Crypto Markets Take Downturn After Weekend Squeeze

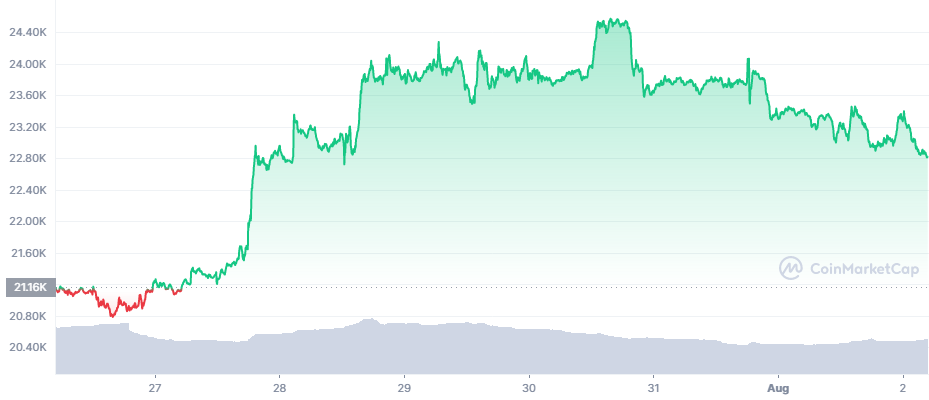

After a relatively strong performance in the beginning of the new week, Bitcoin (BTC) stalled and sank once again under $23,000. This downturn dragged down all assets, affecting more the coins and tokens that pumped in the past few days.

BTC slid to $22,815.06, extending the losses from the US trading hours on Monday, while Ethereum (ETH) lost the $1,600 tier and slid to $1,571.92. Despite starting out a new business week, trading volumes remained subdued and activity was limited. BTC traded at around $26B in 24 hours. The BTC dominance also fell to 41.2%, while trading is still happening in a mostly fearful sentiment. The Crypto Fear and Greed Index stalled at around 33 points, not breaking out to neutral.

ETH trading is also starting to become more appealing, with more open interest on derivatives. ETH is expected to move more actively leading up to the Beacon Chain merge and a shift to proof-of-stake.

ETH is also growing its market cap influence to 18.6%, while retaining above $40B locked in DeFi protocols.

BTC failed to hold above the 200-day MA, which coincides with valuations above $24,000. The recent hike to that price could not establish support.

The question for BTC remains whether the recent recovery is a bear market relief rally, or a sign of shifting expectations. The latest downturn caused relatively small liquidations, showing that long positions were still relatively limited. One scenario allowed for BTC to hike to $28,000 and for now, this is still not out of the question.

Glassnode data show BTC capitulation and selling have ended and BTC still traded above its realized price. ETH also took a breather after threatening to dip under $1,000. Despite the market stresses, the BTC price bounced almost perfectly from the lower bound of the Rainbow Chart, failing the scenarios of a continued dip under $20,000.

BTC was also saved by what looked like deliberate whale buying on the Binance exchange, giving hopes that the price may dip but not extend its freefall endlessly. Still, BTC remains in a bear market and there are predictions for more downturns by the year-end.

Celsius (CEL) Short Squeeze Slows Down

The drive to cause a more significant Celsius short squeeze for the CEL token also stalled. CEL remains at $1.19, though calls to continue the short squeeze may be renewed. The general idea is to buy up and hold CEL off exchanges, creating artificial scarcity for holders of short positions.

There is also a conflict between taking profit and holding CEL without selling to achieve even more dramatic price action.

So far, CEL remains listed on most exchanges, though missing from the Binance exchange. The chief concentration of buying is on the FTX exchange.

Hot Coins and Tokens Shed Gains

The most active climbers from the past few days were also the greatest losers. The correction started with Ethereum Classic (ETC), sliding to the $33 range after peaking above $43. ETC performed one of its usual peaks followed by a drop and still has time until September 19 to see if it will get a boost from former Ethereum miners.

Currently, the ETC hash rate is at 30 TH/s, which is an all-time high. The pickup started after June 29, with the expectation of moving ETH to proof-of-stake.

Other former top coins included Filecoin (FIL), which erased more than 13% in a day to $8.54. FIL fell from a recent peak above $11.23, sparked by a series of new upgrades on the project and social media hype.

Internet Computer (ICP) also fell to $8.15 after peaking above $10. The news of adding BTC-derived smart contracts and products had a limited effect on the ICP price, causing only a short-term pump.

Polkadot (DOT) and Uniswap (UNI) also fell from their local highs from last weekend, erasing around 10% in a day.

USDT Supply Inches Up

The supply of USDT is now above 66.19B tokens, up from around 65.8B tokens in the past few weeks. For now, this inflow of new USDT is relatively small to generate a more significant market shift.

USDD, the TRON-derived stablecoin, is also growing carefully, with around 725M tokens minted. USDD does not have the rapid and aggressive growth of Terra’s UST, and for now, has a limited function. TRX is also a relatively conservative asset, standing at $0.071 with minor fluctuation in its trading range.

The crypto market is entering a period of fewer significant macro pressures, as most of the stresses have played out their narratives in terms of price action.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

From Airdrop to Wallet we look at all the crypto jargon and what it really means

Celebrities on social media can have huge followings creating enormous power to influence their followers. We look at who are the most influential and some of the potential risks of following their advice

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.