Did Bitcoin (BTC) Reverse the Trend

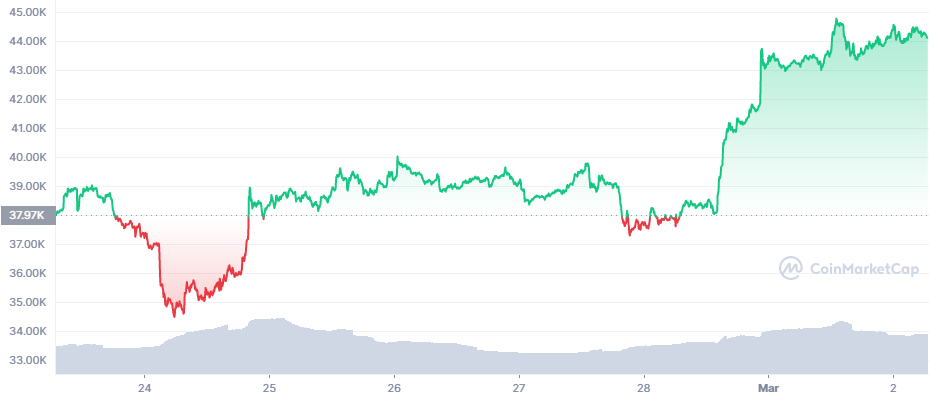

Bitcoin (BTC) moved above $44,000 in an extended mid-week rally, while showing signs of accumulation. However, there is no clear answer whether the latest price action has reversed the downward trend of the past few months.

Glassnode data show the latest dip led to buying, with a lot of new investments in the money.

Despite this, BTC sentiment is still neutral at best, with the potential to quickly switch directions. BTC has proven to resist a deeper price drop, so far coinciding with buying readiness. The leading coin is still below its recet stability level around $46,000, but has shown that turbulent news often translates to price growth.

With the latest rapid daily appreciation, BTC has already completed two cycles of bouncing from lows, while never dipping to the predicted lows of $29,000. This time, it is still possible to have another downward leg, but with the potential for reversal. BTC is still not completely confident of reversing the downward trend, at least based on short-term signs.

During the latest rally, BTC managed to get ahead of the growth of both stock markets and gold. Even with more conservative leverage, BTC is getting buying support and accumulation. Based on the Rainbow chart, BTC is nowhere near bubble territory, though not a clear indicator to buy.

Is BTC Returning to Volatility

For BTC, price moves like the last day are not that unusual. Volatility has returned proportional to the new higher prices, and the latest rapid appreciation is not unique.

BTC may once again follow the logic of attacking leveraged positions, with longs getting vulnerable with the recent price exuberance.

BTC has returned some of its volumes, to above $36B in the past 24 hours, up from recent lows of around $16B on weekends. BTC this time is also the bigger mover, rising to a dominance of 43.1%. For now, Ethereum (ETH) is lagging with prices just under $3,000.

Only Top Altcoins React to Growth

Small-scale altcoins are hardly making moves during the past BTC rally. Some assets remain relatively stagnant, while others stage a fast recovery. The upward trek of LUNA, SOL and AVAX continued, with all assets looking ready to get closer to $100 or move to three-digit prices.

At the same time, older booming assets like XRP or Cardano (ADA) remain little changed. XRP moved up to $0.78, while ADA hovered at $0.96. Most altcoins limited their daily gains between 5 and 10%.

NEAR Protocol Breaks Out

Near Protocol was the one outlier to break out with more than 24% in daily gains. NEAR stood at $11.49, a significant move for the past week, though still not above the monthly high.

Near Protocol carries Terra USD (UST) and thus holds significant value. The protocol is also used to take out loans against BTC, a form of selling option without incurring a taxable event.

Near Protocol still reports only about $148M in total value locked, with more than 69% of the value held in Ref Finance. NEAR joined a list of outlier coins having short-term pumps.

The DeFi hub also recently started launching NFT collections, adding to demand for alternative blockchains.

Binance, Kraken Warn Against Banning Accounts

The Binance International exchange and Kraken have stated they will not limit any accounts based on pressure from the Ukraine-Russia conflict. In the past, Binance has closed its services for mainland China traders, but only after a local law was passed to ban cryptocurrency trading.

Currently, there have been no official calls to exchanges to limit, track or delete accounts. Binance International remains available for deposits and withdrawals in crypto assets, though with some potential limitations when it comes to banking transfers.

Overall, no attempts to censor the usage of BTC have succeeded, though blockchain tracking continues to get more detailed. BTC and crypto assets remain a tool for censorship-free transfer of value even in cases of banking limitations.

What is the Next Step for BTC

One of the intermediate steps for a renewed bull market is for BTC to recover above $46,000. At the current level, BTC is consolidating, but with not enough drive to regain a higher range.

Signals can be highly misleading for BTC and unexpected events are not out of the question. Despite this, BTC can also gain momentum fast.

Despite the trend to hold onto coins, it is still possible for whale transactions to appear suddenly on exchanges. Selling at the top is not ruled out completely, despite a growth of small-scale retail wallets holding more than 1 BTC as an investment.

Large transactions are still happening, and BTC remains capable of moving significant value, after recently carrying more than $9B in settled value in a single block.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

We look at where to buy and how to buy including limits, fees, security, and verification

We are now paying prizes in Iota. Learn a bit about it and where you can buy, sell and store it

An early alternative to Bitcoin, LTC aimed to be a coin for easy, fast, low-fee spending. LTC offers a faster block time and a higher transaction capacity in comparison to Bitcoin.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.