Bitcoin (BTC) Breaks Rally After Fed Rate Hike

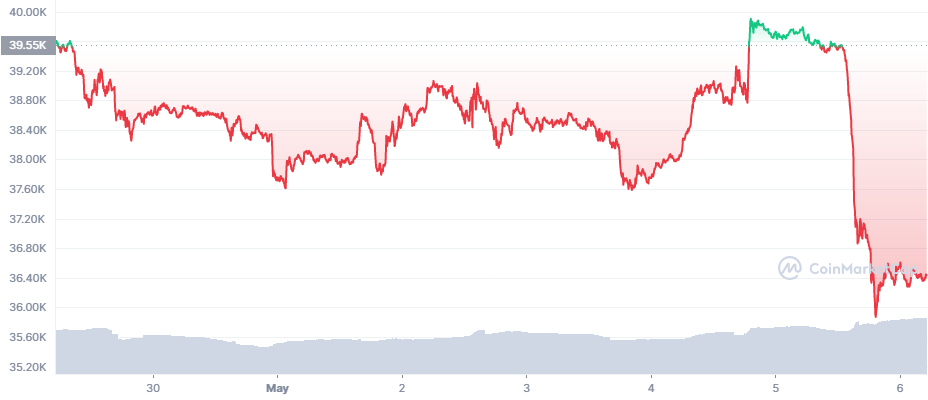

Bitcoin (BTC) had a flash crash during early US trading hours on Thursday, breaking down the recent hike close to $40,000. Instead, BTC dipped to a low of $36,455.00 ahead of the weekend, erasing previous attempts to climb back above $37,000.

The immediate reason linked to this day’s event is the decision of the US Fed to raise the base interest rate by 0.5%, after years of quantitative easing that helped bring about the BTC bull market in the past decade. The rate was partially expected, but down the line, in mid-2022. Currently, BTC is also threatening to return to a slide, or at least continue to trade in a tight range.

The decision caused immediate inflow of market action in an otherwise more subdued futures trading market. After the deep losses of April, BTC trading stagnated with daily volumes around $30B. The recent price action also renewed more significant liquidations.

The price of BTC also trailed the overall loss in tech stocks, where the inflow of easy Fed liquidity was also working to create a bull market. BTC had significant correlation with tech stocks in the past months.

There are some attempts to predict the price of BTC in terms of upcoming US Fed decisions. In the past, BTC has also dropped ahead of each Federal Open Market Committee meeting, only to return to its rally afterward.

Rate hikes may not hurt BTC in the longer term, especially if its wider adoption continues.

BTC Scarcity Still at Work

The short-term price move does not detract from the well-known upcoming halving. BTC has already moved to make new all-time highs since its halving in 2020, though not touching six-digit levels.

With only 900 BTC produced a day and an outflow from exchanges, access to BTC will only become more difficult with time.

Bitcoin mining is also expanding to grab as many block rewards as possible, before daily production shrinks to just 450 BTC.

The Luna Foundation is also buying up BTC, with the latest data showing another $1.5B investment at the current lower prices.

Can BTC Dip Lower

Sudden BTC dips may attempt attacks at lower positions. There are some expectations for a crash to $35,000 before a new recovery. After the crash, BTC had trouble returning above $37,000, and traders may try to clear long positions at lower levels.

The expectation for the current downward move is to touch levels under $30,000 at the lowers. Overall, BTC is expected to skip 2022 in terms of large-scale rallies, or choose another quarter for expansion. Macro uncertainty keeps weighing on the leading coin, as well as the need to find alternative sources of liquidity.

The dip under $37,000 led to liquidations of $111.3M for BTC alone. More than $372M in liquidations happened across the market, for major coins and tokens.

BTC remains the dominant asset with a share of 41.7% of the entire market cap. With only around 42% of holders in the money, BTC is now fully bearish. The Crypto Fear and Greed Index sank again to 27 points, again signaling fear. But the recent slide may not reflect a capitulation, as both retail and corporate buying continue.

Altcoin markets remain shakier, and a prolonged sideways movement or a bear market can erase more significant value. With so many platforms depending on DeFi and circular fund flows of growing complexity, the crypto market has entered a new stage of potential deleveraging.

New Stablecoins Attempt to Preserve Market Gains

The supply of Tether (USDT) remained unchanged in the past 10 days, hovering above 83B tokens. At the same time, alternative algorithmic stablecoins and the well-used USDC token also work to provide liquidity in both niche and larger markets.

USDT returned as a top 3 token as Binance Coin (BNB) sank under $380 after the correction. The heightened activity and panicked buying and selling lifted USDC trading volumes above $80B in the past 24 hours, also making the token the most actively traded crypto coin.

USDD, the newly launched stablecoin by TRON (TRX) also made its debut, with a slight fluctuation between $0.97 and $1.03. In a single day, the supply of USDD rose from 2.7M to 8.3M tokens with a tendency to expand in the coming months.

USDD is also turning into a multi-chain asset, possibly flowing back into DeFi space.

USDD will connect TRON’s economy to the wider DeFi space, dominated by Terra (LUNA) and Solana (SOL). The arrival of USDD happened on a turbulent market day, with a challenge to avoid cascading losses during market volatility. After the correction, TRX also stepped back, to $0.075 from a peak at $0.085 the previous day, selling off after the news of the USDD launch.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What do members of the public think about Crypto in 2021/22? We survey some UK people and look at search data with some surprising results.

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.