Waves (WAVES) Heads for $30 on DeFi Value Locked

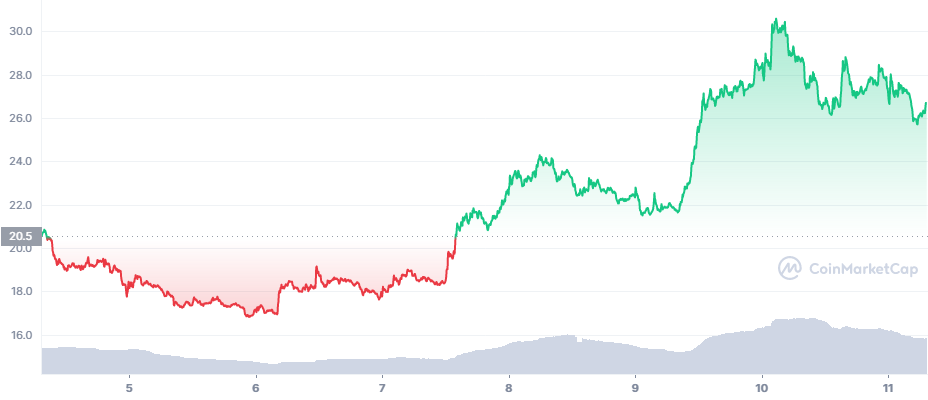

Waves (WAVES) is on a breakout, getting closer to $30 and becoming a top chain in terms of total value locked. The WAVES asset extended its gains late on Thursday, rising above $30 at one point. Later, WAVES retreated toward $26, raising questions if the asset had enough momentum to reach new highs.

WAVES saw significant growth of its TVL in the past month, most of which is due to the rise in the native asset. WAVES was locked for staking or liquidity, and the price trend lifted the fortunes of its DeFi and DEX ecosystem.

With the latest move, WAVES followed the trajectory of Terra (LUNA), where newer altcoins and ecosystems manage to displace even Binance’s TVL.

WAVES Survived Bitcoin (BTC) Drop

The WAVES market price continued to its current peak, despite the crash of BTC prices. BTC erased value againb, sinking closer to $39,000 and dragging down most other assets.

WAVES once again became an anomaly, going against the trend, as it compensated for previous sluggish price action.

How High Can WAVES Go

WAVES has ranked near the top in terms of gains and exposure since the beginning of March. But the asset can see significant slippage on its Binance trading pairs, thus cutting its rally short.

WAVES has yet to repeat its all-time high above $40, and is seen as having a chance at prices close to the range of LUNA. WAVES has waited for a long time to go to triple-digit prices, but has remained a second-tier network.

Now, with WAVES 2.0 ready to launch and connectivity to other networks, the influence of the asset may grow in the longer term.

WAVES will try to position itself as DeFi 2.0, where the protocol has a more significant hold of its liquidity, with no incentive to move funds out. WAVES is also gaining a key usage as collateral in the Neutrino protocol.

Neutrino issues an algorithmic stablecoin, USDN, and has been filling up its WAVES reserves in the past few weeks. Being used as support for USDN turns WAVES into a similar case of LUNA. The scarcity of both LUNA and WAVES will be driven by demand for their algorithmic stablecoins. This will prevent the assets from being sold, as there will be expectations of growth within the new DeFi ecosystem.

Can WAVES Retreat

WAVES has been rallying for weeks, and has touched peaks close to $30 in the past days. After the big rally, it is possible WAVES retreats to its previous range, with predictions of going under $15.

One of the big supports of WAVES is the usage of USDN, as Neutrino protocol has added more than 5M WAVES to its reserves.

WAVES may thus move less on technical logic, and more on its relation to the Neutrino protocol.

For some, the success of WAVES measures demand for USDN and the success against other stablecoins. USDN is also a source of passive income when staked.

What is Neutrino Protocol

Neutrino Protocol turned out to be one of the biggest WAVES buyers in the past few weeks. The protocol holds more than $1.4B in total notional value, spread across ETH, WAVES and other stablecoins and tokens.

NSBT is the native token of Neutrino protocol, which can be staked for passive rewards, expected to grow as the protocol grows its activity. NSBT can also be staked and locked as gNSBT, a governance token.

Neutrino Protocol also plans an update to swap WAVES and USDN in one-block transactions, increasing DeFi speed.

Neutrino USD has a supply above $586M equivalent, and carries just 0.2% of the market cap of all stablecoins. This stablecoin is catching up, however, and is already more influential than Gemini USD (GUSD). With the growth of Neutrino Protocol, USDN may take over a bigger market share.

NSBT is also on an expansion track, trading at $30.24 after a rally in the past few weeks. The asset has peaked at around $48, but expects a strong year in 2022, with multiple updates and more value locked. NSBT also followed the trend of WAVES and became one of the expanding tokens in the past day.

In the coming months, NSBT staking will shift to a new smart contract, and WAVES buying may continue to produce more USDN.

The drive for new DeFi hubs of value is happening as the TVL of Ethereum (ETH) diminished. Since the start of the year, DeFi on Ethereum is down more than 25%, from a peak above $100B down to around $74B with a falling trend. Value is shifting to Terra, Solana (SOL) and Avalanche (AVAX), along with new up-and-coming protocols like WAVES.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Who are the biggest influencers in the NFT space across the various social media platforms.

What do members of the public think about Crypto in 2021/22? We survey some UK people and look at search data with some surprising results.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.