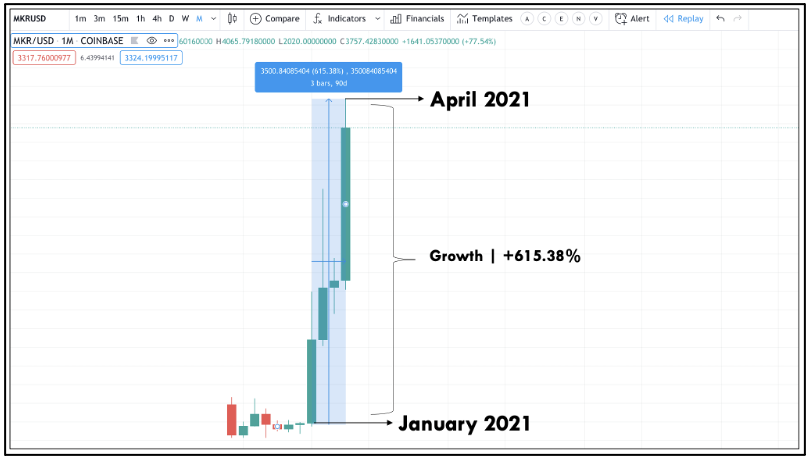

Altcoins Reach $1 Trillion In Market Cap | Maker (MKR) Gained 615% This Year

#

The combined market capitalization of all the altcoins has reached one trillion dollars recently. It is indeed a great milestone for the crypto industry, which was only known for Bitcoin to the outside world just a few years ago. As of today, the crypto market dominance of Bitcoin (BTC) is exactly at 52%, while altcoins take a 48% share. Ethereum (ETH) is currently leading the altcoin space with a 12.6% market share.

In some of our recent articles, we have discussed the technical analysis of altcoins with maximum growth. We have also accurately forecasted the price of those cryptos with huge potential. This article discusses one such altcoin – Maker (MKR), with a huge price hike of 615% since the beginning of this year.

Introduction to Maker (MKR)

Maker is a decentralized autonomous organization with MKR as its utility token. It is an Ethereum based platform, and its main purpose is to allow its users to manage the popular DAI stablecoin. The inception of Maker happened during the huge bull run of cryptos at the end of 2017. The fundamental purpose of Maker is to operate and manage DAI, which is a decentralized, community-owned stablecoin. Since DAI is pegged to the US dollar, one DAI will always be equal to the value of one USD. Maker is one of the pioneer projects on DeFi stance. Their governance token MKR gives the voting right to the community that manages DAI. These voting rights offers the community complete control over the decisions of Maker Protocol’s future.

Reasons for the price surge in Maker Price

As discussed, the MKR coin surged by over 615% in the past four months and by over 50% since yesterday. According to expert opinions, this astronomical growth is anticipated, and this crypto is still expected to continue its bull run. MKR token has broken its previous all-time high value by reaching a record high of $4,102; the current price of one DAI is hovering around $3,984. One of the primary reasons for this price surge is the recent decision taken by their team to go fully decentralized and give 100% control of Maker to its community.

There is no real need to explain the importance of stablecoins in the crypto market at this point. Out of all their pros, recent studies suggest that stablecoins do play a crucial role in acting as a doorway for capital inflows to the crypto market. Currently, most of the popular stablecoins out there are being controlled by centralized authorities like Circle or Tether. In contrast to that, the DAI stablecoin, which Maker is issuing, is walking towards true decentralization – the fundamental principle of cryptos as a whole.

To be a part of the Maker community and participate in its governance, the users must hold the MKR token. This has led to a higher demand for MKR and resulted in a surge in its overall price. Also, the supply of DAI has increased a lot in the recent past. It is considered a go-to decentralized stablecoin option for many DeFi projects like Cream Finance (CREAM), Compound (COMP), etc. Therefore, this could be one of the other primary reasons for the price surge in MKR token.

Technical Analysis of Maker (MKR)

MKR/USD | Weekly Time Frame

The MKR/USD pair has surged by over 80% since the past week. The price could reach its nearest resistance at $4435 and could even break it to reach its month’s resistance at $5270. There is no sign of sellers on this timeframe, but the support levels are $1982 and $710.

MKR/USD | Daily Time Frame

Since yesterday, Maker has grown over 52%. We can see the 10-period moving average being below the price action on the daily timeframe, which indicates a clear bull market for this crypto. The nearest round number resistance zone for this pair is at $4200, and in case of continued buying pressure, the price could reach the $4435 zone. In case of any adverse seller momentum, the price could take support from the $2,702 level before making a brand new higher-high.

MKR/USD | 4-hour Time Frame

The series of bullish candles closing above the previous candle’s high indicates the degree of buying momentum in the Maker cryptocurrency. The nearest resistance zone for the price is its current all-time high value at $4,102, and the support levels are at $3,147 and $2,702.

MKR/USD | 1-hour Time Frame

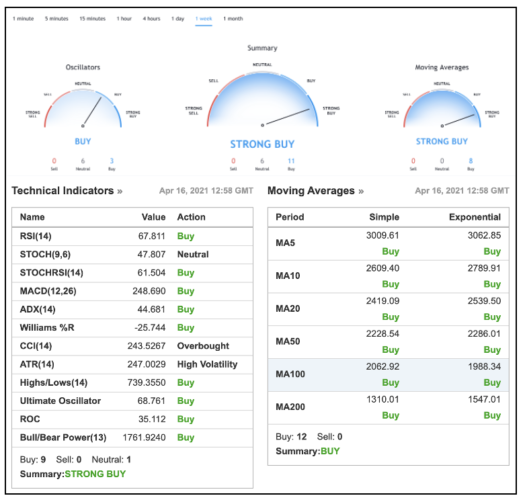

We can see the moving average just starting to go above the price action on the one-hour timeframe. There could be a possibility of people cashing out their profits after MKR reaching its ATH value. Therefore, if you are trading this pair, it is recommended to analyze the market, gauge the seller momentum and only then take any trading decisions. But as the below image suggests, there is a strong buy sentiment on this crypto overall.

If you are an investor and interested in DeFi projects, Maker should be your go-to investment option at this point. Look out for a dip and jump on to the trend by purchasing Maker (MKR) on some of the most popular cryptocurrency exchanges. Cheers.

#

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

We are now paying prizes in Iota. Learn a bit about it and where you can buy, sell and store it

What is cryptocurency? What gives it value? How do you buy and store it? Beginners questions answered in plain English.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.