Why Terra (LUNA) Recovers First After Dips

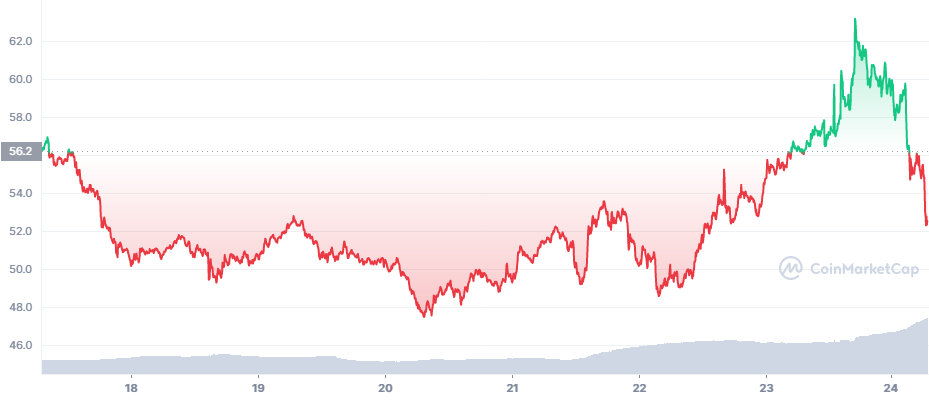

Terra (LUNA) had several days of trading activity where the asset defied the overall depressed state of the market. With Bitcoin (BTC) relatively weak, LUNA still managed to grow more than 12% to above $60. On Thursday, however, LUNA sank back toward the $54 range after crypto assets sank across the board. BTC sank to the $34,000 range on news of the Russian invasion of Ukraine.

LUNA expansion may have caused a short squeeze, but there was also an anomaly in UST trading. The dollar-affixed asset, which is produced with LUNA staking, broke its peg to the dollar and reached higher valuations.

UST has small fluctuations of under one cent, meaning it is sometimes used for arbitrage along with other stablecoins. But trading anomalies can also alter the dollar price and lead to surprising valuations. In the case of UST, the price went up as high as $1.20.

The overall trading of UST did not reflect the anomaly, which only happened in a single Binance trading pair. UST is more volatile than other stablecoins, as it is an algorithmic asset, with only LUNA backing.

Similar assets like DAI have diverged from the $1 price in the past, and even Tether (USDT) has fallen as low as $0.80 on the Kraken exchange during the bear market in 2018.

What Caused the LUNA Rally

LUNA is one of the coins that has made traditionally rapid recoveries, revealing the agility of altcoin markets. While riskier on the downside, those assets also move to higher valuations much faster compared to BTC and even Ethereum (ETH).

LUNA is moving on general expectations of a new move, based on technical charts that also affect trader sentiment. Additionally, Terra is an entire ecosystem, where tokens and additional markets help boost locked value. Terra, Solana and sometimes Avalanche are some of the protocols that defy the market and serve as a safe haven to protect gains.

This time, it was LUNA’s turn to shine and extend the gains across the ecosystem.

LUNA was the sixth most traded asset on the Binance exchange, inviting trading volumes near the monthly high. For now, SOL and AVAX are still stagnant.

LUNA Adds Liquidity with New Pairings

Another reason for the exposure of LUNA was the recent addition of new leveraged pairs on the Crypto.com margin trading engine.

Terra Forms BTC Reserve to Protect UST

The Terra ecosystem has received some criticism that it relies too much on LUNA and its DeFi protocols are risky. For that reason, the project has added new tools to protect the value of UST.

Recently, Terra announced the creation of a dedicated BTC fund to back the value of UST.

The fund should protect UST from a bearish spiral, when the price of LUNA is dumping and cannot support UST adequately. With the fund, Terra has shown long-term dedication to the stability of its DeFi ecosystem, gaining the trust of investors for multiple use cases.

Terra also partners with the NEXO ecosystem, giving more use cases for the UST asset.

The advantage of LUNA also lies in regular token burns that manage to lift market prices. LUNA thus often performs in the green while the rest of the market backtracks.

The Terra ecosystem now holds around $17.71B in notional value, of which more than 53% is locked within the Anchor protocol. LUNA aims to become programmable Internet money and serve decentralized value exchange in the long run.

The protocol got another boost from the recent addition of LUNA and UST to ThorChain, one of the potentially confidential networks. Decentralized use cases, which avoid exchanges and use swaps or liquidity pools, may be harder to trace. For LUNA, this is especially relevant after attempts to track BTC transactions, as well as exploit mixer flaws to even track supposedly confidential transfers.

How High Can LUNA Go

LUNA may turn bullish as it crossed the $54 mark, though it would have to preserve its Wednesday pump gains. LUNA is also used for short-term arbitrage across protocols.

The next expectation for LUNA is to move above $70. On Wednesday, LUNA managed to hover above $62 briefly, but a bigger breakout from the falling trend may happen toward three-digit prices.

The asset may be prone to scarcity, as most LUNA is locked for staking, or taken for regular burns to support UST.

However, given fees and risk, those trades may have a limited effect on LUNA. The asset, along with UST, has shown it can absorb the heightened activity on crypto markets, triggered by the highly successful past year.

For now, LUNA is not represented on the Coinbase exchange, but it offers access to international traders through Binance and Kraken.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Crypto gets a lot of criticism sometimes but what sort of job are the current banks doing at looking after their customers. Who are the best and the worst banks to be with?

The basics of cryptocurrency portfolios and how to get started in tracking your crypto holdings

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.