Top Cryptos Consolidate While A Few Altcoins Saw Huge Growth

##

The bull-run on the cryptocurrency market is still intact after the first quarter of 2021. However, the situation is a bit different to what it was a couple of months ago. The top two cryptos – Bitcoin and Ethereum, are currently experiencing a side-ways market while a few altcoins ride the current bull market this week. Let’s get into details.

Bitcoin (BTC/USD)

After making a brand new all-time high value ($61,736), the BTC/USD asset class price has been moving in a range. As you can see in the above image, the price action of this crypto got consolidated, with buyers and sellers showing equal strength. The weekly and daily support zones for Bitcoin are at $50,930 and $55,230, respectively. At the time of writing, the price of Bitcoin was around $57,430 and is about to reach its 4-hour support zone at $57k level.

Bitcoin’s price action failed to make a higher high or higher low since the past few days and was unsuccessful in staying above the $59k level. The is a decent seller momentum on the 4-hour timeframe, and the price could continue its bull run and possibly make a new higher high after taking support from the $57k level. Two primary resistance levels for BTC are currently at $58,500 and $59,700, except for the obvious resistance at its current all-time high value.

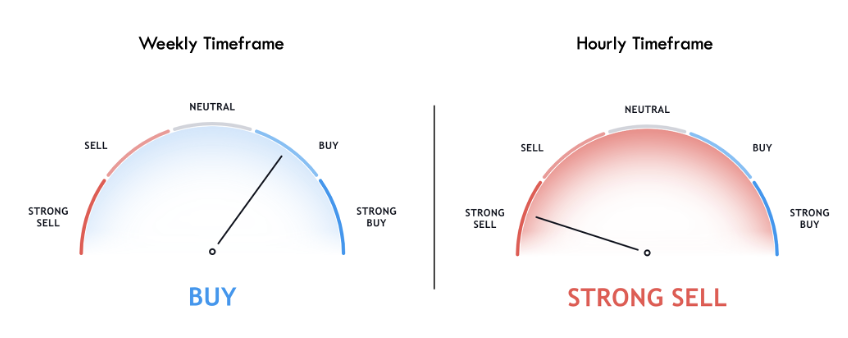

As you can see above, the bullish trend is still very much valid on the weekly timeframe. However, the current market sentiment on the hourly timeframe is heavily bearish. Therefore, if you are willing to day-trade the BTC/USD pair, please keep a note of this. If you are an investor, holding BTC is a great idea based on the industrial adoption this crypto is going through.

Ethereum (ETH/USD)

A couple of days ago, Ethereum (ETH/USD) broke its previous all-time high value and made a brand new one at around $2,200. Ever since then, the price action started to move in a range that is holding above the $2,080 mark.

The support levels for Ethereum are at $1,802 and $1,572 on the daily and weekly timeframes, respectively. The resistances zones are at $2,120 and its current all-time high value. The price to break its current ATH, it should clear the daily resistance zone at $2,120. At the time of writing, the ETH/USD pair’s price is $2,017 and is showing a bearish momentum on the 4-hour timeframe. The price could fall to $2,080 or $2,050 levels in case of strong seller momentum. Just as we saw in Bitcoin, there is a strong sell sentiment for ETH/USD pair on the lower timeframes and an intact buy sentiment on the higher timeframes.

Other significant coins in the ‘Top-10 crypto list’ that surged

Top cryptos after Bitcoin and Ethereum in terms of market capitalization have seen pretty decent growth in the past week. Let’s see how they have performed and where they could head shortly.

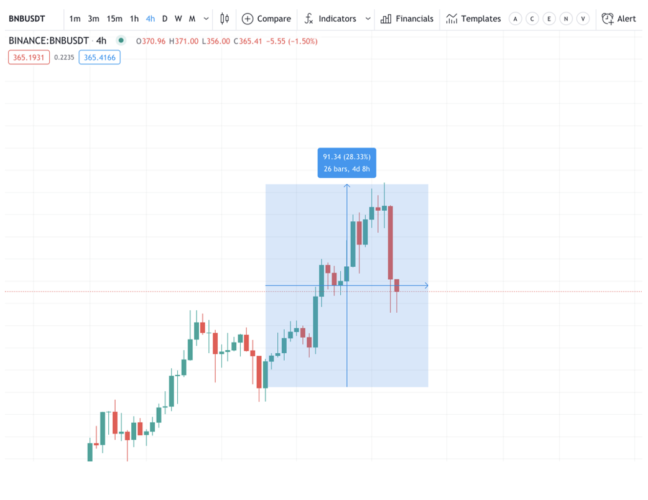

Binance Coin

BNB/USD has made a brand new ATH value and recently broke the $400 level. Currently, this crypto is experiencing a pullback, and the price could take backing from the nearest support at the $350 zone.

