Will Ethereum (ETH) Break $3,000 Soon?

##

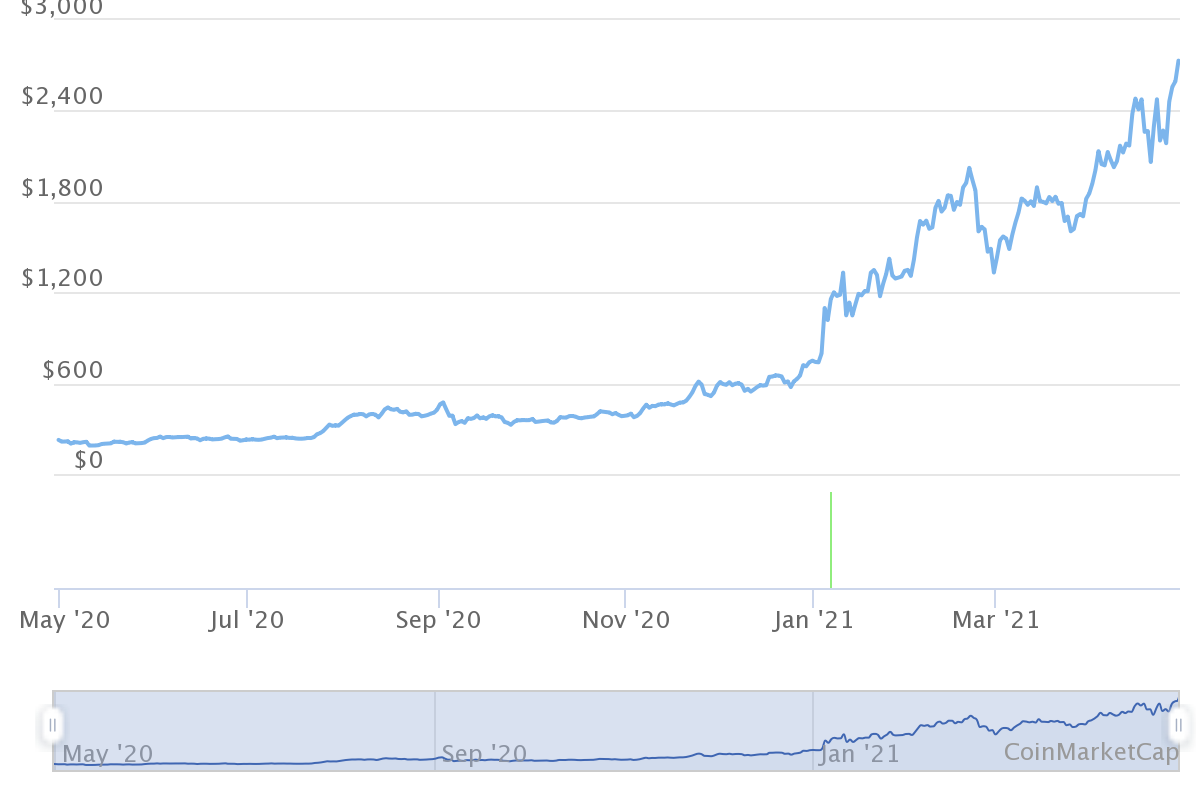

Ethereum (ETH) looks close to another edge upward, after breaking out from stagnant positions against Bitcoin (BTC). The price of ETH also set records in dollar terms, climbing to a daily high of 2,757.48 on April 28. The price remained well above the $2,700 range on Thursday, with the rest of the market in the green, sparking hopes of additional price records.

ETH prices went vertical after a correction to the $1,800 range, peaking on significant trading volumes. The strong recovery within a week of a significant crash remains one of the bullish factors for continued ETH growth.

The Ethereum ecosystem is getting a significant boost from DeFi, where every day ETH must be locked for liquidity and decentralized trading.

ETH Scarcity Coming

The one problem for ETH is that its supply continues to rise, with already more than 115M in circulation. Previous expectations of capping the total supply under 100M tokens were not fulfilled, and each day produces a glut of new ETH from block rewards and transaction fees.

Only block rewards produce about 12,900 ETH in a 24 hour period, with more than 6,000 ETH handed over to miners in the form of fees. The upcoming Ethereum network upgrades, once implemented, will reduce new coin creation and lower the incentive to sell. Uniswap alone, the current biggest user of Ethereum bandwidth, adds 1,500 ETH in fees distributed to all mining pools.

Miners may have an incentive to sell, but the presence of DeFi lending protocols also allows them to place the rewards as collateral and gain passive income. Locking in the ETH is also an incentive, as it boosts the market price.

In the future, some of the ETH mined now may be needed for staking and for burning a part of the supply in the form of fees. This will add to the scarcity and slow down the growth of the total supply.

ETH Expands into Mainstream Finance

The rise in ETH market prices is not solely a DeFi phenomenon. After BTC came into view for corporations and mainstream investment firms, ETH is becoming the next big thing. While less known, ETH is viewed as having upside potential where BTC is more difficult to move.

Recently, J.P. Morgan presented an explanatory note to investors, citing the asset had strong sides in terms of liquidity and decoupling from BTC.

In the note, ETH is presented as an alternative to BTC, with potential to offset market risk. The ETH/BTC pair is becoming more limited, while more than 60% of ETH volumes are directly against the USD or Tether (USDT), potentially moving on a different price path.

Until recently, BTC maximalists expected ETH to continue to slide and decrease its dominance, but the recent higher highs are pointing to a different price scenario.

The Ethereum network also has a boost from carrying USDT tokens which then directly affect trading. Out of the total supply of 51B USDT, the ERC-20 tokens are more than $24B, with the rest distributed to TRON, Algorand, and other smaller networks.

On Track to $3,000 Milestone?

With ETH hovering in the $2,700 range, the next big milestone is $3,000, with a potential breakout against BTC. Current breakout chart patterns add to the expectations of new highs.

The higher ETH prices also push the value locked in DeFi projects to a peak above $65B. The DeFi space grows not only through the Ethereum network, but through new blockchains that also add bridges to Ethereum-based tokens or liquidity pools.

The current ETH rally, however, happens in a period of diminishing BTC dominance. ETH has expanded to 15.7% of the entire crypto market valuation, while BTC shrank its dominance from above 60% at the start of the year, to 48.7%.

In the case of another BTC rally, interest in ETH may diminish and the price return to a lower position.

ETH Ecosystem Grows

ETH has triggered multiple projects to expand their use cases dramatically. The popularity of DeFi and crypto collectible NFTs raised network usage. Recently, Polygon (MATIC) added to the growth of DeFi, while also setting aside funds to create an NFT platform.

Polygon works as a second-layer solution to Ethereum’s main net, allowing for NFT minting without the hefty gas fees. The success of ETH boosts the MATIC market price, which is on track to the predicted $1 level. MATIC added another 17% overnight to trade at $0.81.

Ethereum transactions are near their all-time high, expanding to more than 1.5M transfers per day. The heightened interest also raised the average transaction fee to above $13, with much more paid for fast DeFi trading.

##

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

We look at where to buy and how to buy including limits, fees, security, and verification

From Airdrop to Wallet we look at all the crypto jargon and what it really means

The first cryptocurrency. It has limitations for transactions but it is still the most popular being secure, trusted and independent from banks and governments.

A multi-utility asset, linked to the diverse activities of the Binance Exchange. A token to pay trading fees, as well as participate in new asset sales, BNB now runs on a proprietary blockchain.