The Bitcoin (BTC) Price Action Conundrum | Best Time to Buy the Dip?

#

The Bitcoin (BTC) price has dropped under the $45k level for the first time in the past 90- days. A few hours ago, the world’s largest crypto price briefly touched significant support at the $42k level. With this bearish move, the value of Bitcoin had now fallen by 35% since April 14th (when BTC achieved its current all-time high value). In this article, let’s discuss a few of the reasons that contributed to this downfall, along with the Technical Analysis of Bitcoin.

What Contributed to the Turmoil?

The strong bearish sentiment in BTC started when Elon tweeted about the environmental concerns of Bitcoin mining, and because of which they won’t accept Bitcoin anymore to buy Tesla cars. In addition to this, a recent reply by Elon has resulted in a significant downfall in the price of the world’s biggest cryptocurrency.

Here is the original tweet and the reply by Elon.

This reply by Elon created panic in a lot of retail crypto traders and novice Bitcoin investors as it passively means that Tesla will eventually get rid of all of its Bitcoin ($1.5 Billion in value) soon.

Why do Celebrity Tweets Impact Crypto Prices to This Extent?

That’s cruel on their part, isn’t it? But yes. There’s a good reason for this to happen. Do you know what impacts the prices of fiat currencies like the dollar, euro, pound? The corresponding new releases of the currencies and the nation’s performance overall will have a decent impact on them, correct? But cryptos aren’t backed by any centralized systems. They are completely decentralized. What gives them credibility is their use cases, of course, but the investments of global companies like Microsoft, Mastercard, Tesla, MicroStrategy, etc., play a major role in doing so. So, when a celebrity investor like Mark Cuban tweets about accepting Dogecoin as a mode of payment, it increases the credibility of Dogecoin, and eventually, its prices get shot up. Likewise, when the founder of Tesla says that he is unsure of his company’s $1.5 billion investment in Bitcoin, that raises a lot of doubts on Bitcoin’s future in the minds of novice and armature crypto investors/traders.

However, Elon was quick to clarify that Tesla didn’t sell any of its Bitcoin (yet).

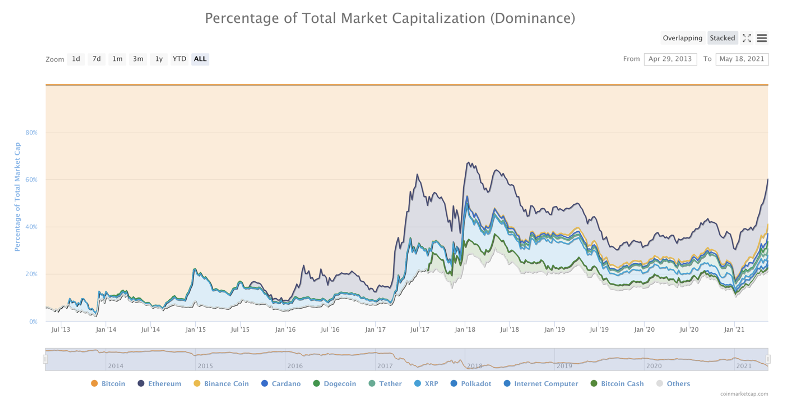

Bitcoin Dominance in The Crypto Market – 39.97%

At the time of writing, the crypto market dominance of Bitcoin is around 39.87% which is a 3-year low, as reported by CoinMarketCap. With this, the altcoin market has now recorded a combined market capitalization of over $1.5 trillion.

Below are the Altcoins with the highest Market Capitalization after Bitcoin

Ethereum (ETH) – 19.03%

Binance Coin (BNB) – 3.96%

Cardano (ADA) – 3.40%

Dogecoin (DOGE) – 3.08%

Ripple (XRP) – 2.33%

Bitcoin (BTC) Technical Analysis

The BTC/USDT pair price has just reached one of the most important technical levels in the history of Bitcoin’s price action. The $42k level is a significant support area for Bitcoin as this is where the industrial players showed some interest in the recent past. Also, because the price has come back to this point, there are more chances of industrial buying and holding to resume from this level. If the price fails to take support from this level, the next stopping of BTC’s downtrend could be at $39k or further below.

But we are very much positive of BTC taking support from this point to reach newer heights. The immediate support area is at $39,225, and the $38k level also seems to be significant support. $58,923 is the resistance we should be looking at in the higher time frame. We aren’t mentioning any closer resistance levels because all of them seem to be week and invalid for the next couple of days. The final resistance we should be looking at is its current all-time high value at $64,754.

As you can see in the above screenshot, the 14-period RSI on the BTC/USDT pair has just reached the oversold area, indicating a reversal. That’s exactly what has happened just a few days ago, which can also be seen in the encircled area.

All in all, we can say that this temporary downtrend in BTC is a healthy dip that could take Bitcoin to newer heights. It is a great opportunity for retail traders to take advantage of the dip and enter the Bitcoin trend before it becomes unaffordable. You can find the best place to buy Bitcoin by visiting our well-curated list of credible crypto exchanges. Cheers!

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Crypto investment remains unpredictable and risky, but good practices can save you from many of the potential pitfalls.

A roundup of the main exchanges in Australia allow you to quickly buy Bitcoin and other crypto on your card

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.