YearnFinance (YFI) Spikes After WOOFY Launch

#

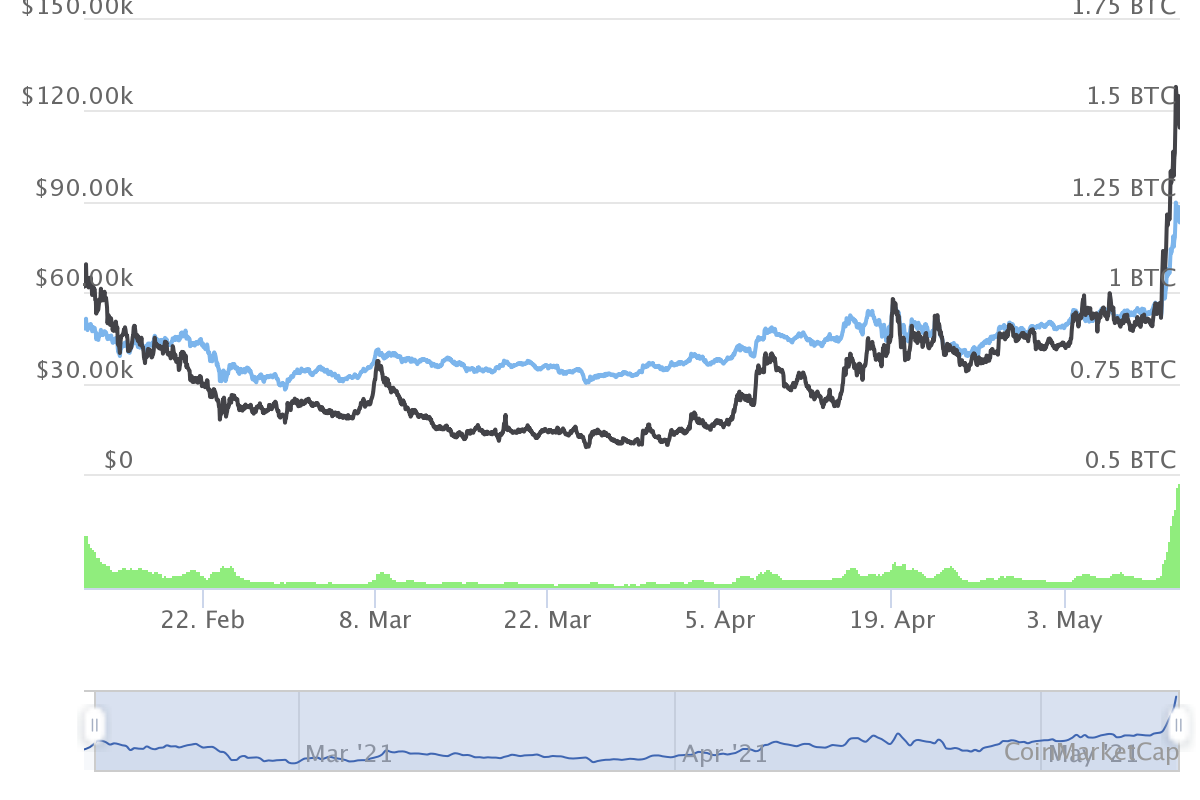

YearnFinance (YFI), one of the leading decentralized lending protocols, saw its market value spike overnight to $88,317.32. The expansion, up from the usual levels around $64,000, put a question mark on the sudden interest in the protocol. One of the reasons was the added attention from a newly launched protocol, WOOFY, which wraps YFI tokens for decentralized trading.

YFI is deliberately a low-supply, high price coin, and its per-unit access is limited to larger investors. There are only 36,365 YFI available, and the project has not gained the mainstream visibility of other crypto lending platforms like Maker (MKR).

YFI only broke above $50,000 in April, and the recent rally adds to expectations of an even higher price range. Now, extreme predictions envision the coin touching $100,000 soon.

Currently, YFI has high liquidity and low slippage pair on the Binance International exchange, which may help preserve some of the gains as YFI owners are also incentivized not to sell rapidly when prices appreciate.

YFI Offers Curated “Farming” Returns

YFI had significant success as a one-stop hub for the best returns in yield farming. Instead of using multiple protocols and selecting the tokens by hand, owning YFI exposes users to the best available yield farms.

