Where is Bitcoin (BTC) Possibly Heading to?

##

Over a month and a half has passed by, and still, there is no clear direction in Bitcoin cryptocurrency. The views from analysts have divided into two based on their anticipation. As some believe the markets are recovering and should soon transit into an uptrend, the rest asset that the sellers are still clearly maintaining grounds.

Technically speaking, the drop in May is not a move that can be ignored. It would, of course, make sense to let go off the piece if the price had recovered instantly after the plunge. But the price holding below recent Support and Resistance levels are enough signs to confirm that the bears are overruling the bulls now. However, on a bigger picture, the market hovering around the demand zones indicates that the buyers have not thrown in the towel yet, leaving hope to investors.

Though altcoins are always in the news with respect to technological developments, Bitcoin doesn’t fade despite no drastic changes as the name always shows up regarding regulations and environmental concerns. In fact, the May drop can be accounted for the lack of acceptance of Bitcoin in countries and companies, as the technicals clearly did not show any signs of the buyers slowing down.

China Crackdown – A Decentralization Problem

The large-scale mining infrastructure in China that Bitcoin depended on has been put down by recent China’s mining crackdown. As mentioned, China, in May, announced that it would be making crypto mining and trading challenging for miners and investors, considering the financial risk it possesses. Although such announcements have been made in the past and the markets have recovered within a month, history seems to have not repeated with the recent iteration.

China indeed plays a massive role with respect to price fluctuations as 65% of the total hash rate come from this country. As a result, the crackdown has brought major turmoil in the Bitcoin (BTC) market lately. And Bitcoin’s global hash rate has dropped to a half year as more and more provinces are commanding to shut the crypto mining rigs.

When we talk about decentralized infrastructure, hardware has usually been a vulnerable aspect. The blockchain networks that run on the Proof-of-Work (PoW) consensus algorithm, Bitcoin, for example, the agreement of transactions, are based on a distributed network of nodes (computers).

Such type of a network is vulnerable to structural exploitations, which includes the concentration of hardware mining in industrial firms in a certain geographical area like China, leading to cryptocurrency “premining” with upgraded software that is unavailable in the market yet.

Thus, having a majority of the global hash rate from one region, reliant on close to unaffordable hardware setups, is antithetical to Bitcoin’s decentralized structure outlined by the creator Satoshi Nakamoto.

In the current scenario, hardware is a major problem for decentralized networks, especially the ones running on the PoW consensus algorithm. And the requirement of large-scale infrastructure has left the policies and politics of countries in a vulnerable spot.

Musk’s Influence Stands Successful

The company owner of Tesla, Elon Musk, is continuing to influence the cryptocurrency ecosystem, and in turn, the netizens as well. A recent survey by Investing.com has captured the popularity of Musk’s opinion among the public. And as per the survey, almost 50% of the total 1,100 respondents in the research said that Bitcoin token is environmentally unfriendly, in line with what Musk agrees upon. Following the criticism of BTC cryptocurrency by Elon Musk, a quarter of investors confirmed they sold their positions on Bitcoin in the past month.

Senator Cynthia Lummis sees Bitcoin as her Retirement Game

US Senator Cynthia Lummis, on the other hand, has quite a different perspective on Bitcoin. She considers cryptocurrency as a tool to diversify one’s investment portfolio for retirement and long-term savings. She is doing the same and wants Americans also to do the same.

In an interview with CNBC, Lummis encouraged investors to hold and buy crypto in order to save and secure their future.

“I worry about having all of our retirement monies denominated in U.S. dollars. As part of diversification, having a very diverse asset allocation, you don’t have all your eggs in one basket,” she said.

Is Bitcoin preparing for a fresh push?

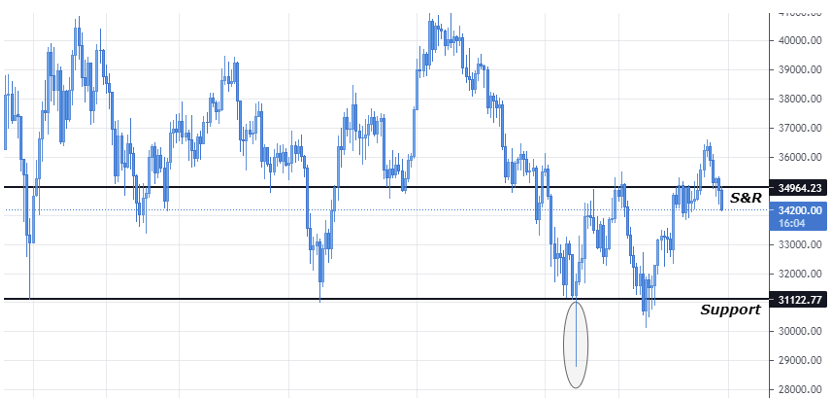

Recently, it was observed that Bitcoin that was ranging and forming a wedge between the levels $35,000 and $40,000 broke south and began to consolidate with $30,000 as Support.

There was a couple of quick reaction coming from the Support in the past, but none of them essentially achieved anything. As a result, the market dipped below the same Support but ended up being a tail in the bottom.

Presently, the market seems to be challenging the newly formed Support and Resistance (S&R), with a strong drop from $36,000.

The current price is at an extremely crucial point, as hold above or below the S&R can be a make or break for BTC.

Now get you can buy Bitcoin and several altcoins in just a few clicks from our list of reputed crypto exchanges.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Part 2 covers intermediate trading strategies including Bollinger bands, the TRIX indicator and pattern trying

Is mining crypto still profitable? With more cryptos like Ether switching to POS is the competition going to get too much?

IOTA is a feeless crypto using a DAG rather than a blockchain. It aims to be the currency of the Internet of things and a machine economy.

This is a specific digital coin running on a series of servers. XRP promises utility in handling cross-border transactions to compete with the SWIFT interbank payment system. Being controlled by banks, many question if it is a true cryptocurrency.