did not hold at the Support, as the sellers turned much stronger at these levels. Hence, as of writing, the market has breached below the Support with a huge bearish candle.

Now, if the Giants continue to fall, the lower cap cryptos can experience a much larger decline. It is about time to know if the buyers will show up at the current levels or not.

We believe that you do not want to miss this opportunity to buy into the giants cryptos at these prices. You can easily get them from our list of reputed cryptocurrency exchanges right away.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

In Part 3 we look at more advanced trading strategies including flags, false breakouts and the rejection strategy

Celebrities on social media can have huge followings creating enormous power to influence their followers. We look at who are the most influential and some of the potential risks of following their advice

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.