Will Bitcoin (BTC) Under $34,000 Destablize DeFi

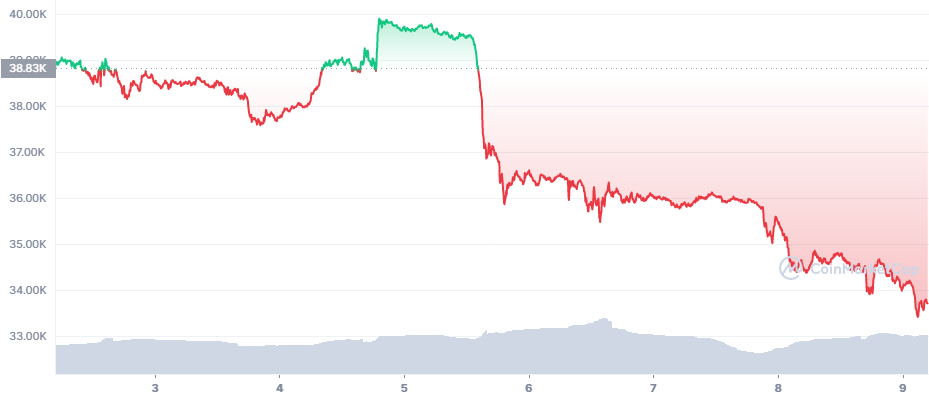

Bitcoin (BTC) sank further, spending most of the weekend under $35,000 and turning the trading sentiment to “extreme fear” once again. BTC extended the drop from a previous slide under $37,000, and followed the deep crash in tech stocks. The new, lower range raises a few questions and alternative scenarios. The new week started to extend the losses, keeping BTC under $34,000.

On Coinbase, late on Sunday BTC traded at $33,829.35, and at $33,833.34 in the BTC/USDT pair on the Binance exchange. BTC trading volumes were relatively high for weekends, above $37B in the past 24 hours. The USDT premium for BTC is almost negligible, though BTC still traded above $35,000 on the South Korean exchange, BitHumb.

BTC already had five consecutive weeks of losses, after wrapping up April in the red. Now, the question is whether a recovery is coming, or a new dip to a lower range. The most extreme predictions for BTC are for a dip under $20,000, though that may take time and extend until Q3.

In the short term, BTC may have a support above $30,000, still allowing for a short-term dip to $32,000. BTC may continue with accumulatio, though the recent slide is testing the decision of big-time buyers to hold onto the coins. At this point, some of the large-scale buyers may be out of the money, or close to it.

Will BTC Affect the DeFi Market

The most recent market slide brought Ethereum (ETH) to $2,500, bringing down the total value locked in ETH-based projects to $71B.

The DeFi market, however, goes beyond Ethereum and hinges on Terra (LUNA) and the UST stablecoins. The UST asset has already spilled over several DeFi protocols. It has been joined by other attempts to create new algorithmic stablecoins, including a multi-asset-backed USDD on the TRON network, launched on May 5.

All those stablecoins are at risk for losing their stability, with repercussions across the whole DeFi market. Terra itself has used its UST stash to buy actual BTC and keep it in storage, though the value of its stash is now uncertain.

A further dip in BTC prices would drag down LUNA as well, with the asset already at $64.55 from a recent peak near $100. When LUNA loses value, the backing of the UST asset is in question.

UST, like other stablecoins, fluctuates by a few cents and managed to hold onto its peg. Even USDT sank to $0.99 while BTC continued to slide closer to $34,000.

The Terra DeFi setup is still at risk for instability in case of a deeper market crash. This time, LUNA is not rising opposite the market.

Will BTC Face Another Capitulation Event

BTC has been sliding gradually in the past months. Year-on-year, BTC is down from one of the earlier peaks above $58,000. Now, there are some signs BTC may have a capitulation-style event.

DeriBit exchange orders suggest the potential for a deeper crash. Additionally, after months of exchange outflows, there are now significant BTC deposits to exchanges.

A capitulation event would wipe out leveraged positions much faster, especially attacking some of the longs around $34,000. This event could speed up the bear market scenario, though not close to the earlier expectations of a dip as low as $15,000 per BTC.

While holding behavior was strong only a few weeks back, in May, there were signs of capitulation after record long-term holding. The pace of selling was gradual, but may accelerate at any time.

At the same time, BTC has entered a zone of accumulation based on the Rainbow Chart, and the dip may fund support. For now, the chief predictions for BTC are for a relatively volatile year in 2022, with possible yearly lows, followed by another attempt at a bull market as far into the future as 2024. BTC has already moved through two years following the last halving, with record mining and no pressure to sell the new coins immediately.

Will BTC Have Another Rally

At this point, the panic on the markets may hold sway for days or weeks. But there are also attempts to predict the next shift in direction. For some, the recent slide precedes a potential rally, to repeat the price movements since the start of 2022.

The expectation for a return to a higher range, potentially by mid-May, hinges on a recent growth of long positions.

In the short term, BTC may continue to trade within a range, fueling bets on either side while escaping the scenario of a rapid downward spiral. The recent dip also caused a return to long positions, with the attempt to catch the price reversal if it happens soon.

Uphold makes buying crypto with popular currencies like USD, EUR and GBP very simple with its convenient options to swap between crypto, fiat, equities, and precious metals.

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Based in Charleston, South Carolina. Serves over 184 countries and has done over $4 billion in transactions. Offers convenient options to swap between crypto, fiat, equities, and precious metals.

We explain the safest and easiest way to buy Bitcoin and other crypto using your credit or debit card.

Will decentralised finance revolutionise the financial world or is a a lot of hype. Should you get invoved?

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.