S2F Model Envisions Bitcoin (BTC) Pathway to $1M

#

The direction of the Bitcoin (BTC) market price seems highly unpredictable, especially in the short term. In hindsight, BTC has tended upward, breaking its own records on a regular basis.

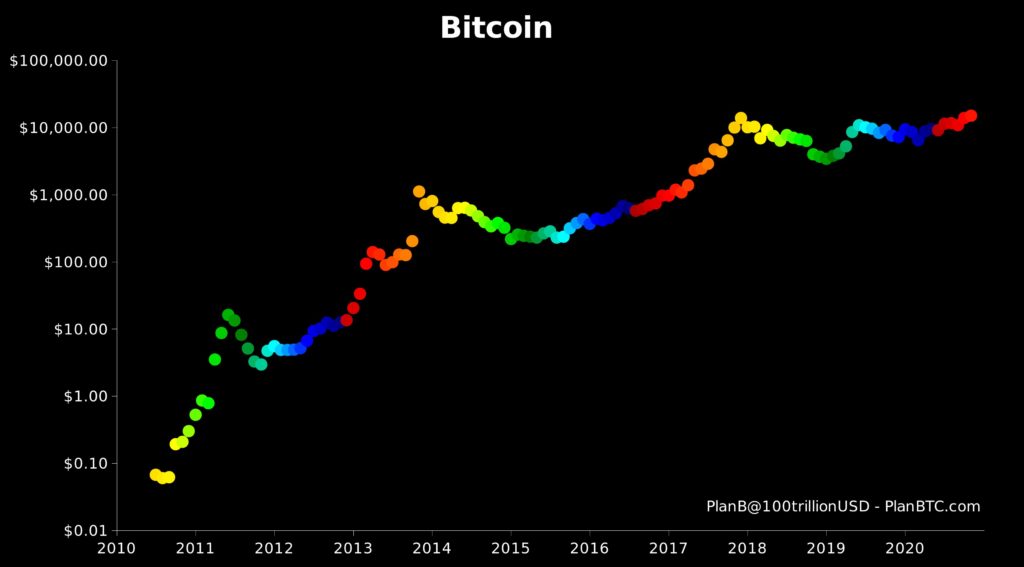

After 12 years of BTC history, crypto influencer PlanB built up a track record of predictions using a pattern that could be applied both retrospectively, and to predict the coming market prices.

In 2021, the stock-to-flow model got its vindication. Instead of simply a retrofitting model, the S2F chart came to be viewed as predicting the future moves of BTC.

In 2021, the BTC market capitalization fulfilled the S2F prediction for total growth. BTC expanded to a total market capitalization above $1 trillion, growing more than 10 times since the market lows in March 2020.

S2F relies on the fact that BTC supply is limited, and growing more scarce with time. There are about three million more BTC to mine, and after the last coin drops, the supply will remain fixed at 21M coins. Of those coins, about 3 to 3.5M are considered lost forever. A significant amount is held in cold storage and possibly won’t enter circulation or be sold for quick gains. Even more coins may stay locked on exchange wallets, leaving very few BTC for other purposes.

Then, there is the issue of a coin’s history. It is difficult, though possible, to track BTC to previous illegal activity or suspected money-laundering. This makes newly mined, never-moved BTC extra value. Relatively long-term BTC holdings with a short transaction history may also spark more enthusiasm when it comes to adding the asset in a balance sheet.

Halvings Work like Rocket Boosters for BTC Price

Halvings are an event happening every four years, which cuts the reward to miners by 50%. Initially, with low mining interest, the halvings seemed to have a minor effect.

But in 2020, when each block produced just 6.25 BTC, the scarcity of the asset started to really attract attention. Now that BTC had established itself as a widely tradable asset, potential buyers realized there may be too few BTC chasing too much money.

BTC is still mostly traded against other cryptos, with the key one being USDT, a dollar-pegged coin that carries up to 50% of the entire volume. But buying also appears from cash markets, with a boost from OTC deals.

The increasing demand for BTC, coupled with more large-scale owners promising to hold long-term is also adding to the bullish case for scarcity. One criticism against the S2F model suggests that it does not account for such periods of increased demand, which boost the short-term scarcity even beyond the limitations of miners creating fewer new coins.

Can Corrections Still Happen?

The S2F model looks correct over the long to medium term. At this pace, the prediction for BTC is to reach the $1M level around 2026.

In the short term, the price of BTC may get ahead of the plotted prediction, then crash. But as of 2021, the S2F model suggest BTC is in its bullish phase, which may continue for another year based on past experience.

Deviations Signal Peaks and Market Bottoms

What S2F will not predict is the exact peak of the bullish phase. The next halving, coming in 2024, will also mean an even greater cut to new BTC produced every day, with the potential to trigger even more demand for a scarce asset.

Analysts have also looked at the deviations where the short-term BTC price has deviated from the central trend of the S2F model. In the past, when BTC deviated above the trendline, this was a market top signal. Deviations below the line signalled the bottom of the market arriving soon.

At the end of February 2021, BTC closed above the predicted trendline, sparking extreme enthusiasm for fast price growth. However, there were also expectations for a drop back to $38,000.

The BTC fear and greed index has calmed down with an indicator of 68, down from 83 in the past month.

As of March 10, BTC is back above $53,000 again, with expectations of attempting to break the $60,000 level in its upcoming moves. However, analysts are also wary of potentially calling in a price peak based on the current price indicators.

Some predictions envision a new local top above $70,000, still in excess of the price suggested by the model.

In the short term, the potential for risk and corrections has emboldened short sellers, betting on the price stopping its meteoric rise. Intraday price action is also a possibility, moving the price by thousands of dollars. The model also allows for protracted bear markets and a slide below the trendline, despite predicting an overall appreciation over the years.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Is mining crypto still profitable? With more cryptos like Ether switching to POS is the competition going to get too much?

Crypto investment remains unpredictable and risky, but good practices can save you from many of the potential pitfalls.

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.