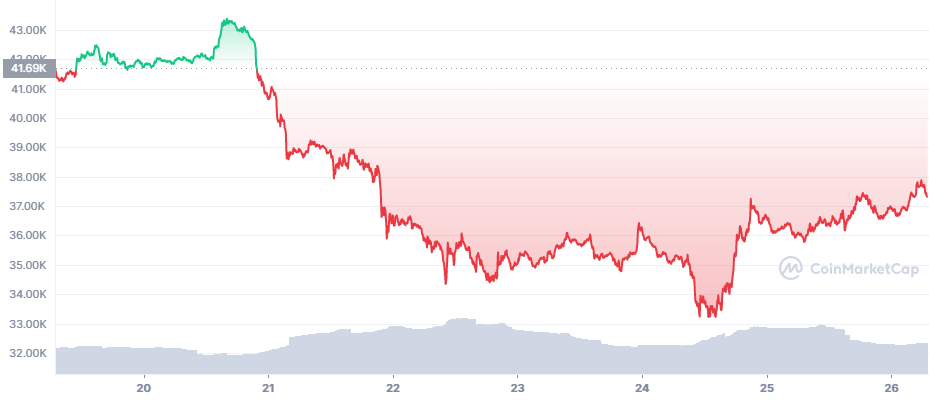

Bitcoin (BTC) Above $37K, Another Dip Possible

Bitcoin (BTC) recovered just as fast as it dipped to $33,000. Within a few hours, BTC traded above $37,000, taking along most of the other major assets. The price move suggested two possible scenarios – either the end of the panic or a bull trap with the potential for additional price weakness.

Ethereum (ETH) and most altcoins quickly regained some of the losses, easily marking gains between 7 and 10% in the past 24 hours. But the BTC recoveryo was the fastest, taking the leading coin to a dominance level of 42.1%.

Buying Support from Big Wallets Noted

One of the immediate effects of a low BTC price was the appearance of whale buyers of physical coins. On-chain data show a large buyer mopping up series of orders.

At this point, it is unknown who the buyer is, or what is the reason, but it was considered one of the signs BTC was a buying opportunity at $33,000. The higher market price is also considered a buying opening according to the Rainbow chart, and a chance for BTC to return to higher valuations.

BTC still carries a net gain for the past 12 months, especially after moving above $37,500.

Now, BTC still has to fulfill the expectations of recovering the upward trend in the coming months of 2022.

The latest price shakedown caused significant liquidations, peaking to levels not seen since November 2021. As more positions get liquidated, BTC may take some time to regain the confidence of leveraged traders.

Total liquidations on the cryptocurrency market reached 194M. Most large derivative exchanges, including Binance and OKEx, saw a predominance of liquidated short positions as BTC unexpectedly broke its slide. BTC funding turned negative on Tuesday, signaling temporarily weakened interest in leveraged trading.

Holding Continues Despite Unrealized Losses

For BTC recent buyers, recent acquisitions arrive with significant unrealized losses. This time, there are some signs the buyers are holding on for future gains. Glassnode data show peak unrealized gains, with still weak exchange inflows.

The current market move is one of the more significant sell-offs, though liquidations happened gradually over a few months starting October 2021.

Is Another Dip Coming

BTC and altcoins have only spent a few hours regaining lost ground. With the end of the month coming, another series of liquidations and attacks on positions may arrive before the weekend.

This may translate into a bull trap and another series of dips under $30,000.

The Crypto Fear and Greed Index is at 12 points, one point down in the past day. The index is in extreme fear, while stock markets are also showing signs of deepening fear after significant NASDAQ index losses.

The latest BTC expansion happened on relatively low volumes around $28B in the past 24 hours, along with a slide in Tether (USDT) supply by about $150M. BTC and altcoins may still display ongoing weakness.

Mining Remains Highly Profitable

Miners are one of the market participants that are the most active. For the Bitcoin network, as of January 24, another solo miner with a single machine managed to solve a block and receive the reward of 6.25 BTC.

At the same time, an Ethereum miner solved a block where fees reached 170 ETH. Because Ethereum is so widely used, most of the mining revenue now comes from fees and not from the already small block reward.

Despite the market shock, both BTC and ETH are above profitability levels, especially with mining farms using renewable sources of electricity.

Platform Coins Lead Recovery

The fastest recovery in the past day belonged to platforms offering to carry DeFi and gaming protocols. Avalanche (AVAX) expanded by 12% to $69.75.

Polygon (MATIC), one of the chief side chain solutions to Ethereum congestion, is up more than 10% to $1.60. Solana (SOL) recovered despite a recent network pause, adding more than 11% to $99.75.

Near Protocol (NEAR) is another rapid gainer, up more than 17% in 24 hours to $12.14. All of the protocols are well-supplied with stablecoin deposits. But the assets also have a significant presence on the Binance exchange, allowing for concentrated buys during the price shakedown.

Smaller altcoins dominate 21% of the market, surpassing ETH, which slid to 17.4% of the market. Despite the short-term gains, most altcoins are now down by roughly 60% from their peak, with few exceptions. DeFi levels remain at $92B in value locked for Ethereum, with additionally close to $100B in other protocols. Altcoin markets and decentralized networks are propped by a new collection of stablecoins, ensuring no rapid outflows of liquidity.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Part 2 covers intermediate trading strategies including Bollinger bands, the TRIX indicator and pattern trying

What do members of the public think about Crypto in 2021/22? We survey some UK people and look at search data with some surprising results.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.