How FEI Failed to Become a $1 Stablecoin

#

The FEI project took just a few days to become the prime example of why a fully algorithmic coin with a stable $1 price is very hard to create. In the past, projects have attempted various schemes to generate dollar-pegged stablecoins that can create liquidity on demand, while remaining predictable.

In the days since its launch, the FEI project caused significant losses to investors. As of April 7, the team also reported an unspecified bug which may further affect the project’s performance.

The task of creating an asset out of thin air proved too difficult for FEI, at least in the current DeFi climate.

The failure of FEI recalls the older attempt to create a fully algorithmic stablecoin called BASIS. The BASIS project launched during the ICO boom and raised $300 million in a token sale, only to later return the funds to its investors.

The FEI Launch

FEI launched at a time when algorithmic stablecoins were once again proposed as a solution for liquidity generation. Despite the existence of many well-established and liquid dollar-pegged coins, the FEI project wanted to depend entirely on the Uniswap liquidity and nudge its asset toward a stable $1 price.

The FEI launch involved a double-token mechanism, where early buyers would also get access to a TRIBE token as an airdrop. There was also the option to swap FEI for TRIBE early, to make use of the new token’s potential gains.

Unfortunately, most investors went into the FEI project for the opportunity to quickly flip TRIBE and possibly make some fast gains. This unexpected inflow of retail buyers aping into the protocol disrupted the FEI dollar peg, while the TRIBE token was sold off for the more valuable Ethereum (ETH).

What FEI Means for DeFi

The failure of FEI is not necessarily a catastrophe. Still, it raises awareness of the riskiness of DeFi projects, and the tendency to attract unaware users that risk all for high returns.

Still, there may be value in the idea of algorithmic stablecoins, which explore new possibilities to unlock the value of ETH through algorithmic trading.

Using FEI may be highly counter-intuitive, as buying the asset is much easier, but selling brings a heavy fee. If a user wants to turn to dollar-like positions, they may lose nearly 30% of their value, because the algorithm will punish attempts to liquidate. Thus, FEI may not be a reliable tool to store value, and actually fluctuate more in comparison to other crypto assets.

There is uncertainty on where FEI may turn in the longer term. In the past, coins like DAI have lost their dollar peg for brief periods, and later found their equilibrium.

It is possible that the FEI price pressure came from the retail buyers that only wanted the TRIBE airdrop and the TRIBE tokens, and with time, the stablecoin will move closer to $1 and balance buying and selling. But for now, the new Uniswap assets remain highly risky.

DeFi Remains Risky

The DeFi market is growing, but still capable of significant price swings. Late on April 7, crypto spot prices dropped briefly, affecting all protocols. The value locked in DeFi dipped to a fraction of its previous high, then recovered.

Currently, DeFi protocols hold more than $51B in liquidity. The FEI protocol alone managed to attract one of the biggest buy-ins in the sector, to the tune of $1.2B. The fundraiser exceeded even some of the largest ICOs during the token sale stage.

The FEI-TRIBE liquidity pair on Uniswap currently carries a bit more than $564M. The FEI valuation is at $1.6B, with the asset inching up to $0.78.

But at this point, crypto users are realizing getting into FEI means owning an asset with an extreme pressure to hold and not sell, thus in effect socializing losses to all token holders.

It remains to be seen if this incentive to hold solves the problem of crypto central banking and algorithmic stablecoins, or it just penalizes traders.

FEI Continues to Cause Losses

FEI has added to the ETH locked in DeFi projects. Currently, around 10% of all ETH is tied up in decentralized protocols.

As of April 8, around 6,000 wallets hold FEI, with an unknown exact number of users. There are doubts the stablecoin can ever reach the $1 zone and is in fact a tool to extract value.

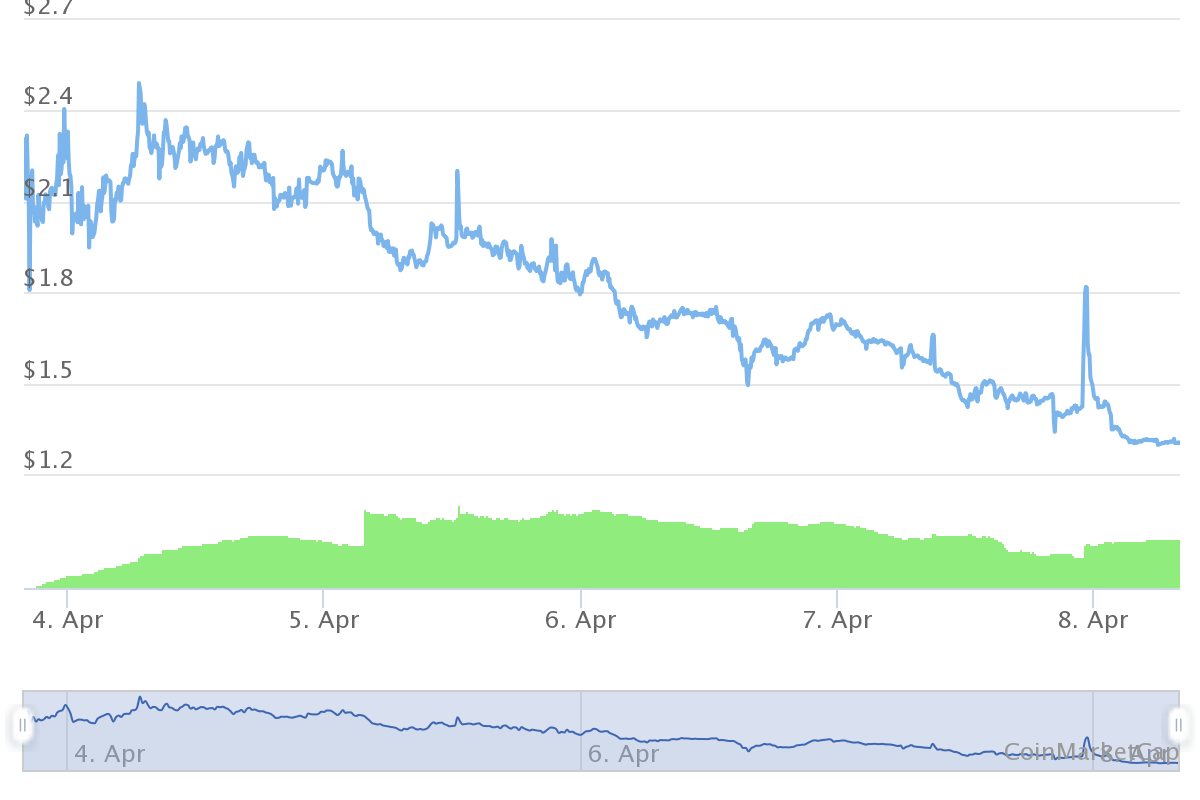

The TRIBE token will also remain highly volatile, as it continuously crashes from a peak of $2.75 down to $1.30 and a downward trend. The early buyers of TRIBE ended up losing a part of their investment, with an unknown way to compensate.

Since there are no barriers to entry in DeFi space, it is possible that other projects attempt to build an algorithmic stablecoin. However, the example of FEI shows deep losses are possible, and those projects may not be the best for an impulsive buy.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Who are the biggest influencers in the NFT space across the various social media platforms.

We are now paying prizes in Iota. Learn a bit about it and where you can buy, sell and store it

The leader in programmable money, smart contracts and decentralised applications. There have been many copycats but none have the community and level of adoption.

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.