Bitcoin (BTC) Has Longest Weekly Loss Streak in History

Bitcoin (BTC) trading has charted an event not seen in all of the coin’s trading history. Seven weeks closed with a net loss, breaking the previous record of six weeks. The last time BTC had a six-week losing streak on the weekly chart was in 2014.

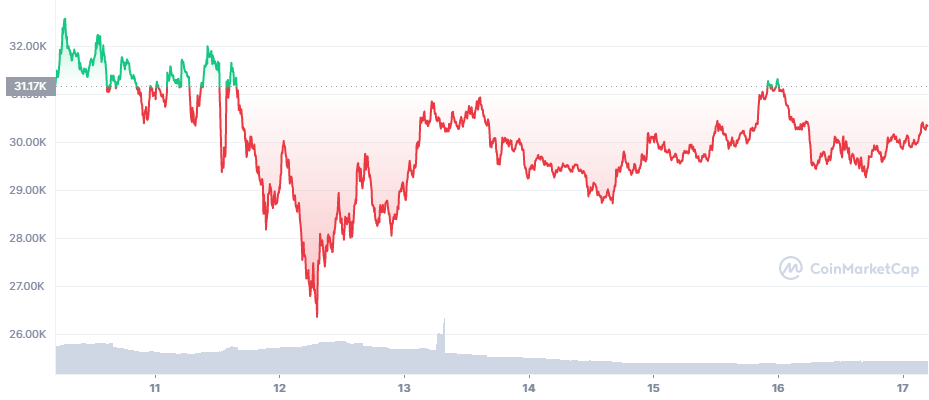

BTC traded at 30,345.56 after once again dipping to the $29,500 range. Until recently, the six-week losing streak also caused expectations the series would be broken soon.

BTC now solidified expectations of a potential bear market and a steeper correction until the end of the year. But there are also short-term expectations for gains on the weekly chart, breaking the unusually long trend. BTC can quickly reverse directions, and there are already signs the coins are flowing out of exchanges again.

Holders Return to BTC

Small-scale wallets and those holding at least 1 BTC are once again showing a growth pattern. At this point. BTC may be offering a buying opportunity before a bigger rally, especially for buyers intending to hold for the long term.

Despite expectations of a deeper correction, some of the top wallets increased their holdings. The buying happens on expectations BTC may bottom out at this position, but may offer additional buying opportunities.

At the same time, predictions see BTC dipping lower, possibly to as low as $22,000. The prediction is based on moving average levels. Even more bearish predictions see BTC erasing as much as 85% from its peak before reversing.

The next move of BTC still hinges on past performance and historical patterns. BTC still expects a renewed bull market in the longer term, especially linked to the next halving in 2024. The recent market moves show there is still a waiting period to check for contagion across DeFi projects and stablecoins.

Tether (USDT) Takes a Step Back

The behavior of USDT was unusual. The leading stablecoin, with trading volumes above $62B in 24 hours, burned off some of the supply. Instead of printing new coins to support BTC, Tether decided to retire more than $8B in value from the supply, cutting the token count down to $75B.

USDT often moves down to $0.99, though it has not broken the peg below $0.97 despite prevailing fears. The token burn may be a move to calm down markets and await a return to confidence.

Is Leverage Coming Back

The Crypto Fear and Greed index has fallen to 14 points, or extreme fear. BTC trading moved to its usual levels of around $33B in 24 hours, once again based on uncertainty. However, Bitfinex trading is showin an anomaly, with an all-time high of long positions.

The positions may be a sign that an imminent rally is expected. But it is also possible those positions get attacked and liquidated.

BTC will now attempt to regain the $30K level as support, before potentially looking at the $32K level. In the long term, prices under $35K are considered a buying opportunity for significant returns. BTC is also a more appealing asset as altcoins showed their volatility and a bear market may erase a larger percentage of their value. Buying BTC is thus more of a safe haven for funds moving out of hotter but riskier projects.

Did Terra LFG Sell its BTC

Terra LFG was one of the important factors for boosting BTC demand. At one point, Terra accrued close to 80K BTC, with one of the notorious wallets containing more than 42K coins.

Then, on the day Terra USD (UST) lost its peg, the holdings were moved in only a few transactions, ending up on Gemini and Binance. There is also no data on whether the BTC was sold or liquidated.

The latest data show Terra came away with only a small vestige of its reserves. But there are still some suggestions the BTC from the wallets may have been redistributed in other ways to some of the LUNA holders and investors.

Yet at this point, the BTC may not be able to bring LUNA back, as the asset has gone through delistings and UST is no longer viable. However, there are also attempts to relaunch a new version of LUNA, with a Version 2 coin being offered to investors.

There are also suggestions for a token swap and an attempt to launch a new asset and possibly renew the reputation of Terra LFG.

The Terra crash was also considered a stress test for BTC. The market fears were absorbed, and some believe the market also successfully absorbed the selling of nearly 80,000 BTC without a more serious correction.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

A beginners guide to candlesticks, trend line, indicators and chart patterns

What is cryptocurency? What gives it value? How do you buy and store it? Beginners questions answered in plain English.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.