Crypto.Com (CRO), Altcoins Try to Repair Market Slide

Crypto.com (CRO), the asset behind one of the most popular crypto cards, has bought the naming rights to the Los Angeles Lakers Staples Center. The news, part of a broader campaign to increase the presence of Crypto.com for wider retail adoption. CRO turned into one of the altcoins that defied the trend, showing there is still some enthusiasm for fast gainers.

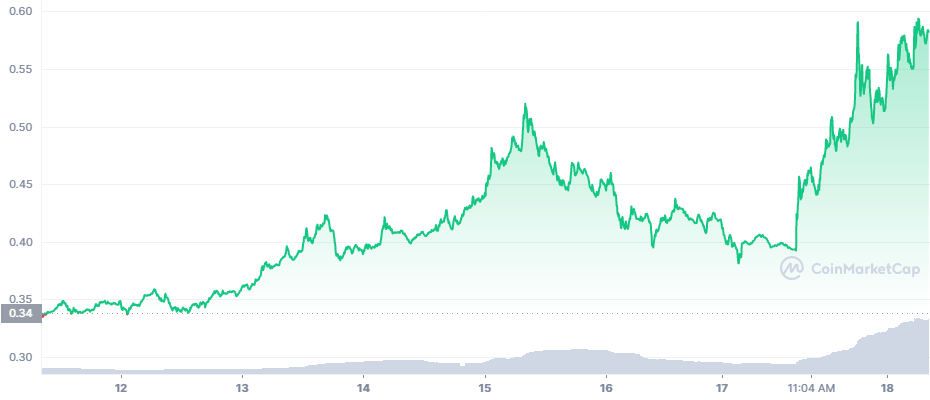

CRO rose to $0.59, repeating its all-time high several times in the past 24 hours. The asset is up more than 39% in the past day, despite the overall drop on cryptocurrency markets. CRO has extended its success run, and may be turning into a safe haven during the latest sell-off.

Despite the lack of a Binance trading pair, CRO has relied on its Coinbase liquidity. The CRO/USD pair is the third most active on the Binance exchange.

The rapid price rise of CRO, however, may be a curb on the project’s success. Issuing a Crypto.com card requires a certain amount of CRO to be staked, and the fee has grown steeper in the past weeks.

Are Altcoins Compensating the BTC Slide

Bitcoin (BTC) retreated below $60,000 after several dips since Monday. The leading coin moved around $59,891.46, attempting to regain its positions.

Several altcoins managed to move against the trend, after lagging the market for the past months. The Solana (SOL) rally slowed down, giving way to other assets.

Avalanche (AVAX) is once again one of the big movers, growing by more than 10% in the past day, to $105.67. AVAX moved to an all-time high at $110.03 as funds flowed into the project.

The growth of AVAX is not just market hype. Over the course of two weeks, the Avalanche protocol extended its total value locked from $8.4B to $11.1B equivalent. The protocol is still not listed among the most prominent DeFi pools of liquidity, but manages to build its user base over time with rapid growth in 2021.

Decentraland (MANA) Reaches New Peaks

MANA, the native token of the Decentraland platform, grew by more than 11% overnight, to trade above $3.60. The token broke its previous all-time high of $3.52, and heads into price discovery.

The MANA token trades far from its all-time high volume, but has preserved heightened activity compared to previous months.

MANA may ride the wave of newly created play to earn games, a new sector of blockchain use cases that combines gaming and decentralized finance. MANA is still out of the top 5 most traded tokens on the Binance exchange, but competes with The Sandbox (SAND), showing heightened interest in play to earn tokens. MANA is the second largest play to earn token in terms of market capitalization, only surpassed by Axie Infinity (AXS).

The collection of play to earn tokens is evaluated at around $30B in total market cap, still a growing industry that is building up its user base and liquidity.

BTC Keeps Ratio with Altcoins

The BTC, Ethereum (ETH) and altcoin dominance ratio has remained stable for the past few weeks. BTC kept up its dominance at 43.2%, with altcoins and ETH making up close to 40% of the capitalization.

The cryptocurrency market lost its momentum for the climb toward $3 trillion in notional market capitalization, stalling at around $2.8T. For now, meme coins have taken a step back, with ShibaInu (SHIB) down about 60% from its peak, and Dogecoin (DOGE) stalling at $0.23.

Will Liquidations Come into Play

The biggest factor for rapid BTC moves are liquidations. At the current levels, BTC managed to erase both long and short positions, despite the relatively low leverage.

BTC coins are being taken off exchanges for spot scarcity, but futures markets look set for a cascade of liquidations. The most probable scenario would be for BTC to break down below $59,000 and cause a liquidation cascade down to $55,000.

More than 73% of Binance futures market liquidations affected long positions. A more cautious trading sentiment sent the Bitcoin fear and greed index to 54 points, up two points in the past day.

However, the brighter scenario may see the leveraged positions shaken down in the coming days, returning to a new climbing trend.

BTC and the overall market will have to reveal if the overall bull market trend is intact, or there will need to be another buildup period of trading. In past years, the December rallies have only taken days or even hours, so the scenarios of BTC moving above $100,000 are not out of the question.

Leveraged trading, however, has a significant impact and creates new volatility based on greedy positions.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Eight ways to buy Bitcoin without needing ID or giving personal information

A review of the many options for crypto exchanges and what the main differences are

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.