Will Merge in ETH 2.0 Cause DeFi Problems

The chief idea of ETH 2.0 will be to merge without disrupting the network’s work, in a way that will not be felt by users. However, over the years, the Ethereum network expanded to tens of thousands of tokens and smart contracts. All the balances and trading history will face the challenge of migrating to a new set of nodes and a new way of distribution. At this point, it is uncertain what unexpected effects may emerge from the new network.

ETH 2.0 was proposed as a proof-of-stake network to replace the currently volatile solution. The biggest problem with Ethereum is that at times of great user load, transactions sometimes take hours or cost thousands of dollars to complete. This wastes gas fees and may have additional effects on protocols built on Ethereum.

For now, most of the future events are speculative, and educated guesses are made on what may follow.

Will Miners Protest the Merge

One of the reasons for delaying the move to proof-of-stake is that miners may decide to continue producing blocks, thus duplicating assets. This will lead to disarray of the whole DeFi space, leaving projects to decide which network carries their valid asset. The problem is made worse by the millions of NFT items.

The Ethereim mining rate recently reached a peak above 1 Ph/s, later stepping bach to 986 Th/s. Miners may also move on to Ethereum Classic to get potentially appreciating rewards.

At the same time, the ETH 2.0 staking contract is already locking in more than 12.79M ETH, for a value above $23B. Each early depositor hopes to validate the network with 32 staked ETH, also using regular consumer hardware. The coins staked cannot be moved until the network launches.

Some of the ETH staked was locked in the contract at a much lower price. There were expectations that owners would decide to sell instead of relying on node operation. However, the locked ETH may remain due to the promise of much higher returns over time.

Additionally, buying 32 ETH may not be easy once ETH 2.0 launches and there is demand for node operation. Hence the readiness to hold those assets and secure the network.

Layer 1 or Layer 2: Will Scaling Still Apply

Currently, scaling Ethereum has been answered with two possible approaches. One is a different Layer 1, such as Solana, Avalanche, Cardano and others.

The other solution is Layer 2 like Polygon or ImmutableX. This solution still relies on Ethereum for the final settlement, though it saves on fees by batching the transactions. With ETH 2.0, some of those services may not be needed in their current form.

Testnet Merger to ETH 2.0 Coming on June 8

The first attempt to merge the so-called PoS Beacon Chain will come on the Ropsten testnet, one of the longest testing blockchains on Ethereum.

In just two days, the testnet will go through the same process of “merger” that was intended for the main network.

The merger process will require of node operators to declare their readiness to avoid miners interfering at the last moment. After the merger, node operators will still receive priority fees, though without the potential for runaway fee wars.

Will ETH Go to $10,000

One of the wilder expectations is that after the successful ETH 2.0 launch, the price of tokens would rally once again and reach valuations above $10,000. Even with more than 120M ETH created, staking and fee burning may add to the ETH scarcity.

It is true that the Ethereum network is still the busiest and most trustworthy. The network carries some of the biggest DeFi hubs, decentralized exchanges and collections of NFT like Bored Ape Yacht Club. Ethereum’s influence is also behind the recent Optimism (OP) phenomenon, a new token that was listed immediately by Binance and KuCoin.

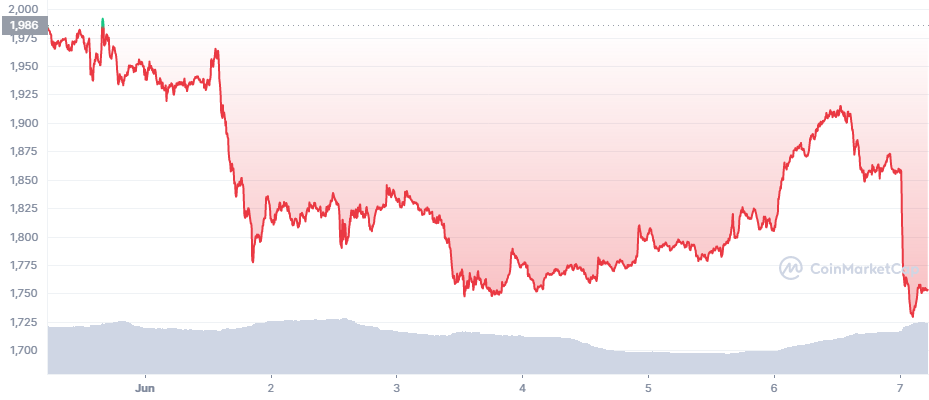

Optimism is also aiming to become an ETH scaling solution, though coming a bit late to the game. However, with no set date for the Merger, the OP token may gain attention. Multiple Optimism copies and scams have also added to the confusion. OP launched on June 1 at $4.55, only to slide to the current range of $1.30.

Networks like Solana also show that validators may also face overload and lose consensus. Others, like Avalanche, have a separate set of projects and games. Ethereum also carries most USDT and USDC tokens, a key liquidity source for both centralized markets and DEX.

If the Merge with the current Beacon Chain is successful, the new network may become even more powerful, provided there is no conflict of the real identity of most tokens.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What are the most common scam coins and how much have they got away with in the past, plus some tips on how to avoid these scam coins.

What do members of the public think about Crypto in 2021/22? We survey some UK people and look at search data with some surprising results.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.