Experts believe that the bullish run of this crypto is not done yet, and it has the potential to reach the $500 level very soon. The potential resistance levels for this crypto before it reaches the $500 mark could be at $422 and $450.

Another notable price action in the top-10 crypto-list could be seen in the Ripple (XRP/USD) pair. As we have mentioned in one of our recent articles, the Ripples’ value surged by over 100% to reach the $1 mark. The price action of ripple crossed the $1.10 mark as well before sellers took over yesterday. There is clear indecision in the market about the direction of this crypto’s price and many mixed opinions as well.

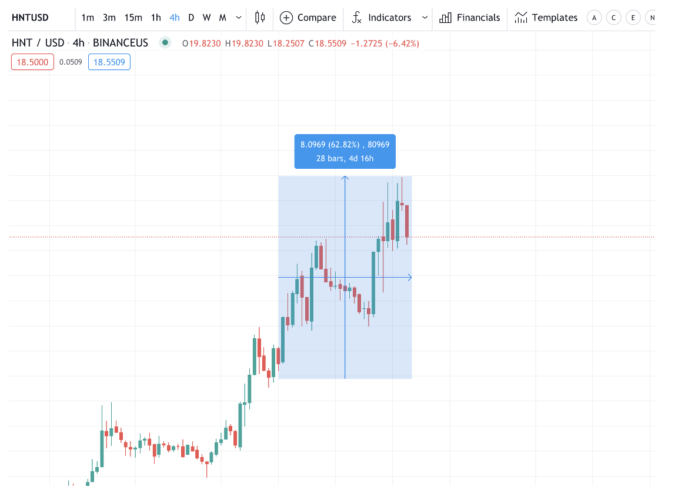

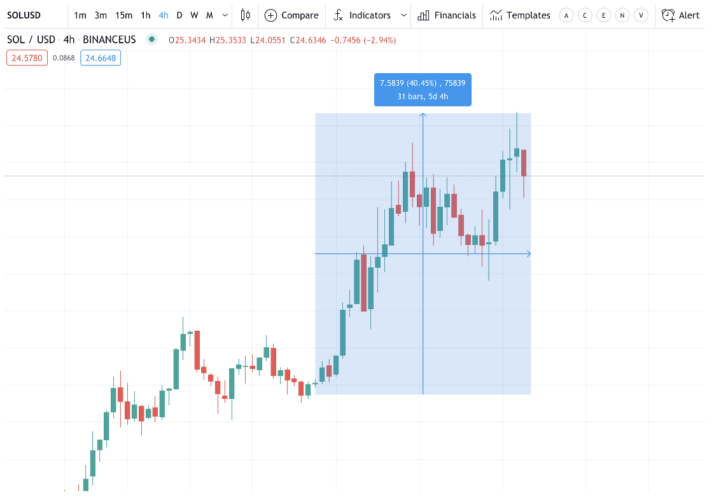

Altcoins that saw maximum growth in the past few days

Below are some of the altcoins that have seen maximum growth since the past week along with their price charts.

Many other altcoins have seen over 50% growth in the second half of April’s first week. Apart from many other fundamental factors, the consolidation of prices on the top two cryptos in the industry could be one factor. All of the above mentioned high potential altcoins could be bought on our reliable exchange list.

In a recent interview, the CTO of one of the most popular exchanges – Bitfinex said there would be a huge surge of interest around other alternative assets than just the top cryptos in this bull market. He mentioned that the surge would continue to rise as these altcoins become more market-ready in the future.

Momentum and interest have begun to expand beyond Bitcoin and Ethereum

Paolo Ardoino – CTO, Bitfinex.

We hope you find this article useful and informative. If you want to see any detailed technical analysis of the altcoins mentioned above, please let us know in the comments below. Cheers!

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

In Part 3 we look at more advanced trading strategies including flags, false breakouts and the rejection strategy

The basics of cryptocurrency portfolios and how to get started in tracking your crypto holdings

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.