What Are The Bitcoin Whales Up To? | The BTC Market Update

##

The cryptocurrency market is back in action. The bears that tanked the market down over 50% brought the entire crypto space to a standstill for three months or so. But surprisingly, the BTC/USDT pair held firm at the technical Support levels despite the recent negative events.

The demand zone at $30,000 that was weakening every step of the way was expected to break in the subsequent trading sessions. But the current price action depicts that a discount up to $28,700 was sufficient for the buyers to take over the market.

The Bitcoin market also failing to hold at the psychological supply levels is a clear indication that the bears have disappeared or have possibly turned buyers.

Now that Bitcoin crypto has broken through the major hurdles, it is critical to observe if the price is heading to the all-time highs in the near term or there still are sellers on the way up.

Following are a few fundamental updates regarding Bitcoin that could help us gauge the market’s direction in the coming business days.

The U.S. Infrastructure bill Concerns

The infrastructure bill that the crypto market was concerned about in the previous continues to attract attention as it is expected to conclude this Tuesday.

The $30 billion out of the $1 trillion bill is attempting to cause tax concerns for crypto investors. The voice has been heard so far that even U.S. senators seek to amend changes to the bill.

The crypto participants are now ready to accept any outcome from the bill, be it favourable or unfavourable, as they made a successful attempt to the concern being brought to attention.

“Washington is well aware now,” said Sam Bankman-Fried, CEO of exchange platform FTX.

Gold Crashes, BTC Holds Firm

The gold market has slumped, losing as high as 7% in two days. The intensity of the crash kept analysts shocked. The market was trading around $1,800/oz for over a month, much above the technical support levels. But the Non-Farm Payroll number dropping last Friday left gold prices on a freefall. The instant drop on Friday as well as on Monday market open took the Average True Range values to short-term highs.

In fact, the entire U.S. Dollar group saw significant bullishness on Friday for the entire New York session.

However, Bitcoin against the U.S. Dollar remained unaffected by the USD correlation, as the BTC market continues to make higher highs and higher lows.

Gold, which is down about 1% as of writing, Bitcoin is up over 4%. Hence, we clearly ascertain that major accumulation is happing in the BTC or the crypto market for the matter.

Bitcoin Millionaire Addresses Holding their Gains

Despite the latest jump in Bitcoin token prices, the BTC millionaire addresses holding between 100 and 10,000 Bitcoins are maintaining their long positions. As a matter of fact, the holdings among the Bitcoin whales have increased by 100,000 BTC in the last week.

According to the data published by crypto analytics platform, Santiment, 9.23 million BTC coins are held by the Bitcoin millionaire addresses altogether, at record highs.

Moreover, the analysis from Glassnode, a crypto data firm, also shows that the biggest Bitcoin addresses are not profit-taking despite the bull run the market is currently witnessing. The firm also highlighted that the overall BTC activity has increased by 30% due to the crypto market trading at higher levels.

All in all, the fundamentals are fairly in sync with the present price trajectory of Bitcoin.

Bitcoin on its way to $50k?

On the price action aspect as well, the interest for buying Bitcoin and altcoins has been increasing, mainly because of the price breaching above technical hurdles.

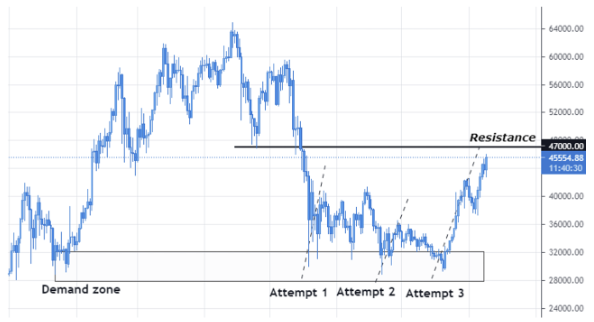

On the higher timeframe, they took Support at $30,000 and made a brand new high, all the way to $60,000, in the initial months of 2021. Failing to cross above the ATH after some overextended consolidation, the market broke below the support at $47,000, turning it to a potential Resistance zone.

But the crash still looked unsuccessful as the buyers held on to the demand zone very firmly. The market then began to move sideways due to the presence of both strong buyers and strong sellers.

During the consolidation phase, the bias from top analysts was split into two. The bulls attempted to go long from $30,000 while bears kept shorting at $40,000.

Finally, on the third attempt, the buyers stepped up, stronger than ever. Technically speaking, the first resistance level at $40,000 was taken down by the buyers with barely any reaction from the price level.

The breach, hence, paved the way for the bulls to head to the subsequent Resistance at $47,000. And depending on the reaction coming in at the Resistance, we can get a clear idea of the forthcoming price action.

Were you able to catch the recent bull run in the crypto market? If not, you can create your portfolio instantly from our list of certified cryptocurrency exchanges.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

How do cryptocurrencies stack up against popular stocks and shares?

Part 2 covers intermediate trading strategies including Bollinger bands, the TRIX indicator and pattern trying

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.