Additionally, YFI allows for savings on gas fees, as it batches transactions for optimized Ethereum network usage. The gains in DeFi happening in the past month, as well as the spike in ETH prices above $4,000 added to the success of YFI.

Owning YFI also gives the right to vote within the protocol, which often includes decisions on the supply of governance tokens. In the past few months, the supply of YFI grew by a few thousand tokens.

Woofi Changes YFI Equation for Low-Price Entry

Woofi is a new app that combines the demand for yield farming with the recent hype surrounding dog-meme coins. After the spectacular success of Dogecoin (DOGE), multiple projects issued new tokens riding on the meme fame.

Woofi takes the hype a step further, adding utility to its token. YFI has a problem with its per-unit price, and buying a fraction of a coin looks confusing. The WOOFY token, on the other hand, is low-priced and has the advantage of whole units.

Woofy offers a convenient app to connect to a Metamask wallet. From there, tokens can be “woofed” or “unwoofed” to participate in the protocol. Since WOOFI launched just days ago, it is unknown if the swap between tokens will work as promised.

Essentially, the valuable YFI can be turned into WOOFI, which can then increase in value. Both coins’ value is pegged to each other, similar to Wrapped ETH, so there should be no risk of loss when swapping between tokens.

But WOOFI has the added bonus of social media and meme hype, possibly leading to fast and volatile price moves.

WOOFY Takes Over Uniswap

WOOFY is an Ethereum-based token, subject to swapping and trading fees. A day after its launch, it was already a top 10 token on Uniswap. The token landed just behind ShibaInu (SHIB), the meme project that got listed under the Binance Innovation exchange conditions.

WOOFY has $8.45M total value locked, just a fraction of the total YFI market cap of $3.1B. The longer-term effect of the new token is unpredictable. For some of its holders, selling at the current high price may be attractive, as seen from this whale transaction to an exchange.

YFI itself is a token with an incentive to simply hold for the long term. The asset can be used for yields in various vaults, but its chief attraction is that it has come to reflect the growth of the entire DeFi sector. YFI is thus a buy-and-hold asset that has made early buyers potentially rich.

Now, there is the question of whether the activity of the WOOFI liquidity pool on Uniswap can offset the lower risk of simply holding the original YFI.

DeFi Getting Dogified?

The recent doge meme hype resembles the “food token” yield farming craze. Currently, a new DOGE-copying project attempts to launch almost daily. Most of the tokens still command very low liquidity, despite claiming to attract thousands of new buyers.

The current hype adds to the elevated gas fees on the Ethereum network. Even dabbling into dog-meme tokens in their early days will require significant fees or long waiting times and failed transactions.

Uniswap remains the leading gas consumer, requiring $2M in fees every day. The exchange consumes up to a third of Ethereum network’s capacity, leaving other projects to compete for access.

How High Can YFI Go?

YFI has somewhat lagged behind the returns of Maker (MKR). Still, the asset surpassed Bitcoin (BTC) on a per-unit price.

The recent rally put the YFI gains since the start of 2021 to more than 100%, almost catching up with MKR. The price of MKR started off around $2,600 and recently spiked close to $5,600.

There is another factor for YFI that may lead to a higher price. The current total value locked within the project is about $4.5B, higher than the market cap of YFI tokens held by voters. The ratio for MKR is different, with the total value of governance tokens about three times lower compared to the collateral value locked into the protocol.

#

With over 50 coins and an obsession with security, Kraken is one of the safest places to buy and trade crypto.

Kraken has a good reputation for security and protection of your funds and operates across the USA (except NY), Canada, the EU and Japan

Crypto gets a lot of criticism sometimes but what sort of job are the current banks doing at looking after their customers. Who are the best and the worst banks to be with?

Is mining crypto still profitable? With more cryptos like Ether switching to POS is the competition going to get too much?

An innovative digital asset utilizing a fully decentralized consensus protocol called Ourobouros. The network aims to compete with Ethereum in offering smart contract functionalities. However it is lightyears behind Ethereum in terms of adoption.

Solana is a cryptocurrency project with a radically different approach to how blockchains work. It focuses on an element which is very simple: time. It seems introducing a decentralised clock to a cryptocurrency blockchain makes it more efficient than anyone could have possibly imagined. Solana is a high-performance cryptocurrency blockchain which supports smart contracts and decentralised applications. It uses proof of stake consensus mechanism with a low barrier to entry along with timestamped transactions to maximise efficiency.