Bitcoin (BTC) Sets Smaller Bull Traps, Longs Liquidated

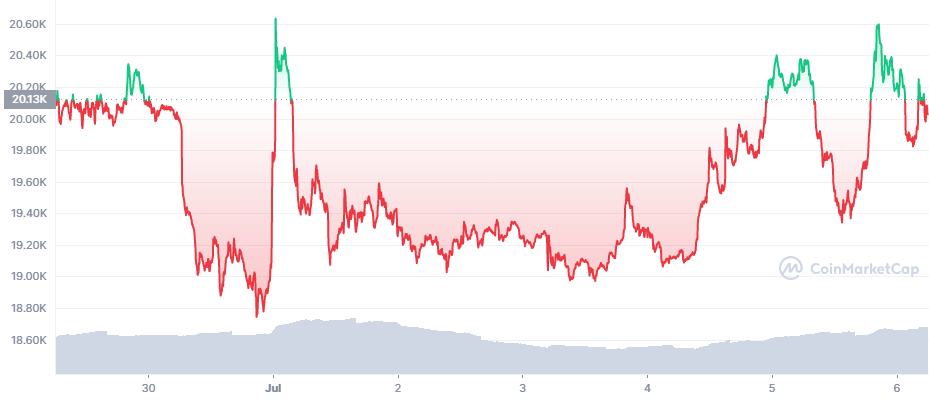

Bitcoin (BTC) hiked above $20,000 in the new week, but failed to hold onto those levels. For some traders taking up long positions, the recent slide still led to liquidations. BTC slid to $19,672.79 late on Tuesday, swinging back to $20,081.74 during European trading hours the next day. More than 50% of liquidations in 24 hours were of long positions, though the Binance exchange saw a predominance of short liquidations.

BTC now stands at a position that may allow for a lower dip, but also with strengthening expectations of returning to a more active price climb. One of the scenarios proposed is that BTC will move to the recovery stage soon and fast, leaving the bear market behind.

The most optimistic scenario leaves the prolonged slide where BTC may continue to move down for months and only recover around 2024 and the next block reward halving.

BTC Still Prepared for Bearish Dip

One of the worrying signals for BTC remains – the behavior of Celsius. The fund has made a series of deposits to secure one of the biggest loans on Maker DAO, going as far as to secure liquidations at BTC prices under $5,000.

While most long-term holders may not sell at those prices, there are still enough whales to sway the spot market and bring down BTC lower. This scenario is only hypothetical, but has been reflected in the behavior of large funds.

In an even more aggressive move, Celsius insured its loan against an even lower dip that looks highly improbable at current prices.

A dip to the lower price range may return BTC to previous bear markets, recalling the lows of 2018 and 2020.

Miners Return to Holding Coins

The behavior of miners may be returning to holding coins after what looked like a capitulation. During the recent selling event, some miners may have panic-sold at a loss, to cover costs.

Mining expanded for BTC during the bear market, meaning some of the new farms may have rushed to cover their investment. At current prices, mining BTC is much less profitable, especially for new operations buying rigs and setting up farms in the past few months. Miners have always sold, some choosing OTC markets instead of exchanges, but during the 2021 bull market it was much easier to offset costs and older miners ended up with record holdings.

Accumulation for Spot BTC Continues

Addresses with more than 1 BTC are growing to another peak, despite the slide in prices. It is possible even at a lower range, BTC may continue building up. At this price range, even riskier buying may be absorbed as BTC is still seen as a long-term asset with great potential.

Balance on exchanges also keeps falling, and while derivative trading is cautious, long-term accumulation shows a trend. Derivative trading remains riskier than a readiness to hold onto coins through fluctuating markets.

The buying of BTC also replaces interest in altcoins, tokens and NFT, especially after showing the risks. BTC maximalists in retail are also moving in the place of crypto enthusiasts, which supported lending schemes or other non-transparent growth hubs.

New buyers are also using self-custodial wallets, losing trust in services that have discontinued withdrawals with no warning.

BTC Keeps Consolidating on Low Volumes

The current market moves all happen on subdued trading volumes. Volumes only crept up to around $23B in 24 hours. USDT trading volumes increased slightly to around $42B in 24 hours.

With USDT diminishing, it is possible for BTC to extend the downward trend. For now, the price moves to between $16,000 and $12,000 have not materialized, with BTC bouncing off the $19,000 level.

BTC remains risky for leveraged trading, possibly liquidating attempts at shorting from these levels. A more rapid trend continuation may happen if BTC breaks below $19,100 and causes a series of liquidations. BTC has moved into a smaller range in the past few days, though showing there is still potential for $1,000 price moves in a short time span.

The market price has already absorbed the recent Fed price hike, and has not moved significantly on the news of the USD rally against the EUR. BTC market cap dominance recovers to 42.2%, with Ethereum dominance up to 15.1%. ETH remains above $1,101.40, still boosting DeFi value locked above $40B.

During the latest price slide, DeFi protocols managed to slide more gradually, without rapid liquidation crashes. This is due to more detailed protections for collaterals and improvements in smart contracts. DeFi continues to offer lending and liquidity, despite the diminished price levels. Exchanges like UniSwap continue trading and offer price discovery for smaller assets.

The markets remain in confusion and there are still no clear signs of a cycle bottom. But the sentiment is slightly improved, with the Crypto Fear and Greed Index rising to 16 points from a low on June 19 at around 6 points.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

What is bitcoin? Who controls it? Where can I buy it? Your questions answered!

A roundup of the main exchanges in Australia allow you to quickly buy Bitcoin and other crypto on your card

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.