Bitcoin (BTC): Who is Stockpiling Coins

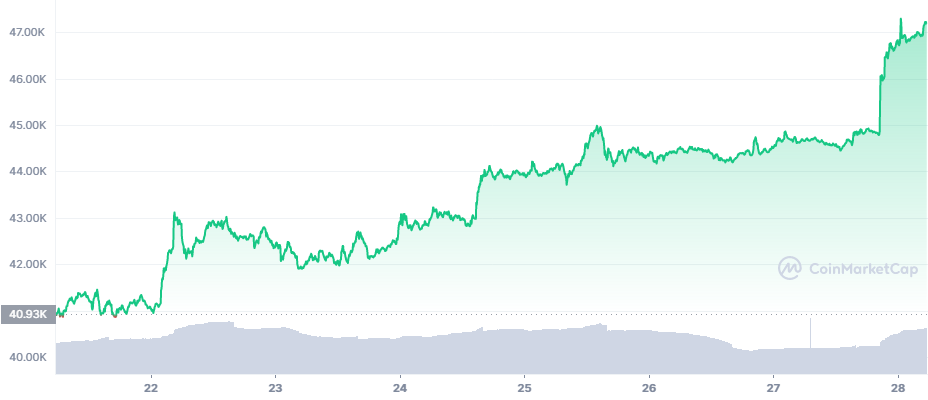

Bitcoin (BTC) rallied strongly on Monday, rising above $47,000. The leading coin established its positions above $44,000 with ease over the past few days, after a period of liquidating short positions. On Monday, BTC traded at $47,207.35.

But beyond the futures market, which sets price directions for BTC, there is another trend of buying up coins. The actual BTC held in cold wallets is presented as collateral. The most notable example is the Terra protocol (LUNA), which has an ambitious plan to hold $10B worth of BTC reserves.

With more large-scale owners keen on keeping their holdings, it may be harder for whales to sway the market, or cause fear by sending large transactions to exchanges.

Who Else is Stockpiling BTC

There are more signs of large-scale holdings being formed in the past few weeks, while BTC showed weakness under $35,000. One recent whale wallet started from zero and accrued nearly 25K BTC in the past two months.

Currently, there are also 274,330 wrapped Bitcoin (WBTC) spread between Ethereum, Fantom network and Polygon.

On March 25 and March 27, two new “whale” wallets were created, and filled in one big transaction. The 14th largest wallet contains 50,813 BTC, and the 15th is filled with 49,826 BTC as of March 27.

There is no record on the owners of those wallets. It is possible the new ones are a technical move of coins to a new address, if the old one would be compromised. The appearance of new anonymous whale wallets coincides with outflows from exchanges. Additionally, Glassnode shows a pickup of retail demand.

Coins acquired at higher prices are still closely held, with more buying in the past few weeks. At this point, price moves are partially futures-derived, but with influence from direct buying.

Will Holders Keep Buying

BTC is on track to reach its price from October 2021, putting some of the buyers in the green. For now, BTC lags under $45,900, awaiting the moves during the new week.

While the price hovers at a lower level, accumulation may continue. BTC active addresses and activity remain relatively stable, except for the recent signs of whale accumulation. Some of the buying can be directly attributed to Terra protocol, adding 1,500 BTC over the weekend.

So far, Tesla, Inc., Microstrategy and Terra are the biggest BTC owners. But almost all platforms are potential large-scale buyers of BTC. Cardano, Avalanche, Solana and other DeFi protocols could use BTC for more credibility and liquidity. The trend was set once actual physical BTC started to be used as long-term storage, especially after the latest halving.

BTC Deposited to Smart Contracts

The BTC used for collateral in algorithmic stablecoins will be locked in smart contracts. This is one possible risk for attacks, if the contracts are exploitable.

So far, algorithmic stablecoins mostly use the underlying assets of various networks, such as LUNA and soon, ADA.

However, the mining of 19M BTC out of 21M shows that the availability of coins will be limited. With less pressure to liquidate BTC and the availability of futures instruments, BTC may become too valuable to be moved for speculation, remaining locked with bigger buyers.

Can Algorithmic Stablecoins Displace Tether

One of the chief ideas is to diminish the need for Tether (USDT) and do away with the constant fears of insufficient collateral. However, it may be difficult to convince markets that a stablecoin backed by BTC can also be used to boost liquidity and trading for BTC.

Still, stablecoins at least will have fully transparent records of the underlying assets. This will also take BTC off the market for the longer term, while sending more value to altcoins and side projects. BTC on exchanges is also diminishing, with the potential stake of Terra possibly taking as much as 10% of the coins available on open markets. Terra may also choose OTC exchanges for the amount required.

The position of BTC is considered resilient, despite attempts to undermine the asset. So far, BTC will probably continue to be legally traded in the EU despite a recent proposal to ban proof-of-work coins.

Mining is also going strong, with only temporary selling in February.

Miners are also one of the most important holders, who own BTC with limited history. Some of the coins available have been blacklisted, and there is also talk of optional doxxing a person’s identity to be included in the transaction message. For now, only a limited amount of BTC is blacklisted.

Another significant BTC stash is the wallet holding more than 94K coins, which were seized recently and may be returned to the Bitfinex exchange.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Celebrities on social media can have huge followings creating enormous power to influence their followers. We look at who are the most influential and some of the potential risks of following their advice

The basics of cryptocurrency portfolios and how to get started in tracking your crypto holdings

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.