Three Factors that Weighed Down the Crypto Market

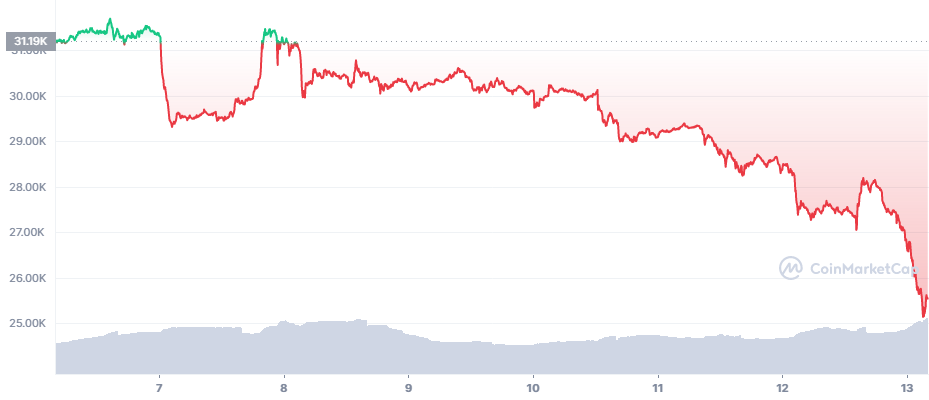

The crypto market accelerated its losses across the board one more time, adding to the fears of entering a deepening bear market. Bitcoin (BTC) sank under $28,000 over the weekend and remained in that level long enough to spark fears of a further price drop. The new week started with BTC dipping to $25,533.05.

The Crypto Fear and Greed Index is down to 14 points or Extreme Fear, still not below its recent 9 point low. The index, however, spends a long time near its lower range, while BTC is still not performing the expected breakout.

Ethereum (ETH) Slides Down Faster

ETH prices tanked faster than all other assets, erasing more than 17% of value week-on-week. ETH crashed to $1,358.09, down 50% from its peak and expecting to sink another 50% if the fearful trading period is extended.

ETH moved down just as its latest use cases – NFT, DeFi and games – started to lose their appeal. After peaking toward the end of 2021, the passive income and payout models in the ETH ecosystem became the object of doubts.

The DeFi space based on Ethereum’s blockchain and ETH collaterals has not gone through dramatic liquidations due to improved automated staking. In just a week, the DeFi holdings on ETH sank to 46B in notional value, and further unraveling can hurt the prices of all decentralized assets.

ETH is also gaining no new support even after its potential to move to proof-of-stake by the end of the year. The asset is also losing its appeal, especially after the crash of Terra and the realization that most DeFi projects hinged on a form of circular value creation.

Most importantly, ETH is nowhere near taking the top spot or gaining ground against BTC. In the past 12 months, there were hopes that ETH-based projects could generate value and make ETH appreciate against the leading coin and even take the top spot.

But ETH is actually set on sinking not only in dollar value, additionally predictions see it cede more ground to BTC. ETH remains highly liquid and closely held, with more than 10M tokens locked for staking and more expected to be locked soon. But the asset also grew its total supply above 120M, while also being displaced by other L1 tokens.

ETH is under additional pressure due to its short-term target of $1,100 based on current trends.

Celsius (CEL) Crashes by 50%

CEL, the native token of Celsius, is also one of the worrying factors on the market. Celsius managed to escape the riskiest exposure to Terra LFG, withdrawing its funds at the last moment.

Yet the Celsius protocol has been viewed with great skepticism for weeks, on the potential repeat of the Terra loss. CEL is now down 48.10% in the past week, down to $0.40, raising a question on the protocol’s viability in providing passive income.

CEL is also relatively more volatile, leading to liquidations on leveraged trading. For some of the positions, it may not be possible to add collateral, hence the liquidations and deepening losses. CEL has relatively low trading volumes under $20M in 24 hours. But the project’s position as a promising source of returns, while also raising doubts of a potential scam, are making Celsius a signal for the wider altcoin market.

BTC Good Long-Term Outlook, Short-Term Fears

As with previous crashes, the BTC market is generating short-term panic. At the same time, some wallets are in accumulation mode, increasing the number of addresses holding at least 1 BTC.

More BTC is being taken off exchanges, while ETH is facing heavier inflows and selling. There is also a slowdown of USDT turnover. This time, Tether’s stablecoin once again slowed its exchange flows in both directions.

The supply of USDT stabilized around 72.4B, while also achieving trading volumes above $49B during the weekend.

Currently, the Rainbow chart suggests BTC is a buy recommendation. At the same time, the overwhelming attitude is bearish, though expecting a reversal at any moment. BTC now has significant year-on-year loss, starting out at above $40K just 12 months ago. The 2021 bull market was almost fully erased for most altcoins as well.

BTC also failed to react as expected to recently reported inflation numbers. The reason for this is that both the USD Fed and the ECB suggested more hawkish interest rates by the end of the year. BTC is highly dependent on easy liquidity, both through stablecoins but also in the fiat world. With less investment money to spare, the crypto market may lose buyers with an appetite for risk.

At the current price, BTC is raising expectations that the bottom is not yet reached. Altcoins may be even more volatile, erasing gains and diminishing their activity. Even previous leaders like TRON (TRX) erased their recent gains, going down back to $0.073.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

We explain the safest and easiest way to buy Bitcoin and other crypto using your credit or debit card.

Learn how to keep your crypto secure and the different types of wallets you can use.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.