Bitcoin (BTC) Preserves Deep Accumulation Despite Dips

The Bitcoin (BTC) dip has not changed the most fundamental aspect – that of accumulating coins for the longer term. In the short term, however, spot and futures trading increase volatility, making BTC stand at a crossroads between recovery and a deeper price drop. In February, the scenario of a bear market extending into 2022 remains feasible.

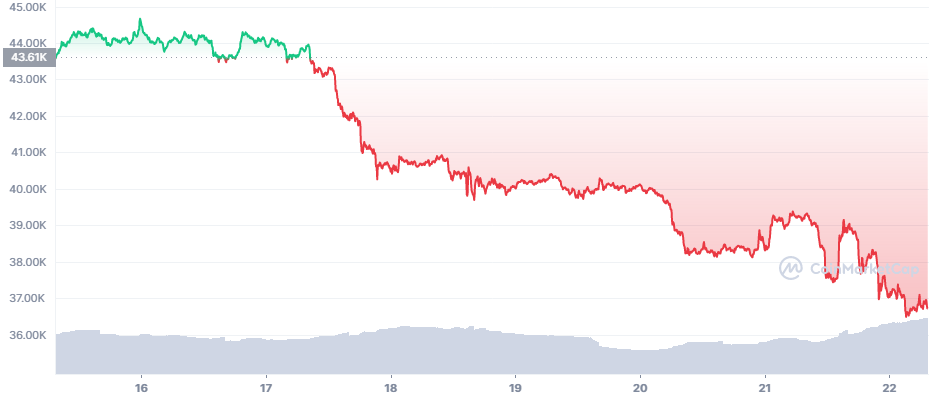

Late on Monday, BTC spent a short time above $38,770 before a sudden crash to $37,703.03, showing the downward pressures were not easy to dissipate. The drop extended to the Asian session, sending BTC to $36,795.29 early on Monday.

With the US trading session setting the pace for the coming business week. BTC may add to its turbulence and revisit a lower range.

So far, there are only limited realized losses, and buyers hold onto the coins most of the time. Recently, a peak of new small-scale wallets was made again, after the previous high at the end of January. At the same time, BTC is now suffering a cut based on year-on-year prices and may extend the 12-month rolling loss to more than 50%.

While BTC trading volumes have diminished to around $23B in 24 hours, the activity of Tether (USDT) is on the increase. The supply of the top stablecoin is also growing, up to 79B tokens with new printing in the past week. The inflow of USDT may translate into trading activity for BTC and altcoins.

In the past week alone, 500M new USDT flowed into the market, along with 3B USDC in a month. USDT is now the third largest asset by market capitalization, after displacing Binance Coin (BNB)av.

Traders Try to Protect from Downside

Heading into March, one of the concerns for BTC is the potential for a larger Fed interest rate hike. Currently, options signal to an expectation for BTC extending its losing streak.

Unlike previous weeks, BTC failed to recover immediately, remaining in the $38,700 range. The latest slide sent the Crypto Fear and Greed index to 25 points, or Extreme Fear. However, the mix of USDT printing and BTC fears has been a historical indicator of trend reversals.

BTC may hobble along until Friday, when the settlement of options expires and may add to the price volatility.

In 2022, Less Panic Selling is Seen

Unlike the end of 2017 and the three-year bear market, new buyers may be more willing to hold through turbulence and treat BTC as a long-term asset. There are also signs that the current price slide may be another “shaking out of weak hands”, as the orders are immediately bought.

Rapid price directions are possible in both directions, but this will not exclude a bear market or prolonged sideways movement.

Another possible scenario for BTC is to continue sideways and start showing signs of accumulation before a renewed rally. But the past few weeks are becoming a battleground of bulls and bears, potentially leading to unexpected price swings.

In the short term, both sellers and buyers can achieve some form of price manipulation, making BTC move against predictions and trends.

Ethereum (ETH) Remains Fully Bearish

ETH deepened its loss as well, with a dip to $2,600. All indicators for ETH remain bearish, as network usage and sentiment break down.

ETH has also been beset by attempts to scam with giveaways, as well as recent thefts of NFT collections. At the same time, value locked in DeFi inched up a little to above $71B, from $70B equivalent a day ago.

Exchange flow conditions for ETH are volatile, with several upturns and downturns in the past month. For now, the inflow of ETH on exchanges has tapered off.

Traders have also noticed bot-like activity on the Bitfinex ETH pairs, buying up coins with regularity.

Terra (LUNA) Saves Altcoin Value

The Terra ecosystem was one of the few to see inflows of value in the past day. LUNA added about 5% to its price, trading at $52.78.

LUNA has been boosting the supply of Terra USD (UST) from 11.6B to more than 12.1B in a week. UST is a safe haven with a dollar-affixed price, mopping up some of the volatility on DeFi protocols on the Terra blockchain.

The market cap dominance of Terra is up to 1.11%, competing with Solana’s share of 1.6% of the total market cap. The rally of LUNA is offset by losses form Avalanche (AVAX), where the asset cut its rally short and did not manage to go above $100 again.

Smaller altcoins still make up 21.05% of the market, going above the influence of ETH.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

How do cryptocurrencies stack up against popular stocks and shares?

A roundup of the main exchanges in Australia allow you to quickly buy Bitcoin and other crypto on your card

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.